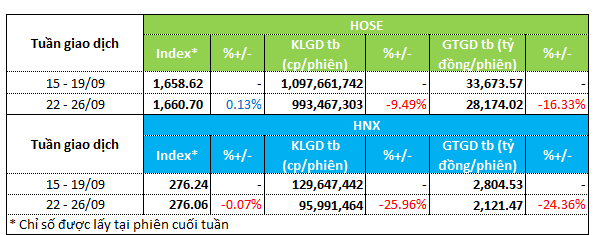

Market activity remained subdued during the final trading week of September. The indices reflected a tug-of-war, with the VN-Index inching up 0.1% to 1,660.7 points, while the HNX-Index dipped 0.07% to 276.06 points.

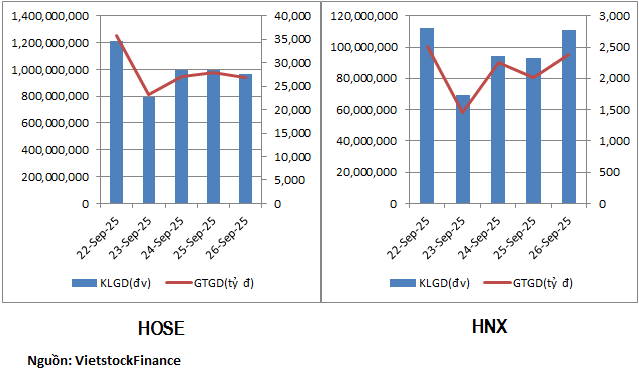

Trading volume weakened significantly across both exchanges. On the HOSE, volume fell 9.5% to 993.4 million units/session, and value dropped 16% to over 28 trillion VND/session. Similarly, the HNX saw a 25% decline in both volume and value, settling at nearly 96 million units/session and 2.1 trillion VND/session.

|

Liquidity Overview for the Week of 22 – 26/09

|

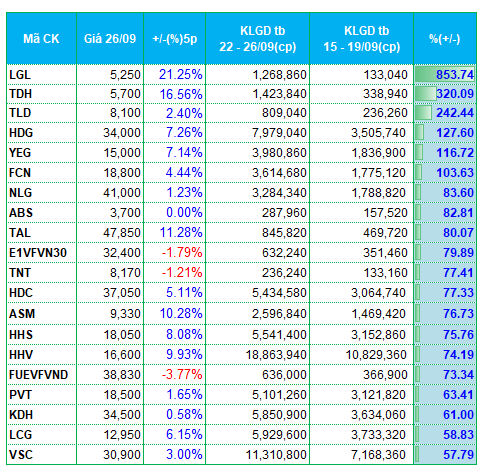

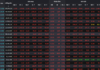

Despite the overall liquidity downturn, certain sectors attracted notable inflows. The real estate sector stood out, with several mid- and small-cap stocks seeing improved liquidity. LGL surged, with trading volume skyrocketing over 850% to 1.3 million units/session, alongside a 20% price gain. TDH also saw a liquidity boom, averaging 1.4 million units/session (up 320%), and its price climbed over 16% to 5,700 VND/share (as of 26/09).

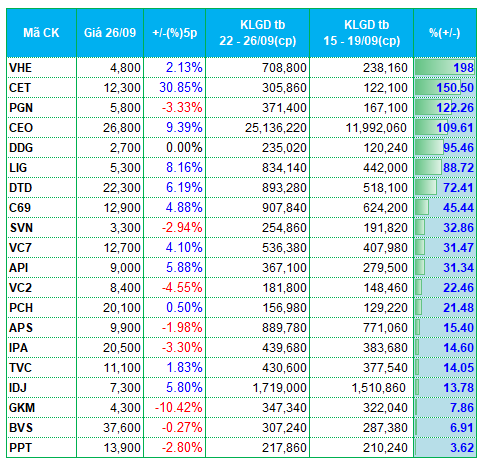

Other real estate stocks like HDG, NLG, HDC, KDH, CEO, API, and IDJ were among the week’s top liquidity gainers.

The construction sector also saw modest inflows. Stocks such as FCN, HHV, LCG, LIG, C69, and VC2 topped the liquidity charts, while building material stocks like TNT, TLD, and GKM also saw volume improvements.

Securities stocks on the HNX showed mild polarization. APS, IPA, TVC, and BVS gained liquidity, while VIG, MBS, and PSI saw declines.

Energy stocks struggled, with PVC, PVS, and PLC seeing volume drops of 18-40%. Fertilizer and chemical stocks like DPM, BFC, DGC, and CSV also faced liquidity declines of 50-60%.

|

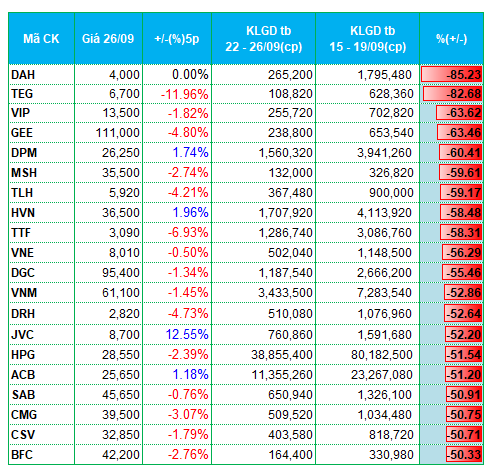

Top 20 Stocks with Highest Liquidity Gains/Losses on HOSE

|

|

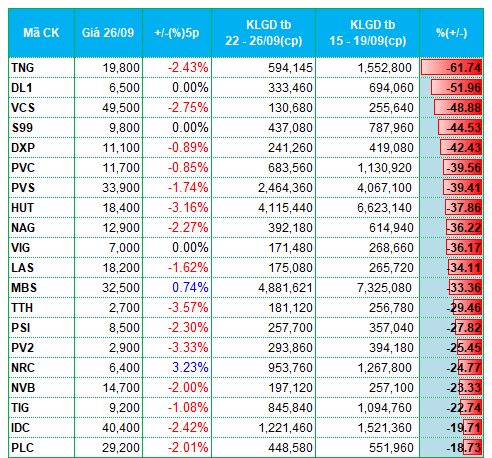

Top 20 Stocks with Highest Liquidity Gains/Losses on HNX

|

Stocks ranked by liquidity changes based on average trading volume above 100,000 units/session.

– 19:28 29/09/2025

Market Pulse 29/09: Continued Divergence in Market Trends

At the close of trading, the VN-Index climbed 5.78 points (+0.35%) to reach 1,666.48, while the HNX-Index dipped 0.91 points (-0.33%) to 275.15. Market breadth favored decliners, with 469 stocks falling and 258 advancing. Similarly, the VN30 basket saw red dominate, as 18 members declined, 10 rose, and 2 remained unchanged.

Foreign Investors’ Massive Sell-Off: Unveiling the Focus of the VNĐ 800 Billion Offload on September 29th

In the afternoon trading session, VPB and GEX emerged as the top net buyers in the market, with net purchase values of 114 billion and 111 billion, respectively.