PC1 Vice Chairman Completes Acquisition of 8 Million Shares

On September 22, Mr. Phan Ngọc Hiếu, Vice Chairman of PC1 Group’s Board of Directors (HOSE: PC1), reported the completion of his purchase of 8 million shares in the company as previously registered. This transaction increased his ownership stake in PC1 Group from 0% to 2.24%. The deal was executed through negotiated agreements on September 16 and 18.

Mr. Hiếu was elected to PC1’s Board of Directors in April 2024 and currently serves as a Board Member for several companies, including LICOGI 16 Power, Lizen, Vietnam Electric Wire and Cable, and Central Power Engineering. Notably, in Q3 2024, he divested a 5% stake in PC1 before reacquiring shares through recent transactions.

According to VietstockFinance data, a total of 8.5 million PC1 shares were traded via negotiated agreements over the two days Mr. Hiếu executed his purchase, with a combined value of nearly 227 billion VND. It is estimated that the PC1 Vice Chairman invested at least 200 billion VND to finalize the transaction.

RCC Board Member’s Relative Fully Divests Holdings

Mrs. Vũ Huyền Trang, spouse of Mr. Phạm Ngọc Quốc Cường—a Board Member at Vietnam Railway Construction Corporation (UPCoM: RCC)—fully divested her holdings of nearly 1.3 million shares (3.97% of capital) between August 22 and September 19, 2025.

Based on the average closing price during the trading period (20,895 VND per share), Mrs. Trang is estimated to have earned nearly 27 billion VND from this transaction.

Another major RCC shareholder, Mr. Đậu Hoàng Việt, also fully divested his holdings of nearly 2.1 million shares (6.44% of capital) on September 22. During this session, RCC shares recorded no matched orders, only negotiated agreements for nearly 3.8 million shares. Thus, it is highly likely that Mr. Việt executed his transaction through a negotiated agreement. The deal’s value is estimated at over 43 billion VND.

BV Asset Seeks to Increase BVL Ownership to Nearly 11%

BV Asset JSC has registered to purchase over 4.8 million shares in BV Land JSC (UPCoM: BVL) through both negotiated agreements and matched orders. The planned transaction period is from September 26 to October 24, 2025, for investment purposes.

If successful, BV Asset will increase its ownership in BV Land from 5.45% to 10.83%, equivalent to nearly 9.7 million shares.

As of the September 23 session close, BVL shares were trading at 18,100 VND per share, up 113% year-to-date, with an average daily liquidity of over 13,100 shares. Based on this price, BV Asset is estimated to require over 87 billion VND to complete the transaction.

Following Younger Brother’s Lead, CKG Chairman Registers Sale of 3 Million Shares

Mr. Trần Thọ Thắng, Chairman of CKG’s Board of Directors, has registered to sell 3 million shares due to personal financial needs. The transaction will be executed from September 26 to October 24 through matched orders or negotiated agreements.

If successful, Mr. Thắng will reduce his holdings in CKG from nearly 12.7 million shares (7.85%) to nearly 9.7 million shares (5.99%). Based on the latest closing price of 13,850 VND per share (September 23), he could earn nearly 42 billion VND.

Shortly before the Chairman’s divestment, his younger brother, Mr. Trần Thọ Công, registered and sold 66,000 shares via matched orders on September 4–5, reducing his holdings from nearly 127,000 shares (0.08%) to nearly 61,000 shares (0.04%).

VinaCapital Fund Registers Sale of Over 9 Million KDH Shares

Vietnam Investment Limited, a fund under VinaCapital, has registered to sell nearly 9.3 million shares in Khang Dien House Investment and Trading JSC (HOSE: KDH) from September 30 to October 29 to rebalance its investment portfolio.

If successful, Vietnam Investment Limited’s ownership in KDH will decrease from 1.189% to 0.361%, equivalent to over 4 million shares. Based on the opening price of 33,650 VND per share on September 26, the transaction value is estimated at nearly 313 billion VND.

Previously, from August 12 to September 10, another VinaCapital fund, Hung Thinh VinaCapital Equity Fund, registered to purchase 850,000 shares but executed no transactions due to unfavorable market conditions. Consequently, the fund maintains its holdings at 616,410 shares (0.0549%).

PVI Fund Seeks to Divest from Kim Tiền Thảo Kidney Stone Drug Manufacturer

PVI Opportunity Fund (POF) has registered to sell its entire stake in OPC Pharmaceuticals (HOSE: OPC), the manufacturer of the renowned Kim Tiền Thảo kidney stone treatment.

POF is managed by PVI Fund Management JSC (OTC: PVIASSET), a subsidiary of PVI Holdings (HOSE: PVI).

POF plans to sell nearly 8.6 million shares, representing 13.4% of the pharmaceutical company’s 1.45 trillion VND market capitalization. The transactions will be executed through negotiated agreements or matched orders from September 25 to October 3.

|

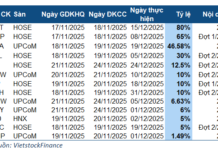

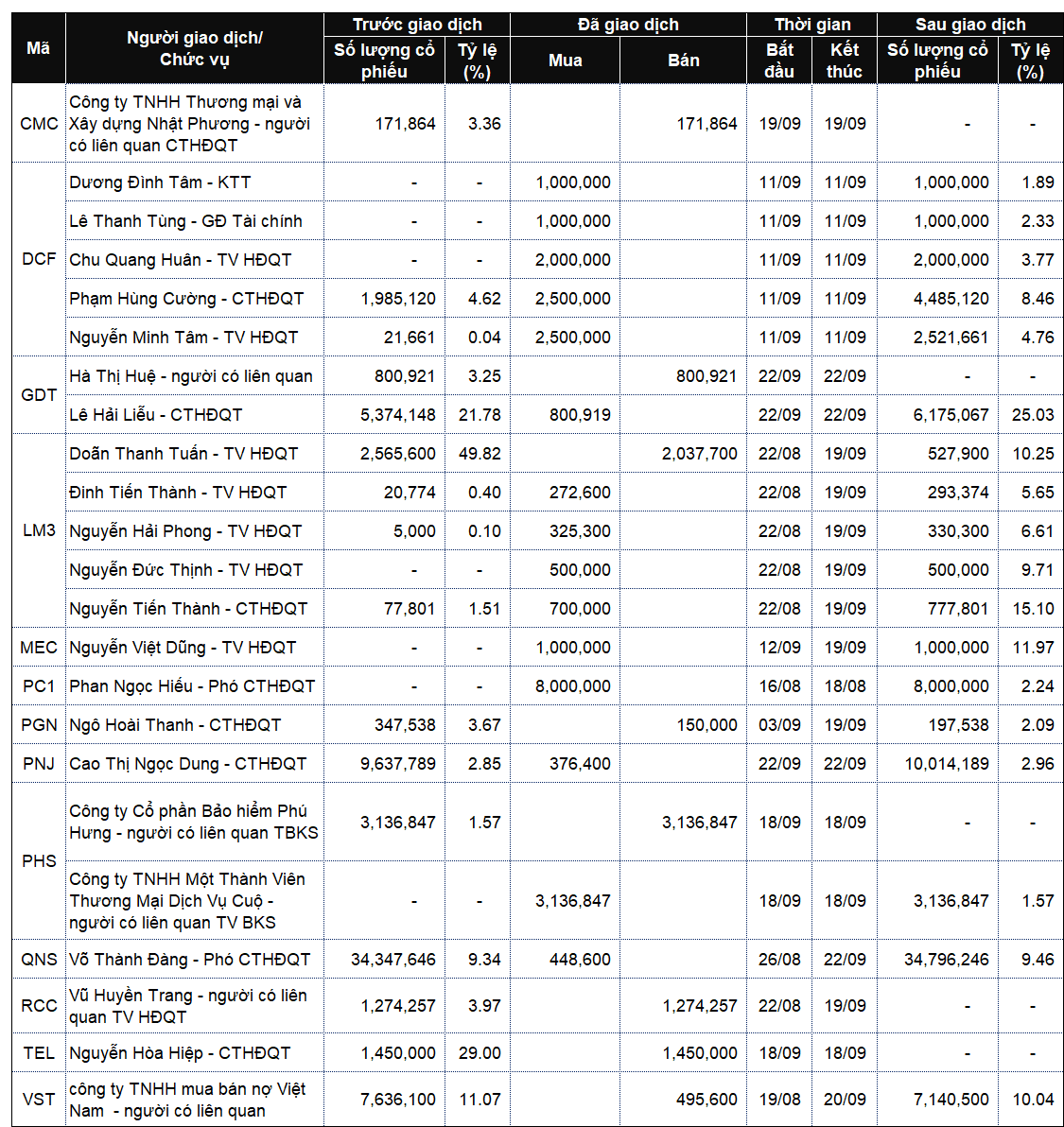

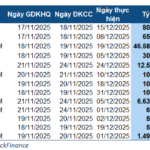

List of Company Leaders and Relatives’ Transactions from September 22–26, 2025

Source: VietstockFinance

|

|

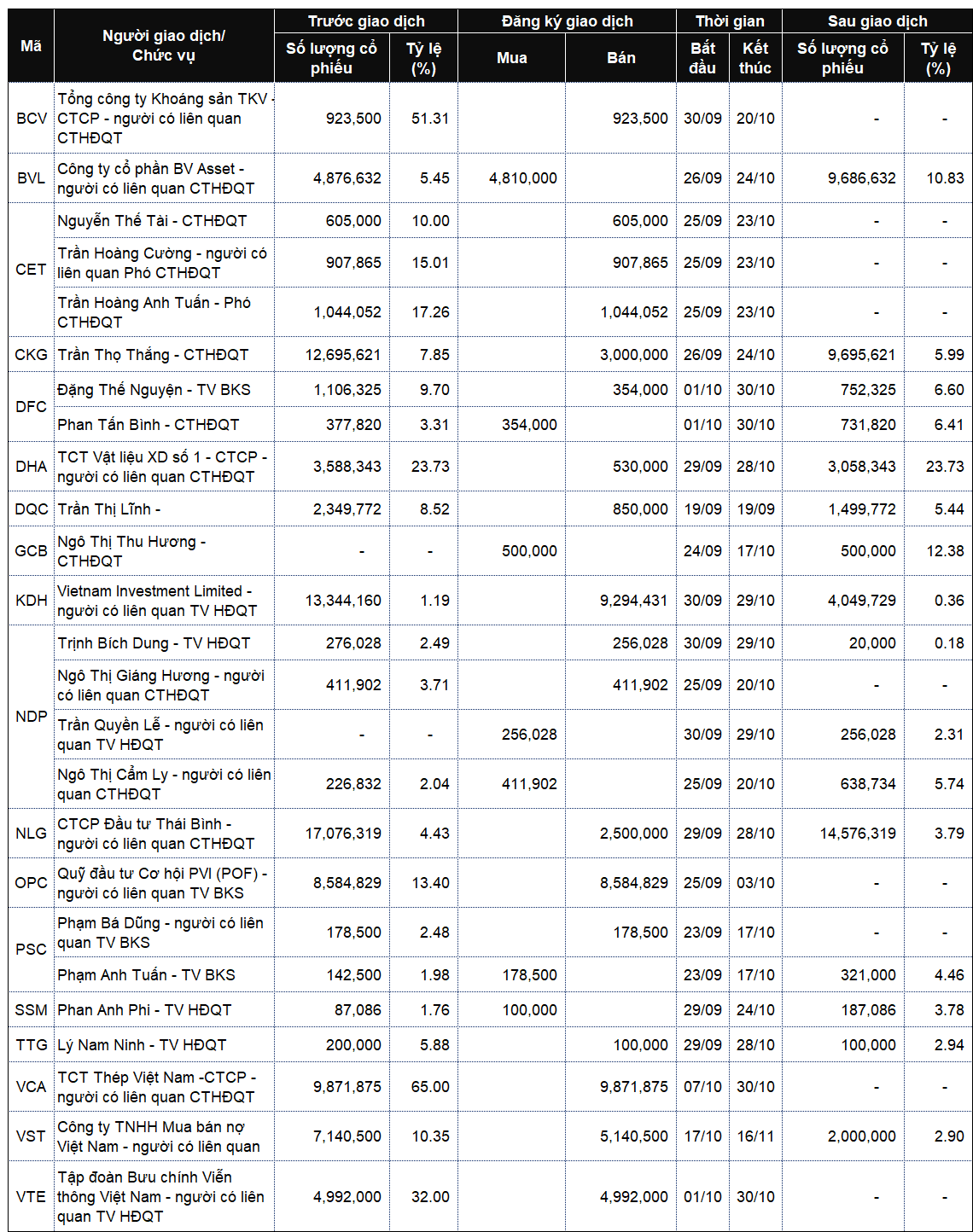

List of Company Leaders and Relatives’ Registered Transactions from September 22–26, 2025

Source: VietstockFinance

|

Thanh Tú

– 14:00 29/09/2025

Real Estate Investment Funds Pull Back from the Market

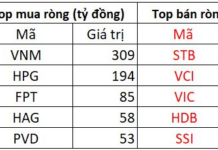

During the week of September 22–26, 2025, investment funds exhibited a pronounced selling trend, particularly concentrated within the real estate sector. This activity unfolded against a backdrop of significant divergence in the VN-Index, highlighting a dynamic and shifting market landscape.

The Railway Company: Unveiling the Dynamic Duo at the Helm with a Vision for Transformational Growth

Let me know if you would like me to tweak it or provide multiple options for the title.

In Hanoi, RCC has leased 120.8 sqm of office space at 371 Kim Ma and an additional 2,005.2 sqm of land with 59.3 sqm of built-up area for their office and business services operations at 33 Lang Ha.

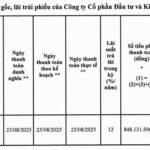

The Khang Điền House Liquidates Over 848 Billion VND in Principal and Interest on Bonds

With a strong track record of financial prudence, Nha Khang Dien has once again demonstrated its commitment to meeting its financial obligations. The company recently made a substantial payment of over VND 848 billion, covering both principal and interest on its bond series KDHH2225001. This timely full repayment underscores the company’s dedication to maintaining a solid financial standing and bodes well for its future endeavors.

“Shareholders Receive First Dividend Payout After a 14-Year Wait”

Despite incurring losses of nearly VND 44 billion in the first half of the year, Vietnam Maritime Transport Joint Stock Company (stock code: VOS) distributed VND 154 billion in dividends to its shareholders. Notably, this marks the first time since 2011 that VOS shareholders have received dividends.