This week, 27 companies announced dividend payout dates, with 25 offering cash dividends and 2 issuing additional shares.

DXG Share Offloading

Dragon Capital funds further reduced their stake in Dat Xanh Group (stock code: DXG) by selling 1.25 million shares, bringing their ownership down to 11.9% of the charter capital. Specifically, Hanoi Investments Holding Limited sold 528,133 shares, Saigon Investments Limited sold 471,867 shares, Norges Bank sold 350,000 shares, and Samsung Vietnam Securities Master Investment Trust (Equity) purchased 100,000 shares.

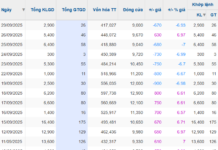

Dat Xanh Group has seen continuous share sales by its executives and major shareholders.

Recently, Dat Xanh Group has recorded multiple sales by its executives and major shareholders. On August 25, Dragon Capital funds sold 3.9 million DXG shares. On August 29, related Dragon Capital funds sold an additional 3.75 million DXG shares.

Additionally, from August 15 to 27, Ms. Do Thi Thai, Deputy CEO of DXG, sold 413,300 shares, reducing her ownership to 0.05% of the charter capital. From August 4 to 26, Mr. Ha Duc Hieu, a board member, sold 6,355,000 shares, lowering his stake to 0.04%. From July 24 to August 19, Mr. Bui Ngoc Duc, CEO, sold 744,418 shares, reducing his ownership to 0.09%.

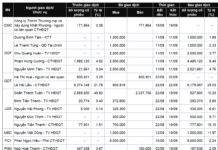

Mr. Tran Quoc Nguyen, a board member and Deputy CEO of Kido Group (stock code: KDC), has registered to sell 438,171 shares to address personal financial needs. The transaction will take place from September 30 to October 29.

If successful, Mr. Nguyen’s KDC holdings will decrease from 627,914 shares to 189,743 shares, equivalent to 0.06% of Kido Group’s capital. He is expected to earn approximately VND 23 billion from this sale.

Vietnam Investment Limited, a VinaCapital fund, has registered to sell nearly 9.3 million KDH shares of Khang Dien House Trading and Investment JSC to restructure its portfolio. The transaction is scheduled from September 30 to October 29.

If completed, Vietnam Investment Limited’s holdings will decrease to over 4 million shares, or 0.361% of Khang Dien’s capital. The fund is expected to earn over VND 313 billion from this sale.

CIC Group’s Chairman registers to sell 3 million CKG shares.

Similarly, Mr. Tran Tho Thang, Chairman of CIC Group (stock code: CKG), has registered to sell 3 million CKG shares from September 26 to October 24. If successful, his holdings will decrease to nearly 9.7 million shares, or 5.99% of the charter capital. He is expected to earn nearly VND 42 billion.

Previously, from September 4 to 5, Mr. Tran Tho Cong, Mr. Thang’s brother, sold 66,000 CKG shares via order matching. His holdings decreased to 0.04% of the charter capital.

Share Purchases

Mr. Phan Ngoc Hieu, Vice Chairman of PC1 Group (stock code: PC1), purchased 8 million PC1 shares, increasing his ownership to 2.24% of the charter capital. He is estimated to have spent approximately VND 213 billion on this purchase.

PC1 Group’s Vice Chairman purchases 8 million PC1 shares.

Conversely, VIX Securities (stock code: VIX) sold 3 million PC1 shares, reducing its ownership to 4.95% of the charter capital. After the transaction, VIX is no longer a major shareholder of PC1 Group. It is estimated to have earned approximately VND 79 billion.

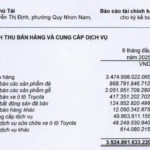

Viettel Post (stock code: VTP) will pay a cash dividend of 10.81%, meaning shareholders will receive VND 1,081 per share. With nearly 122 million VTP shares outstanding, Viettel Post is expected to pay over VND 131 billion in dividends.

PVI Holdings (stock code: PVI) will finalize its shareholder list on October 2 for a 31.5% cash dividend payout. PVI plans to distribute nearly VND 750 billion in cash dividends, marking the 10th consecutive year of dividends at 20% or higher.

Techcombank (stock code: TCB) will finalize its shareholder list on October 1 for a 10% cash dividend payout. Techcombank plans to distribute VND 7,086 billion in dividends, with payments scheduled for October 22.