Illustrative image. (Thai Ha/Vietnam+)

|

Hanoi is undergoing a dramatic transformation with rapid urbanization, population pressure, and a surge in housing demand. This has led to skyrocketing property prices, creating an insurmountable barrier for millions of residents, particularly young people and middle-income families, to achieve their dream of homeownership. The reality is that apartment prices remain high, ranging from 70 to 100 million VND per square meter, making it incredibly challenging to own a home.

As the cool autumn breeze sets in Hanoi, a coffee shop in the Ecohome3 social housing area (Dong Ngac Ward, Hanoi) becomes a “forum” for discussions laden with financial worries, housing struggles, and the dream of owning a home.

Over a hastily brewed cup of coffee, Nguyen Van Them (40, from Ninh Binh Province) sighs deeply, staring at his phone screen filled with information about apartment projects for sale.

With a tone of helplessness, Them shares that after 10 years of hard work, he and his wife have saved a considerable amount, planning to buy a 63.3-square-meter, two-bedroom apartment in the Ecohome3 social housing project. However, every few months, apartment prices here jump significantly. Earlier this year, prices were around 50 million VND per square meter, but now they have risen to over 60 million VND per square meter.

“With the current high housing prices, those earning around 30 million VND per month like us can only afford to buy a house on ‘TV,'” Them says.

Sharing the same dream of homeownership, Nguyen Cao Hai Danh (28, from Hung Yen Province) expresses that his total monthly income is about 30 million VND. While it seems decent, rent and living expenses consume a significant portion, leaving little for savings to buy a home.

To purchase a 4-billion-VND apartment, he needs 1 billion VND upfront and must take on a massive bank loan. With interest rates not being low, the monthly payments feel like a ticking time bomb. He dares not dream of owning a home in Hanoi.

Real estate investor Do Thanh Binh (Dong Ngac Ward, Hanoi) believes that the reluctance to take out bank loans amid fluctuating market interest rates has created a barrier, leaving many young people earning 30 to 40 million VND per month “helpless” in their pursuit of homeownership in Hanoi.

Apartments in Hanoi. (Photo: Xuan Quang/Vietnam+)

|

Notably, even when residents turn to low-income housing or social housing solutions, the process is far from straightforward. Complex administrative procedures, unclear project information, and strict eligibility criteria make it difficult for many to access these options.

In a recent report on the real estate market for the first nine months of the year submitted to the Government, the Ministry of Construction stated that the average primary selling price of apartments in Hanoi in the third quarter of 2025 ranged from 70 to 80 million VND per square meter, a 5.6% increase from the first quarter and a 33% rise compared to the same period in 2024. Some luxury apartment projects in Hanoi recorded selling prices between 150 and 300 million VND per square meter.

According to calculations by Batdongsan.com.vn, with Vietnam’s average monthly income per capita reaching 9.5 million VND in 2024, a young person born in the 1990s would need to work and save for 25.8 years to buy a 60-square-meter apartment priced at around 3 billion VND, assuming a deposit interest rate of 4.5%.

On the afternoon of September 22 in Hanoi, during a meeting of the Central Steering Committee on Housing Policy and Real Estate Market, Prime Minister Pham Minh Chinh emphasized to representatives from ministries, localities, and businesses: “So many people need housing, but because prices are too high, they cannot afford to buy. Apartment prices ranging from 70 to 100 million VND per square meter—who can afford that?”

Experts, managers, and businesses have identified the reasons behind the soaring housing prices and proposed solutions to “cool down” the market.

From a business perspective, Nguyen Tuan Anh, Director of HHA Investment and Trading Company, believes that while Hanoi has recently seen improvements in new supply, it still falls short of meeting the actual demand for real housing. Additionally, delays in resolving real estate project procedures have led to supply shortages.

Rising input costs, such as land, construction, and loans, along with speculation, have driven housing prices higher in recent times. Speculation and price manipulation have also distorted the housing market, requiring relevant agencies to implement strong measures to control these activities, especially in the apartment segment.

To “cool down” housing prices, economist Cao Thanh Trung (Ministry of Finance) argues that the fundamental and sustainable solution lies in increasing the reasonable supply. The market urgently needs affordable commercial housing, social housing, and worker housing projects.

Banks should also offer reasonable interest rate support for businesses developing affordable housing rather than applying a uniform interest rate across all segments.

The government can support businesses by expediting procedures, reducing indirect financial costs, and establishing reasonably priced land funds, as well as implementing quick compensation and site clearance to lower costs.

Managers believe that reducing housing prices requires more fundamental solutions for the entire real estate market, creating a transparent and sustainably developing market.

According to Tong Thi Hanh, Director of the Department of Housing and Real Estate Market Management (Ministry of Construction), in the coming time, the Ministry of Construction will submit to the Government a Resolution on piloting the establishment of a state-managed real estate transaction center. This includes legal management of supply and transaction prices for both primary and secondary real estate markets.

The Ministry will also outline a roadmap, including timelines and pilot subjects. Another task is to study breakthrough and flexible mechanisms to attract resources and create a legal framework for the real estate market, thereby fostering a truly healthy and sustainable market development./.

Nguyen Thang

– 11:30 29/09/2025

Mid and Small-Cap Real Estate Stocks Attract Investment Despite Market Liquidity Decline

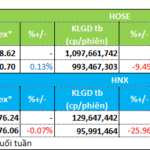

The market has entered a phase of consolidation, with investor sentiment waning as evidenced by the consistent decline in trading volume over recent weeks.

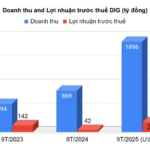

DIC Corp (DIG) Reports 5x Profit Surge in 9 Months, Yet Only 29% of Target Met, Teasing a Deal Yielding VND 748 Billion in Gross Profit

At the Analyst Meeting held on the afternoon of September 26th, the leadership of DIC Corporation (DIC Corp, HoSE: DIG) unveiled remarkable estimated business results for the first nine months of 2025, showcasing explosive growth. They also outlined the foundations for confidently achieving the full-year plan, despite having only completed just over a quarter of the profit journey.

Exciting News for Thousands of Residents in Bac Ninh

Masterise Homes, renowned for its luxury segment, is now venturing into the social housing sector alongside other real estate developers. They are launching a groundbreaking 4,000-billion-VND project in Bac Ninh, marking a significant expansion in their portfolio.