On September 26, 2025, VinEnergo Energy JSC, a subsidiary of Vingroup, officially announced the groundbreaking of the Hai Phong LNG Thermal Power Plant project. According to the conglomerate, this plant will boast the largest capacity in Vietnam and rank among the world’s leading facilities.

The Magnitude of Hai Phong LNG

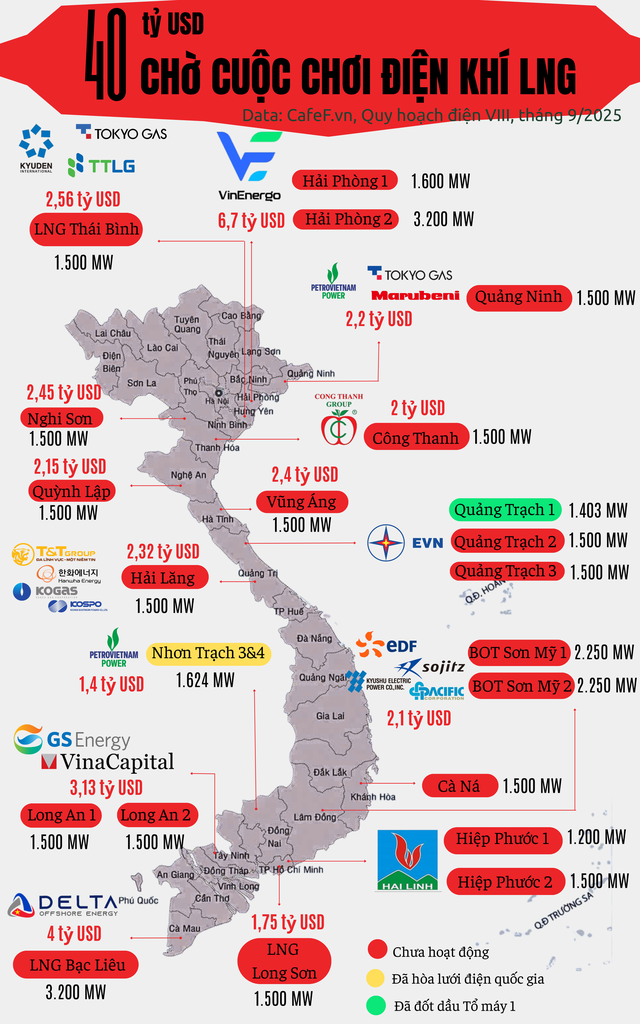

The Hai Phong LNG Thermal Power Plant comprises two plants spanning 100 hectares. The total investment for the project is VND 178 trillion (approximately USD 6.7 billion).

As outlined in Power Plan 8, Hai Phong LNG 1 will have a capacity of 1,600 MW, operating from 2025 to 2030. Hai Phong LNG 2 will have a capacity of 3,200 MW, operating from 2031 to 2035.

However, the Hai Phong government has pledged to expedite Phase 2, aiming to bring it online during the 2025-2030 period if the power grid demands it.

With a combined capacity of 4,800 MW, these two plants will surpass the planned capacity of the Son My 1 and 2 LNG Power Plants (4,500 MW) and the Quang Trach 1, 2, and 3 cluster (4,403 MW), making them Vietnam’s most powerful.

Once fully operational, the Hai Phong LNG project will generate approximately 9.6 billion kWh/year (Phase 1) and 19.2 billion kWh/year (Phase 2), totaling 28.8 billion kWh/year. This equates to roughly 8% of Vietnam’s total electricity production in 2025.

Despite the groundbreaking, the project faces a challenging road ahead. Vietnam’s experience over the past decade has shown that numerous planned projects have stalled, with only the Nhon Trach 3 and 4 plants nearing connection to the national grid.

Over USD 40 Billion Invested in LNG Thermal Power Projects

Power Plan 8 outlines a comprehensive vision for LNG power projects, reflecting Vietnam’s aspirations for energy security and green growth. These projects are backed by billions in investment from international giants and prominent domestic enterprises.

The plan includes over 36,500 MW of LNG power capacity, nearly half of Vietnam’s current total installed capacity, with an estimated investment exceeding USD 40 billion.

To date, the Nhon Trach 3 and 4 Power Plants (1,624 MW, USD 1.4 billion) stand as a rare success story. Developed by PetroVietnam Power Corporation (PV Power), both plants have successfully connected to the national grid and are undergoing testing, with commercial operations expected in 2025.

However, PV Power faces challenges with the Quang Ninh LNG project (1,500 MW, USD 2.2 billion). Despite partnering with experienced Japanese firms Tokyo Gas, Marubeni, and domestic company Colavi, the project is hindered by land clearance issues.

Vietnam Electricity (EVN) is responsible for the Quang Trach projects in Quang Binh. Quang Trach I (1,403 MW, VND 42 trillion) has made progress, successfully completing its first boiler test. Quang Trach II (1,500 MW, VND 52.49 trillion) is in the early stages, with an EPC tender worth over VND 26 trillion underway.

Powerful Consortia of Domestic and International Giants

Vietnam’s power market has attracted numerous international “heavyweights” partnering with domestic firms in ambitious consortia.

T&T Group, led by businessman Do Quang Hien, is a notable private sector player. The group collaborates with international giants to leverage their expertise and capital.

In the Hai Lang LNG project (1,500 MW, USD 2.32 billion), T&T partners with a strong Korean consortium comprising Hanwha, KOGAS, and KOSPO. Despite breaking ground in January 2022, the project faces delays and feasibility report challenges.

Rendering of the Hai Lang LNG Project

T&T also partnered with PV Power to bid for the Nghi Son LNG project (Thanh Hoa), but the province ultimately canceled the preliminary results.

The Nghi Son project attracted interest from various investors, including a consortium of SOVICO Corporation and JERA Co., Inc. (Japan), a South Korean consortium led by Korea Electric Power Corporation, and Gulf Energy Development Public Company Limited (Thailand).

In Hung Yen (formerly Thai Binh), a consortium of Tokyo Gas, Kyuden (Japan), and Truong Thanh Group (Vietnam) is developing the Thai Binh LNG project (1,500 MW, USD 2.56 billion).

In Tay Ninh (formerly Long An), the Long An I and II projects (3,000 MW, USD 3.13 billion), led by GS Energy (South Korea) and VinaCapital, face challenges. Despite plans for a 2025 groundbreaking, a government inspection revealed irregularities requiring adjustments.

In Lam Dong (formerly Binh Thuan), the Son My I (2,250 MW, USD 2.2 billion) and Son My II (2,250 MW, USD 2.1 billion) projects are stalled due to land clearance issues. Son My II is led by AES Corporation (USA), while Son My I involves a consortium of EDF (France), Kyushu Electric, Sojitz (Japan), and Pacific Corporation (Vietnam).

The most disappointing case is the Bac Lieu LNG project (3,200 MW, USD 4 billion) proposed by Delta Offshore Energy (USA). Despite receiving approval five years ago, the project remains largely on paper, symbolizing the gap between commitment and reality.

Even domestic projects like the Hiep Phuoc LNG project (Ho Chi Minh City), led by Hai Linh Company, face challenges, primarily the inability to finalize a Power Purchase Agreement (PPA) with EVN.

In Ninh Thuan, the Ca Na LNG project (1,500 MW, over VND 56 trillion) received only one bid during the tender process, from a consortium of Trung Nam and Sideros River.

Half of Projects Still Seeking Investors

While some projects have secured investors, half of the LNG power landscape remains open, including the aforementioned Nghi Son project.

In Nghe An, South Korean investors like POSCO and SK Innovation have shown keen interest in the Quynh Lap LNG project (1,500 MW), even proposing direct designation as investors to accelerate progress.

Other projects, such as Long Son LNG (Ba Ria – Vung Tau, 1,500 MW) and Vung Ang III LNG (Ha Tinh, 1,500 MW), are still in the investor selection phase.

With Vingroup’s entry, the market anticipates a new turning point for the LNG power sector.

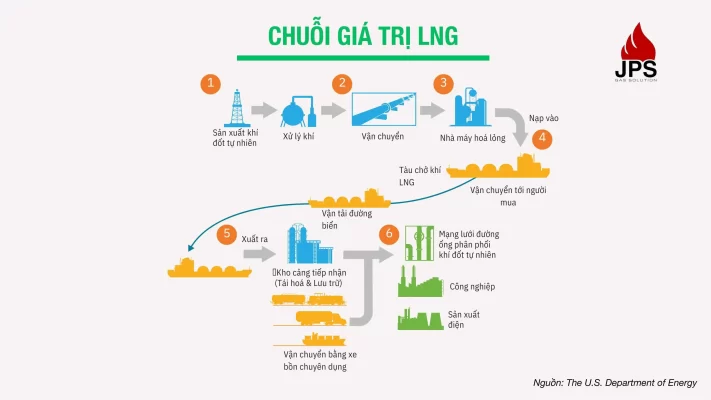

An LNG power plant is the final link in a complex supply chain. Its operation requires a comprehensive supporting infrastructure.

Natural gas is extracted, cooled to -162°C to become LNG, and transported by specialized ships to Vietnam. Upon arrival, LNG is stored in massive tanks at receiving terminals. When needed, LNG is regasified and piped to power plants.

While global LNG prices and the VND/USD exchange rate are critical cost factors, Vietnam’s LNG import infrastructure is still nascent. PetroVietnam Gas Corporation (PV GAS) is the leading, and nearly sole, operator in this sector.

To date, Vietnam has only one operational LNG terminal, the Thi Vai LNG Terminal (1 million tons/year), which began operations in July 2023. PV GAS is expanding its capacity to 3 million tons/year by 2026 to serve the Southeast region.

In September 2025, Ha Tinh Province approved the North Central LNG Terminal (Vung Ang LNG Terminal) project for PV GAS. This terminal will supply LNG to power plants under Power Plan VIII (Quang Trach 2, Vung Ang, Quang Trach 3) and other industrial consumers in the region.

Additionally, PV GAS is developing the Son My LNG Terminal in Binh Thuan, with a capacity of 6 million tons/year, to serve the Son My power plants and the South Central region.

“Revenue Soars, Profits Surge: The Power Giant Enters a Billion-Dollar Growth Cycle”

This company is Vietnam’s second largest independent power producer, with an impressive installed capacity of 4,230 MW. A true powerhouse in the industry, this enterprise illuminates the nation with its bright ideas and innovative energy solutions.

The Power of Words: Crafting a Compelling Title

“Finalizing the 8th Power Plan Revision: A Race Against Time”

The delays in implementing power source and grid projects are prolonging the timeline for operation, impacting the goals of providing sufficient electricity and socio-economic development. To address these challenges, it is necessary to adjust Power Planning 8 to ensure alignment with the actual situation and legal requirements.