City Auto Joint Stock Company (Stock Code: CTF, HoSE) has recently released a report detailing the stock transactions of insiders and related parties.

According to the report, Tan Thanh Do Group Joint Stock Company did not purchase the planned 3 million CTF shares due to a change in strategy.

Following this unsuccessful transaction, Tan Thanh Do maintains its 15.21% stake in City Auto, equivalent to approximately 14.6 million CTF shares.

Illustrative image

It is noteworthy that Mr. Tran Ngoc Dan, Chairman of City Auto’s Board of Directors, also serves as the Chairman of Tan Thanh Do. Additionally, his two sons, Mr. Tran Lam and Mr. Tran Long, both members of City Auto’s Board, hold the positions of CEO and Deputy CEO at Tan Thanh Do, respectively.

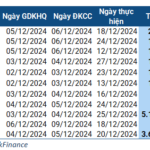

In related news, Mr. Nguyen Van Thanh, brother-in-law of Mr. Tran Ngoc Dan, has registered to sell 300,000 CTF shares to reduce his ownership stake.

The transaction is expected to take place via agreement or order matching between September 16, 2025, and October 15, 2025.

If successful, Mr. Thanh’s CTF holdings will decrease from nearly 2.6 million shares to approximately 2.3 million shares, reducing his ownership from 2.68% to 2.37% of City Auto’s capital.

Regarding business performance, City Auto’s audited consolidated financial report for the first half of 2025 shows a net revenue of over VND 4,095.3 billion, a 23.2% increase compared to the same period in 2024. After deductions, the company reported a net profit of nearly VND 4.1 billion, a 55.9% decline.

As of June 30, 2025, City Auto’s total assets rose by 5.7% from the beginning of the year to over VND 4,140.5 billion. Short-term receivables accounted for VND 2,104.5 billion, or 50.8% of total assets, while inventory stood at over VND 819.5 billion.

On the liabilities side, total payables increased by 7.9% to over VND 3,014.8 billion. Loans and financial leases amounted to VND 2,483.1 billion, representing 82.4% of total liabilities.

PC1 Group Leader Successfully Acquires 8 Million Registered Shares

Mr. Phan Ngoc Hieu, Vice Chairman of the Board of Directors at PC1 Group, has successfully acquired 8 million PC1 shares as planned, boosting his ownership stake from 0% to 2.24%.

The Ever-Rising Bridge of Prices: Green Electric Board

Despite a modest gain of 3.24 points (+0.25%) in the VN-Index this morning, the index traded above the reference level for most of the session, and the advance-decline ratio was strongly positive. This is a testament to the buying power of investors, who are comfortable with higher price levels. Blue-chip stocks are leading the charge, both in terms of index points and liquidity, accounting for over half of the market’s turnover.