According to the Trade Defense Agency (Ministry of Industry and Trade), private enterprises participated in 88% of trade defense investigation cases. These businesses also accounted for 92.8% of the total output in the investigated cases.

Since its establishment, the Trade Defense Agency has conducted 48 investigations and reviewed 35 ongoing trade defense measures. Based on these, the agency recommended the Ministry of Industry and Trade to apply 36 trade defense measures on imported goods.

The annual revenue of domestic manufacturing enterprises involved in trade defense cases is estimated at nearly 600 trillion VND, employing over 56,000 workers directly. Tax revenue from trade defense measures reaches approximately 1.6 trillion VND annually.

This information was shared at the 2025 Trade Defense Forum themed “Proactive Defense – Accelerating Integration – Promoting Private Sector in the Global Supply Chain,” held on September 25 by the Trade Defense Agency (Ministry of Industry and Trade).

Protected enterprises in the industrial sector account for 43%, while agriculture, forestry, and fisheries represent 37%. Illustration: T.L |

Trade Defense Measures: A Shield for Business Integration

Mr. Dương Duy Hưng, Director of the Comprehensive Economics Department, Central Policy and Strategy Board, emphasized the need to reposition Vietnamese enterprises in the global value chain, shifting from processing to high-value creation. He highlighted limitations such as low technology levels, lack of skilled labor, short-term thinking, and insufficient focus on brand building.

To overcome these, businesses must invest in research and development, enhance workforce skills, shift production mindsets, strengthen supply chain linkages, and improve institutional support for sustainable private sector development and international integration.

In this process, trade defense measures serve as a crucial shield, especially for the private sector. According to Mr. Nguyễn Hữu Trường Hưng, Head of the Damage Investigation and Safeguard Division, Trade Defense Agency (Ministry of Industry and Trade), from 2009 to 2017, only 32 enterprises initiated or supported trade defense cases. From 2017 to present, this number has risen to 82, more than doubling.

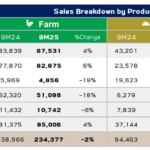

Structurally, protected enterprises in the industrial sector account for 43%, while agriculture, forestry, and fisheries represent 37%, both key sectors for employment and added value.

Alongside leveraging trade defense measures, Vietnamese businesses must effectively utilize opportunities from Free Trade Agreements (FTAs). Ms. Trần Thanh Bình, Head of the Goods Origin Division, Import-Export Department (Ministry of Industry and Trade), noted that Vietnam’s total import-export turnover surged from $30 billion in 2001 to $730 billion in 2022. This achievement is primarily driven by Vietnam’s active participation in FTAs.

In 2024 alone, tens of thousands of Certificates of Origin (C/O) were issued for specific markets, including 6,379 Turkey C/O forms for exports to Turkey and hundreds for South Africa, Brazil, and other developing countries.

These figures demonstrate that compliance with origin criteria such as wholly obtained (WO), tariff shift (CTS), or regional value content (RVC) is not optional but essential. It is the key to helping businesses avoid trade disruptions and maximize integration benefits.

Steel Industry Faces Over 30% of Trade Defense Cases

From 2004 to August 2025, Vietnamese steel faced 86 trade defense cases from abroad. Photo: TL |

At the forum, Mr. Lê Sỹ Giảng, Director of GH Consults LLC, discussed the rise in anti-circumvention investigations, posing significant challenges for exporting nations, including Vietnam.

From 2009 to 2021, Turkey led with 32 cases, followed by the U.S. with 31 and the EU with 8. Conversely, China faced the most investigations with 37, while Vietnam ranked second with 13, highlighting high risks for exported goods. Common circumvention methods include product alteration, importing components for domestic assembly, or third-country assembly.

In the steel sector, pressures are even more pronounced. Mr. Lê Việt, CEO of Southern Steel Corporation (SSCV) and Vice Chairman of the Vietnam Steel Association, reported that from 2004 to August 2025, Vietnamese steel faced 86 trade defense cases, accounting for over 30% of total cases against Vietnamese exports. The primary cause is strong export growth, averaging 19% annually from 2016 to 2024.

Additionally, increasing protectionism in major markets has negatively impacted the industry. In the first eight months of this year, finished steel exports dropped by 20% in volume and 28% in value, totaling over 7 million tons. Most cases originated from key export markets like the U.S., EU, Mexico, and ASEAN countries.

Export market structure has also shifted significantly. While ASEAN previously accounted for nearly 60% of exports, by 2025, this share dropped to 30.8%. Meanwhile, the EU’s share rose to 20.9%, and the U.S. reached 9.6%. Notably, Vietnam’s steel industry has proactively used WTO rules to counter adverse measures, safeguarding legitimate interests and sustainable development.

Anh Đào

– 10:00 26/09/2025

Vietnamese Textile Industry: Overcoming Challenges, Seizing Opportunities to Sustain Growth

As the textile industry aims for continued export growth, businesses face not only intense international market pressures but also the challenge of overcoming inherent internal limitations.

Vinatex and Leading Garment Enterprises Unveil Q4 Strategic Plans

Despite mounting tariff pressures from the United States, Vietnam National Textile and Garment Group (Vinatex, UPCoM: VGT) and its subsidiaries are reporting positive signals: Viet Thang estimates a 9-month profit exceeding 8% of the annual plan, Hanosimex has secured 85-90% of orders until November, and Phong Phu and Hoa Tho are expanding their international market presence.