Missing the Beat: Waiting for Property Prices to Drop

In 2024, Mr. Vu (34, an office worker in Hanoi) had his eye on a two-bedroom apartment in a project located in Hoai Duc, with an asking price of around 60 million VND per square meter.

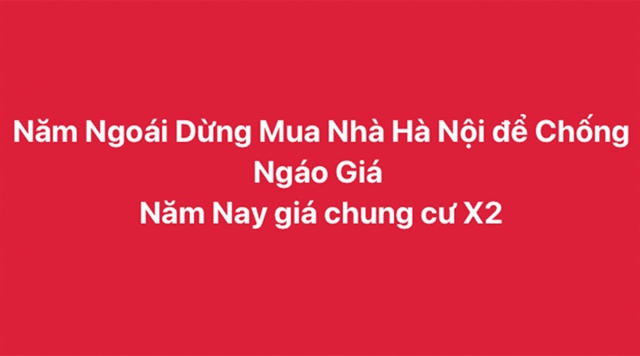

During his house-hunting journey, he joined several Facebook groups, one of which particularly caught his attention: “Stop Buying Houses in Hanoi to Avoid Price Madness.” The group was abuzz with posts urging members to “boycott” skyrocketing property prices, sharing information about overpriced projects, and predicting a sharp decline in house prices due to economic challenges. Mr. Vu was convinced by these analyses.

“At the time, I read many posts in the group and thought that apartment prices of 80-100 million VND per square meter were absurd. Everyone said to wait, that prices would crash, so I decided to postpone my purchase,” Mr. Vu explained. Believing that property prices were inflated and would soon plummet, he postponed his dream of buying an apartment last year.

Now, he faces the bitter reality that property prices have not only failed to drop but have soared, leaving him regretting his missed opportunity. Watching prices skyrocket, Mr. Vu laments, “Last year I missed out, and now if I want to buy the same apartment, I’d have to pay an extra billion VND. A friend even joked that waiting for prices to crash has crashed my dream of owning a home.”

Many regret halting their home purchases in anticipation of price drops. |

At current prices, the apartment Mr. Vu once considered is now beyond his financial reach. “Back then, I had 1.5 billion VND saved up, and I only needed to borrow a little more to buy it. Now, a similar apartment costs 5-6 billion VND, and I don’t know where to get the money,” he said.

The Facebook group Mr. Vu once actively participated in is now virtually dormant. What was once a bustling hub with thousands of interactions now only sees sporadic posts, mostly advertisements. Many members, like Mr. Vu, have quietly left the group or feel embarrassed when recalling their decision to wait for prices to crash.

Last year’s decision to delay purchasing a home has left Mr. Son and his wife (from Bac Ninh) in a similar predicament. In 2024, they were looking to buy an apartment in Linh Dam. At that time, the average price was around 30-35 million VND per square meter, equivalent to 2-2.2 billion VND for a two-bedroom apartment.

The couple thought they could take their time, save more money, and buy later. They hoped prices would drop since the apartments didn’t have land titles yet and were nearly 10 years old, making them look outdated.

Just one year later, their dream of owning an apartment seems increasingly out of reach as prices have skyrocketed from 2 billion VND to 3 billion VND. “I heard that the apartment complex we looked at has almost no units left. Someone is reselling a unit for 3 billion VND, and people are still lining up to inquire. There’s no land title, yet the prices are still sky-high,” Mr. Son recounted.

With their current budget, the couple has little chance of buying a similar apartment in Linh Dam. According to real estate agents, apartment prices in Linh Dam have surged, especially in older projects like HH Linh Dam and VP6. The 60-square-meter, two-bedroom apartment they once considered is now listed at 3-3.2 billion VND—equivalent to 50 million VND per square meter, a nearly 50% increase from last year.

Mr. Son noted that last year, with 1.3 billion VND saved, they only needed to borrow 700 million VND to buy the apartment. Now, with prices at 3 billion VND, they would need to borrow over 1.5 billion VND, putting immense financial pressure on them.

The couple has considered shifting their search to farther areas like Ha Dong or Dong Anh, but apartment prices there have also risen significantly.

Apartment prices surge. Photo: M.H |

A Risky Gamble

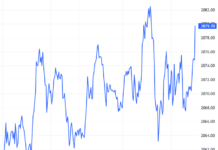

Market data shows that over the past five years, the average apartment price in Hanoi has risen from 20-25 million VND per square meter to 80-100 million VND per square meter.

Many new apartment projects are listing prices between 80 and 100 million VND per square meter. Some luxury projects have even reached 150-300 million VND per square meter. Limited supply, rising input costs, and new legal factors are expected to continue driving primary market prices higher. Prices for older apartments that have been in use for many years have also risen sharply, pushing secondary market prices in some inner-city areas close to 100 million VND per square meter.

This highlights that “stopping purchases” in a market experiencing strong growth, coupled with economic expansion and inflation, has turned this decision into a risky gamble for those with genuine housing needs.

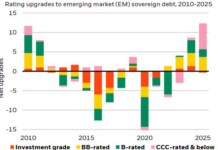

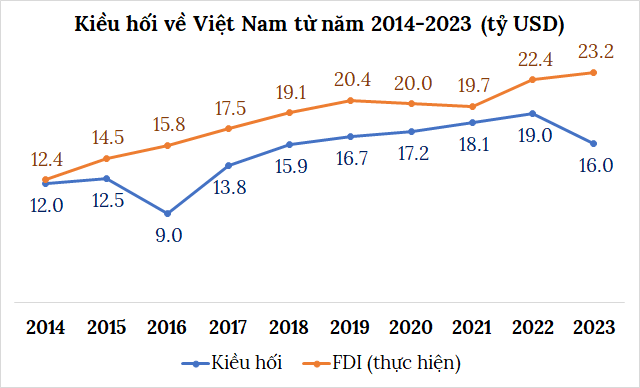

Financial expert Nguyen Manh Cuong believes that property prices are rising due to limited supply and strong real demand. Amid global inflation and low interest rates in Vietnam, real estate remains a safe haven, attracting both domestic and foreign capital. Therefore, delaying home purchases in hopes of price drops often leads to paying higher prices in the future.

According to Mr. Cuong, last year’s decision to “stop buying” was a costly lesson. It should be seen as an opportunity to plan long-term: save more, increase income, and better prepare for the next home purchase.

Predicting that property prices may continue to rise, Mr. Cuong advises those who “missed the boat” last year to make decisions promptly if they find a suitable apartment.

Duy Anh

– 13:01 27/09/2025

Is Di An Poised to Replicate Thu Duc’s Decade-Old Success Story?

A decade ago, Thu Duc transformed from a suburban area into a real estate hotspot, with property prices skyrocketing due to infrastructure development and urban planning. Today, experts believe Di An is following a similar trajectory, presenting a golden opportunity for investors who don’t want to miss the “last train.”

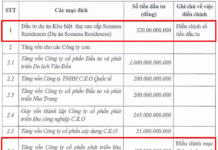

Vista Nam An Khanh Expands with 8 New High-Rise Towers, Offering Thousands of Luxury Apartments

Vista Nam An Khanh Urban Area has just unveiled plans to construct eight high-rise towers across plots CT3, CT4, and HH5, set to introduce thousands of new luxury apartments alongside state-of-the-art commercial and service spaces.