Two weeks ago, TCBS, a securities firm under Techcombank, successfully raised $410 million, valuing the company at $4 billion. This marks one of Vietnam’s largest IPOs in recent years, nearly matching half the total value of the 36 IPOs conducted in Malaysia—Southeast Asia’s leading IPO market—so far this year.

Since the start of 2025, Dragon Capital, a major investment fund, has forecasted that 13 companies, including Techcom Securities, will go public in Vietnam by 2028. These companies are expected to achieve a combined market capitalization of $47.5 billion, representing approximately 14% of Vietnam’s current stock market value.

Compared to just one IPO in 2024 and three in 2023, the current wave of IPOs is significantly more robust. Nguyen The Minh, Head of Research and Development at Yuanta Securities Vietnam, stated, “Companies planning IPOs don’t want to miss this wave.” He attributes the surge to rising stock prices and new regulations streamlining listing procedures.

The VN-Index has climbed over 30% year-to-date, leading Southeast Asia in performance, according to LSEG data. Notably, Vinpearl, Vingroup’s hospitality arm, raised approximately $190 million in its May IPO, marking its return to the public market after over a decade as a private entity.

Recently, several major firms have announced IPO plans, including Hoa Phat Agricultural Development JSC (HPA), a subsidiary of Hoa Phat Group, and VPBankS, VPBank’s securities arm. Dragon Capital suggests potential listings may also include VPS, Vietnam’s largest securities firm by market share, and the Long Chau pharmacy chain under FPT Corporation.

The market’s boom is partly fueled by robust credit growth, including margin lending, raising concerns about asset price bubbles. Vietnam’s credit-to-GDP ratio now exceeds three times the average for emerging and middle-income economies.

Hoang Huy, Equity Strategist at Maybank Securities Vietnam, notes that the IPO wave among securities firms is driven primarily by the need to raise capital for regulatory compliance and margin lending support.

Foreign Investors Remain Cautious

Despite positive developments, foreign investors remain cautious about Vietnam’s market. Anticipation of Vietnam’s potential upgrade from frontier to emerging market status by FTSE Russell—expected as early as October 8 (Vietnam time)—has heightened interest but has yet to attract significant new capital.

The World Bank estimates that approximately $5 billion in net foreign inflows, from both passive and active investors, could enter the market before and after the upgrade. However, foreign investors have significantly reduced their presence on the HOSE.

Specifically, foreign investors have net sold roughly VND 90 trillion ($3.4 billion) year-to-date, lowering foreign ownership to around 15.5% this month—well below 17% in 2024 and nearly 19% in late 2023.

“Foreign investors are selling due to currency volatility concerns and profit-taking after Vietnam’s strong market rally, but this doesn’t mean they’re exiting entirely,” commented Huy of Maybank.

– 10:03 30/09/2025

Vietstock Daily September 30, 2025: Market Polarization Persists

The VN-Index has rebounded, surpassing the Middle line of the Bollinger Bands. However, trading volume has declined for the fourth consecutive session, remaining below the 20-session average, indicating persistent investor caution. Meanwhile, the Stochastic Oscillator has already signaled a buy opportunity. If the MACD follows suit with a similar signal in upcoming sessions, the potential for sustained upward momentum will strengthen.

Market Pulse 29/09: Continued Divergence in Market Trends

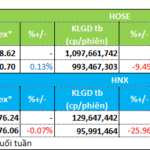

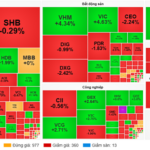

At the close of trading, the VN-Index climbed 5.78 points (+0.35%) to reach 1,666.48, while the HNX-Index dipped 0.91 points (-0.33%) to 275.15. Market breadth favored decliners, with 469 stocks falling and 258 advancing. Similarly, the VN30 basket saw red dominate, as 18 members declined, 10 rose, and 2 remained unchanged.

VN-Index’s Deceptive Rally Leaves Investors Facing Heavy Losses

The stock market’s deceptive “green on the outside, red on the inside” state has left many investors’ accounts in the red, as losses mount despite superficial signs of stability.