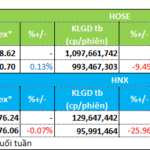

The stock market concluded the third quarter of 2025 on a lackluster note. The VN-Index edged closer to the 1,680-point mark, facing intensified selling pressure. At the close, the VN-Index dipped by 4.78 points (-0.29%), settling at 1,661.70 points. Foreign investors continued their net selling streak, offloading a total of 1,268 billion VND across the market.

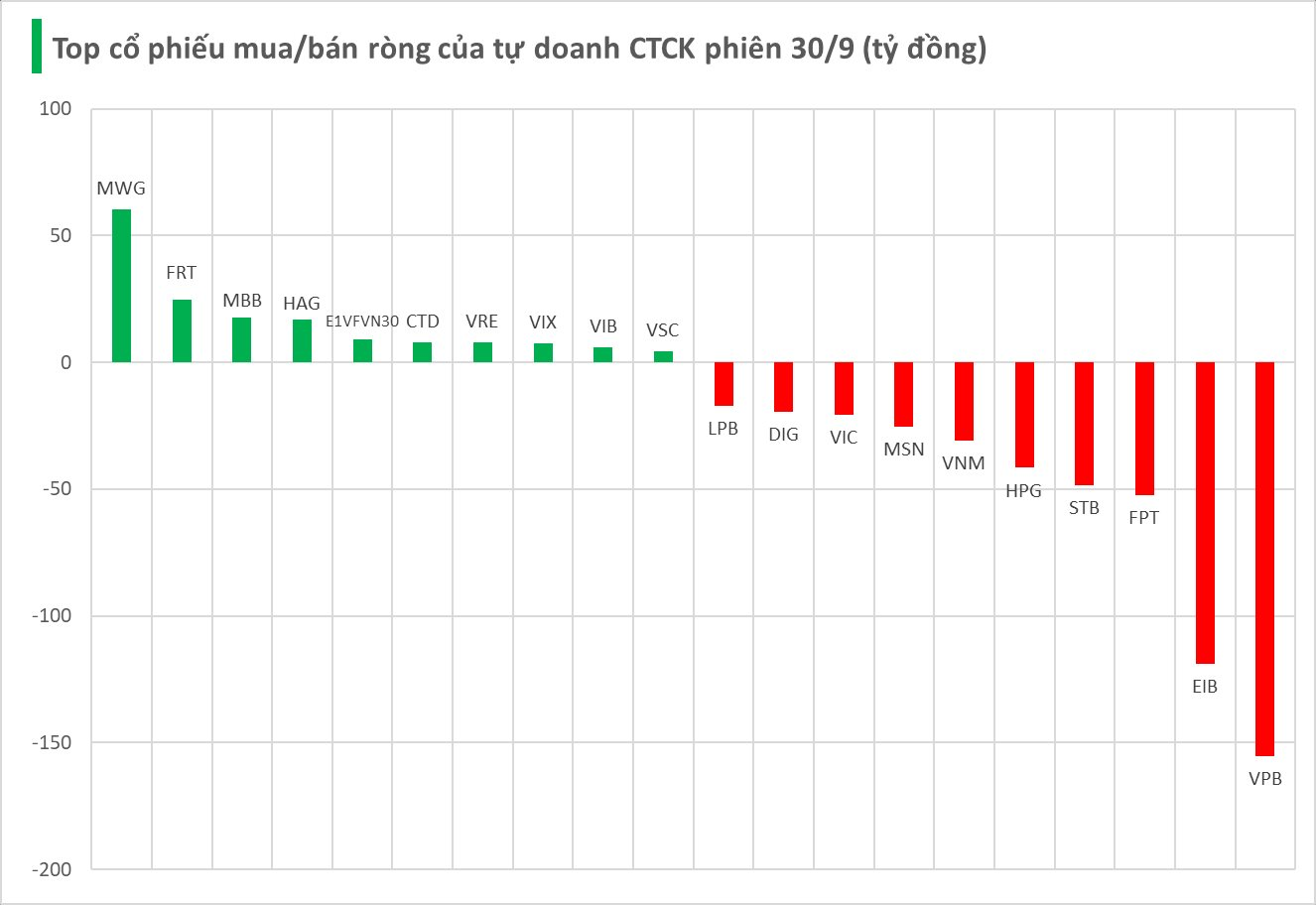

Securities firms recorded a net sell of 523 billion VND on the Ho Chi Minh City Stock Exchange (HOSE).

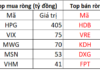

Specifically, securities firms led by VPB recorded the highest net sell value at -155 billion VND, followed by EIB (-119 billion), FPT (-52 billion), STB (-48 billion), and HPG (-42 billion VND). Other notable stocks with significant net selling included VNM (-31 billion), MSN (-25 billion), VIC (-21 billion), DIG (-19 billion), and LPB (-17 billion VND).

Conversely, MWG emerged as the most heavily bought stock, with a net purchase of 60 billion VND. FRT secured the second spot with 25 billion VND, trailed by MBB (18 billion), HAG (17 billion), E1VFVN30 (9 billion), CTD (8 billion), VRE (8 billion), VIX (7 billion), VIB (5 billion), and VSC (4 billion VND).

Technical Analysis for the Afternoon Session of September 30th: Continued Tug-of-War

The VN-Index remains locked in a tug-of-war around the Bollinger Bands’ Middle Line, even as the Stochastic Oscillator signals a potential buying opportunity. Meanwhile, the HNX-Index experienced a notable decline, retesting the lower boundary of its Triangle pattern.

Vietstock Daily September 30, 2025: Market Polarization Persists

The VN-Index has rebounded, surpassing the Middle line of the Bollinger Bands. However, trading volume has declined for the fourth consecutive session, remaining below the 20-session average, indicating persistent investor caution. Meanwhile, the Stochastic Oscillator has already signaled a buy opportunity. If the MACD follows suit with a similar signal in upcoming sessions, the potential for sustained upward momentum will strengthen.