VPS Securities has announced its capital increase plans, recently approved at an extraordinary shareholders’ meeting.

First, VPS plans to issue 710 million bonus shares to existing shareholders at a ratio of 1:1.245601579. The issuance capital of VND 7.1 trillion will be sourced from undistributed profits (VND 6.912 trillion) and supplementary capital reserves, financial risk provisions, and operational risk funds. The implementation is scheduled for Q4/2025 to 2026, pending approval from the State Securities Commission (SSC).

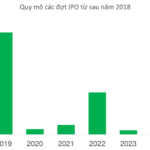

Second, VPS Securities will conduct an IPO, offering 202.3 million shares. The offering price will not be lower than the book value of VND 22,457 per share, as per the 2025 semi-annual financial report. The offering is open to all domestic and foreign individuals and organizations, targeting 13.65% of the company’s post-IPO equity. Foreign ownership limits will be raised to 100%. The IPO is expected to take place in Q4/2025 to Q1/2026.

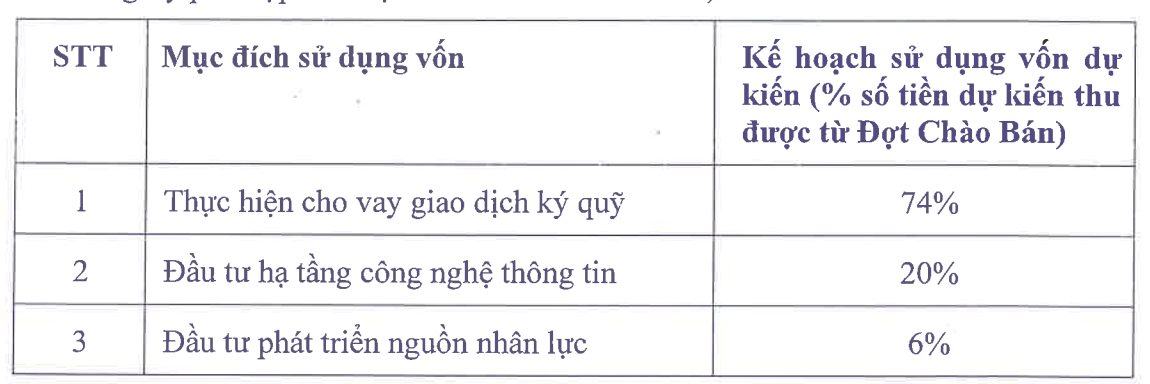

If the IPO is fully subscribed, VPS will raise at least VND 4.543 trillion. The proceeds will be allocated as follows: 74% for margin lending, 20% for IT infrastructure investment, and the remainder for human resource development.

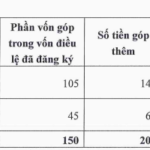

Third, VPS will privately offer nearly 162 million shares to professional investors and contributors to the company’s development. The offering price remains undisclosed, with implementation expected in 2025 or 2026.

If all three plans are successfully executed, VPS Securities’ chartered capital will reach VND 16.442 trillion, nearly tripling its current level.

Notably, all shares will be listed on the Ho Chi Minh City Stock Exchange (HoSE) post-IPO. If VPS fails to meet listing requirements after the IPO, the shares will be registered for trading on the Unlisted Public Company Market (UPCoM).

The shareholders’ meeting also approved the resignation of Mr. Indronil Sengupta from the Board of Directors and Ms. Nguyễn Thị Vân Huyền from the Supervisory Board, both citing personal reasons. Mr. John Desmond Sheehy was appointed to the Board of Directors, and Ms. Nguyễn Ngọc Khánh joined the Supervisory Board.

In the first half of 2025, VPS reported VND 3.192 trillion in operating revenue, a slight decrease year-on-year. Pre-tax and after-tax profits reached VND 1.285 trillion and VND 1.027 trillion, respectively, up 40% year-on-year.

In Q2/2025, VPS maintained its leading position in brokerage, capturing 15.37% market share on HoSE, 18.82% on HNX, 16.57% on UPCoM, and 46.39% in derivatives.

HVH Plans to Invest Additional VND 140 Billion in Euro Villas Project Developer in Phú Thọ

On September 26th, the Board of Directors of HVC Investment and Technology Joint Stock Company (HOSE: HVH) approved adjustments to the capital contribution in its subsidiary, HVC and Ho Guom Hoa Binh Investment Limited Liability Company (HVC Hoa Binh).

Gelex Infrastructure Unveils IPO Plan: Targeting $28,000–$30,000 per Share, Aiming to Raise $300 Million, Potentially Valuing Company at $1 Billion

According to BVSC Securities, Gelex Infrastructure Corporation is poised to raise approximately VND 3,000 billion, a strategic move to bolster capital for its real estate segment and re-evaluate the market’s perception of the “engine” that currently constitutes two-thirds of the group’s total assets.