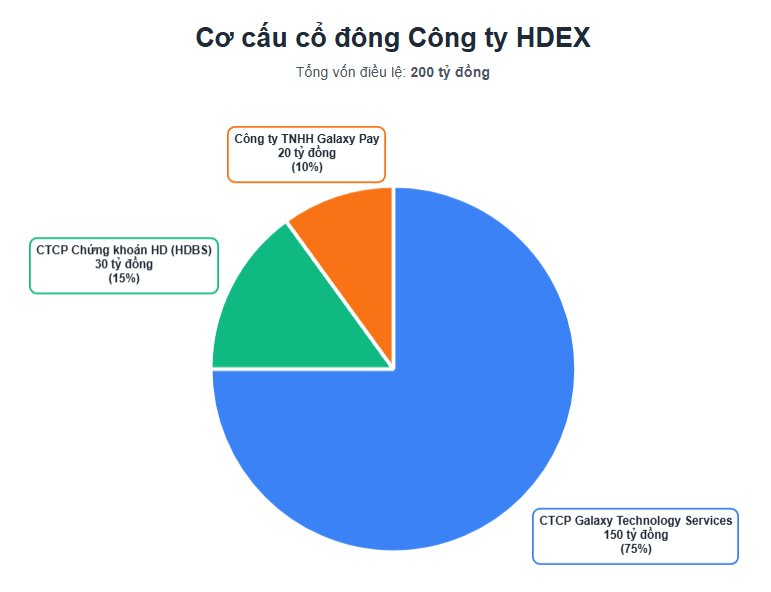

On September 25, 2025, HD Cryptocurrency Asset Exchange Corporation (HDEX) was established with an initial charter capital of VND 200 billion, headquartered at PV Gas Tower, 673 Nguyen Huu Tho, Nha Be Commune, Ho Chi Minh City.

HDEX’s shareholder structure reveals the presence of entities within billionaire Nguyen Thi Phuong Thao’s ecosystem. Specifically, HD Securities Corporation (HDBS), an affiliate of HDBank, contributed VND 30 billion, equivalent to 15% of the capital. The remaining capital is held by Galaxy Pay LLC (10%) and Galaxy Technology Services Corporation (75%). Mr. Huynh Kim Tuoc serves as the Chairman of HDEX’s Board of Directors.

Galaxy Holdings Ecosystem

The involvement of Galaxy Pay and Galaxy Technology Services is noteworthy, as they are subsidiaries of Galaxy Holdings (Galaxy Digital Holdings LLC), a digital technology conglomerate under Sovico Group. Galaxy Holdings was established in August 2021 with a charter capital of VND 500 billion, initially chaired by Mrs. Nguyen Thi Phuong Thao as both Chairman and CEO.

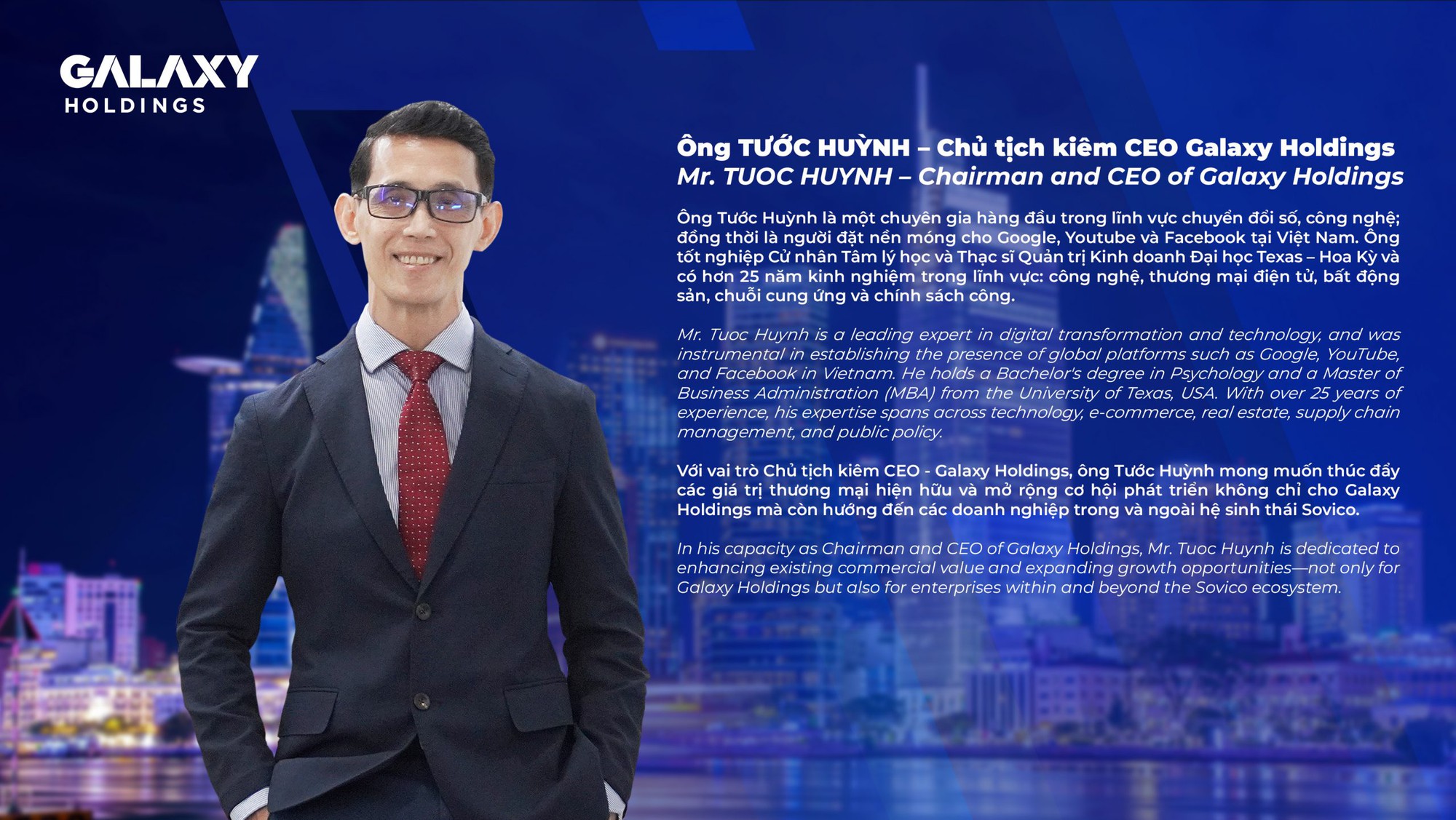

Since July 4, 2025, Mr. Huynh Kim Tuoc has been appointed as Chairman and CEO of Galaxy Holdings. Mr. Tuoc is recognized as an expert with over 25 years of experience in digital transformation and technology, having played a pivotal role in establishing Google and YouTube’s presence in Vietnam.

Just days before HDEX’s establishment, HDBS announced plans to seek shareholder approval for issuing over 365 million shares to existing shareholders at a ratio of 2:5, priced at VND 20,000 per share. If successful, the securities firm aims to raise more than VND 7.3 trillion. According to the capital allocation plan, approximately VND 1.47 trillion will be used to invest in a cryptocurrency asset exchange company, potentially HDEX. This company is expected to increase its charter capital to VND 10 trillion.

The influx of capital from major institutions into the cryptocurrency asset sector is driven by an evolving legal framework. Under Resolution 05/2025/NQ-CP issued on September 9, 2025, the government has permitted the pilot implementation of a cryptocurrency asset market.

The resolution outlines specific requirements, including a minimum capital of VND 10 trillion for exchange operators, with 35% of the capital held by at least two institutions such as banks, securities firms, fund managers, or insurers. This explains HDEX’s large-scale capital increase plan and the involvement of financial institutions.

HDBank’s ecosystem is not an isolated case. The race in Vietnam’s cryptocurrency asset exchange market has seen participation from several major financial players. Previously, the market witnessed the establishment of Vietnam Prosperity Cryptocurrency Asset Exchange Corporation (CAEX) with contributions from VPBankS, VIX Cryptocurrency Asset Exchange Corporation (VIXEX) by VIX Securities, and Techcom Cryptocurrency Asset Exchange Corporation (TCEX) linked to TCBS. Notable collaborations also include MB Bank and Dunamu, the operator of South Korea’s Upbit exchange.

The participation of major financial institutions signals efforts to transition cryptocurrency asset trading from informal to formal markets, enabling regulation and integration into the domestic financial system.

According to Chainalysis, cryptocurrency inflows into Vietnam from June 2024 to July 2025 exceeded USD 200 billion. A VinaCapital report estimates that approximately 17 million Vietnamese own cryptocurrency assets, with most transactions occurring on international exchanges.

Vietnam Risks Becoming a ‘Tech Waste Dump’ Without Stricter Auto Fuel Regulations?

Vietnam’s ambitious goal to reduce car fuel consumption to 4.83 liters/100km by 2030 has sparked intense debate. Experts warn, however, that delaying implementation risks turning the country into a “technological dumping ground” and forfeiting opportunities for green growth.

How Do International Experts Forecast Vietnam’s 2025 GDP Growth Compared to ASEAN-6 Nations, Over a Month After the U.S. Imposed a 20% Retaliatory Tariff?

Among countries in the region, Vietnam stands as the sole nation for which the Asian Development Bank (ADB) has revised its GDP growth forecast upward for this year, compared to its April report.