The assets of Chairman Do Anh Tuan are nearing the $2 billion mark.

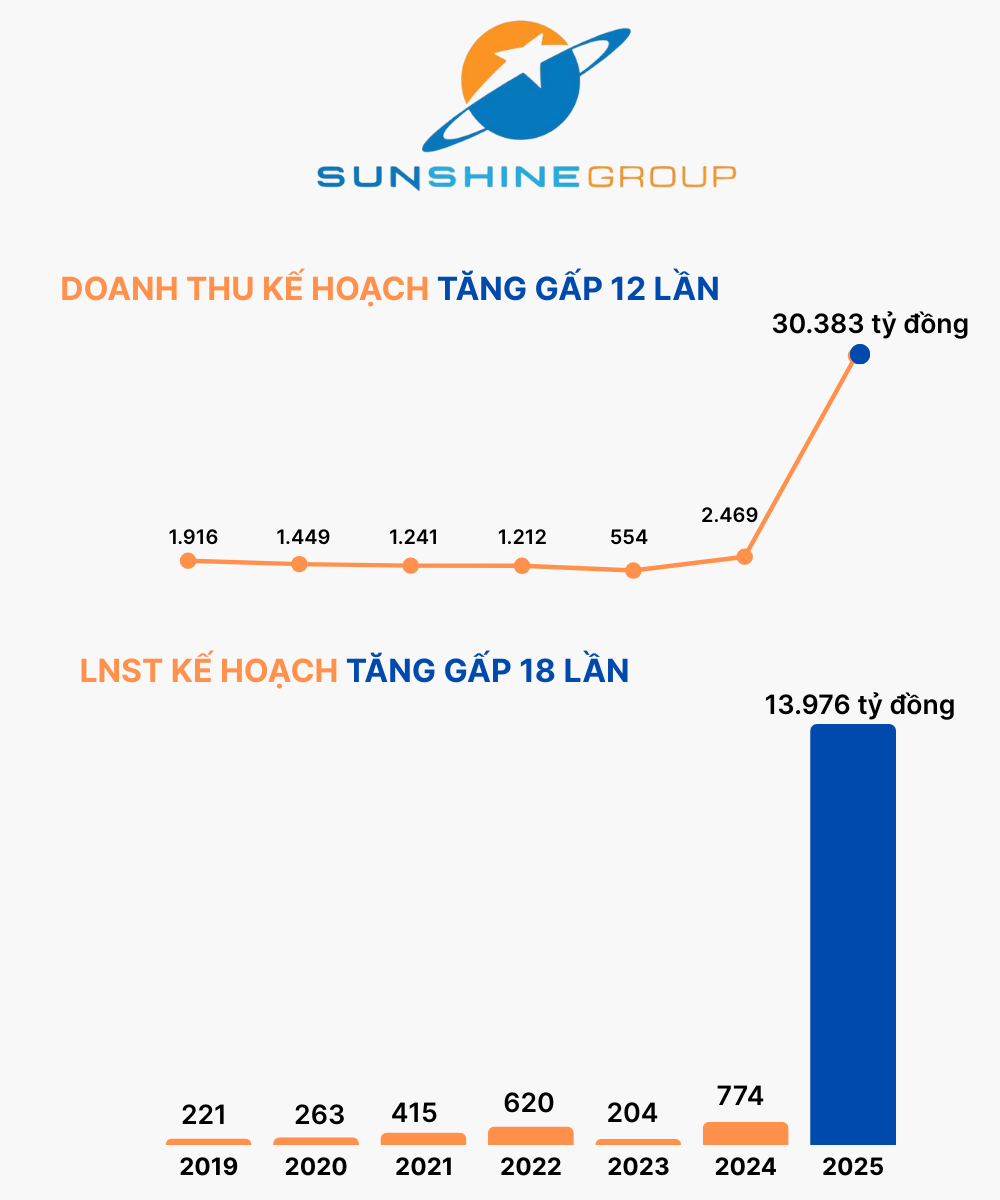

Sunshine Group Joint Stock Company (Sunshine Group, HNX: KSF) has announced its business plan for the last two quarters and the full year of 2025, projecting robust growth. For the entire year of 2025, Sunshine Group aims to achieve a revenue of VND 50,000 billion and a post-tax profit of VND 12,000 billion, representing a 12-fold and 18-fold increase, respectively, compared to 2024.

In Q3 2025 alone, Sunshine Group estimates a revenue of VND 3,664 billion and a post-tax profit of VND 1,474 billion, with a remarkable profit margin of 40%. Advance payments from buyers are expected to reach VND 20,750 billion, more than triple the equity capital (VND 6,139 billion).

In the real estate sector, advance payments from buyers typically include deposits or prepayments made by customers before project handover. These funds are considered a reserve, convertible into revenue and profit upon project completion and financial reporting.

Moving into Q4, the group targets a breakthrough with a revenue of VND 26,060 billion and a post-tax profit of VND 12,419 billion, a 7-fold and 8.5-fold increase, respectively, compared to the previous quarter. Notably, the ROE is projected to surge from 24% to 89%, positioning Sunshine Group among the market’s most profitable enterprises. Despite a significant drop in advance payments to VND 6,300 billion, equity capital is expected to quadruple to VND 24,456 billion.

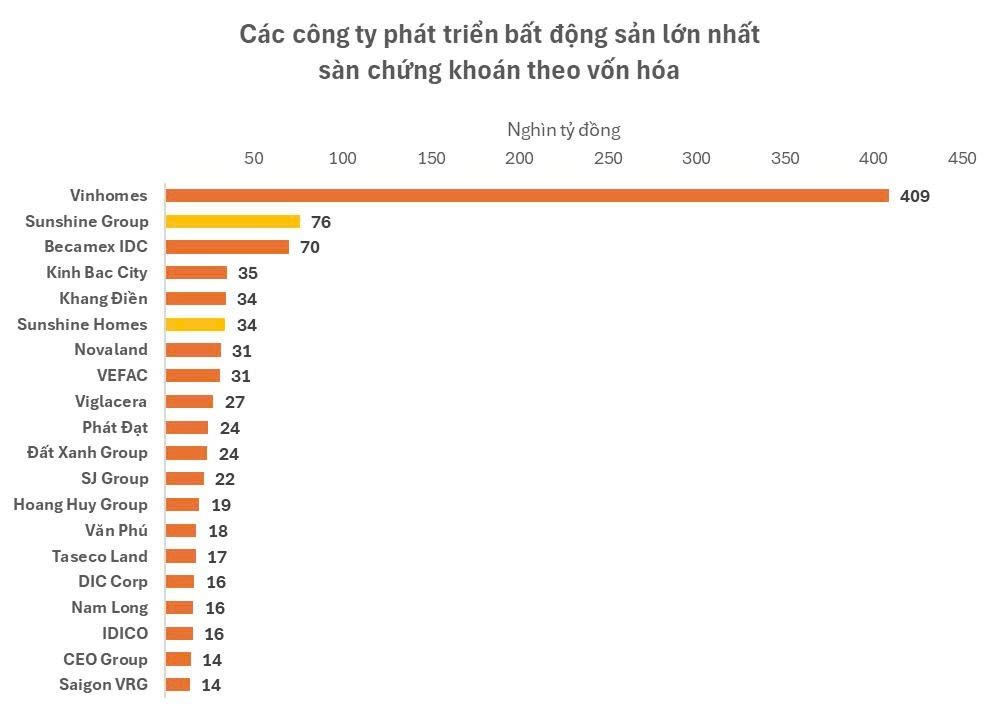

Recently, Sunshine Group completed a public tender offer, integrating Sunshine Homes Development JSC (SSH) into the group. Post-merger, Sunshine Group’s charter capital increased from VND 3,000 billion to nearly VND 9,000 billion, with a market capitalization of VND 76,000 billion as of late September. This positions the company as the second-largest real estate enterprise by market capitalization, following Vinhomes (VHM), surpassing Becamex IDC (BCM), Kinh Bac (KBC), and Khang Dien (KDH).

The substantial increase in market capitalization not only reflects Sunshine Group’s financial stature post-restructuring but also opens up significant opportunities for investment expansion, strategic capital attraction, and market leadership in Vietnam’s real estate sector.

Sunshine Group has significantly expanded its land bank and portfolio of billion-dollar projects during 2024–2025. Notable among these are high-end projects such as: Noble Crystal Tay Ho WorldHotels Residence, Noble Palace Tay Ho, Noble Crystal Long Bien, Noble Palace Long Bien, Noble Palace Tay Thang Long, and Noble Palace Garden. This portfolio continues to grow with recent large-scale projects, including: Noble Palace Riverside (Hanoi), Sunshine Legend City (Hanoi), Sunshine Marina Mui Ne (Lam Dong), and Sunshine Bay Retreat Vung Tau (Ho Chi Minh City)…

Through a robust M&A strategy, Sunshine Group now owns a portfolio of projects with complete legal frameworks, ready for handover from 2025 to 2026, with a total product value estimated at over VND 200,000 billion (excluding projects under legal resolution and development preparation). In 2025 alone, the group plans to hand over thousands of low-rise and high-rise units from key projects like Noble Palace Long Bien, Noble Palace Tay Ho, Noble Palace Tay Thang Long, and Sunshine Sky City, with a total value of approximately VND 100,000 billion.

In response to the Prime Minister’s call for ministries, sectors, localities, and businesses to jointly address housing issues for young people, Sunshine Group plans to supply 20,000 high-quality apartments at reasonable prices in both Hanoi and Ho Chi Minh City, contributing to solving the housing challenges faced by today’s youth.

A pioneering project in this strategy is Sunshine Legend City, spanning nearly 60 hectares in eastern Hanoi, and Sunshine Bay Retreat Vung Tau, covering nearly 20 hectares in Phuoc Thang Ward, Ho Chi Minh City (formerly Vung Tau City before merger). These projects integrate high-quality apartments with affordable pricing, helping to realize the dream of homeownership for young people, aligning with the government’s broader vision.

According to a representative from Sunshine Group, this new product line is developed to the same quality standards as the group’s existing high-end apartment projects, which have received high market and resident acclaim for post-handover apartment quality and supporting services. However, the key difference lies in the pricing strategy: by mastering the entire closed development chain, Sunshine Group can effectively control costs and reduce profit margins, offering young people the opportunity to own a quality home without compromising their living experience.

Billionaire Nguyen Thi Phuong Thao’s Ecosystem Enters the Crypto Asset Platform Race, Targeting $420 Million in Charter Capital

A groundbreaking new entity in the cryptocurrency exchange sector has emerged, backed by HD Securities and key players within the Sovico Group ecosystem. This development follows HD Securities’ recent announcement of a plan to raise over 7.3 trillion VND, with a significant portion earmarked for investment in this innovative field.

Market Pulse 30/09: Capital Flows Return as VN-Index Experiences Deep Correction

After a sharp decline at the start of the afternoon session, the market gradually recovered, closing near the reference level. However, the indices still ended the day in negative territory. The VN-Index closed at 1,661.7 points, down nearly 5 points, while the HNX-Index settled at 273.16 points, shedding 2 points.

Vietnam Risks Becoming a ‘Tech Waste Dump’ Without Stricter Auto Fuel Regulations?

Vietnam’s ambitious goal to reduce car fuel consumption to 4.83 liters/100km by 2030 has sparked intense debate. Experts warn, however, that delaying implementation risks turning the country into a “technological dumping ground” and forfeiting opportunities for green growth.