The share buyback program will be executed from October 6 to November 4. TVC will utilize capital from the following sources, in order of priority: undistributed after-tax profits (401.5 billion VND), share premium (52.4 billion VND), development investment fund (23.7 billion VND), and other equity funds (23.5 billion VND).

The company will purchase shares through both negotiated transactions and order matching. The purchase price will not exceed the reference price plus 50% of the stock price fluctuation range based on the reference price.

As of September 30, 2025, TVC shares are trading at approximately 11,000 VND per share. Based on this price, the buyback transaction is valued at 165 billion VND. Thus, the company may only need to use its undistributed profits to fund the transaction, without tapping into other sources.

With over 110.6 million shares outstanding, TVC plans to reduce the number of shares to over 95.6 million after the buyback, lowering its charter capital from over 1 trillion VND to more than 956 billion VND.

Previously, the company completed a buyback of 8 million shares between December 18, 2024, and January 15, 2025.

The purchase of 15 million treasury shares was approved at TVC‘s 2025 Annual General Meeting of Shareholders. During the meeting, Chairwoman Nguyễn Thị Hằng commented on the plan: “The company’s accumulated profits exceed 300 billion VND. At a price of 13,500 VND per share (as of June 14), buying back up to 15 million shares would cost around 200 billion VND. The remaining funds are expected to be used for a 10% dividend payout for 2021. If 2025’s business results are positive, an interim dividend of approximately 6% will be distributed by year-end.”

TVC Chairwoman Nguyễn Thị Hằng

|

Recently, Chairwoman Nguyễn Thị Hằng registered to purchase 1.5 million TVC shares to increase her ownership stake. The transaction is scheduled from September 11 to October 9. Currently, she holds 100,000 shares, equivalent to 0.09% of TVC‘s capital. If successful, her ownership will rise to 1.44%, or 1.6 million shares. At the current market price of nearly 11,000 VND per share, the transaction is estimated to cost approximately 16.5 billion VND.

TVC also recently acquired additional shares in its subsidiary, T-Cap Securities (HOSE: TVB). Specifically, the company registered to purchase 1.5 million shares from August 29 to September 26. By the end of the registration period, TVC acquired 185,000 shares, increasing its ownership in TVB from 68.81% to 68.98%.

First-half 2025 earnings decline sharply

For 2025, TVC has set a conservative business plan. On a consolidated basis, the company targets total revenue of 350 billion VND and after-tax profit of 150 billion VND, down 40% and 66% respectively compared to 2024. For the parent company, the targets are 190 billion VND in revenue and 80 billion VND in after-tax profit, decreases of 43% and 72% respectively.

Commenting on the plan, Chairwoman Nguyễn Thị Hằng noted that despite the lower figures, they reflect significant effort from management and employees. The company still faces substantial operational, salary, and recruitment costs. Amid efforts to manage expenses effectively, revenue is expected to be impacted by fluctuations in the stock market, uncertain U.S. tariffs, and geopolitical challenges.

The Chairwoman emphasized that 2025 marks the final year of the restructuring process, with expectations for a more positive outlook in 2026.

First-half 2025 results highlight these challenges. After-tax profit stood at 37 billion VND, an 87% decline year-over-year. This was due to falling revenue and the absence of financial expense provision reversals seen in the same period last year.

As of June 30, total assets on the balance sheet were 2 trillion VND, down nearly 10% from the start of the year. The company reduced its trading securities balance from 1.1 trillion VND to nearly 95 billion VND, while cash and equivalents increased from 50 billion VND to over 1 trillion VND.

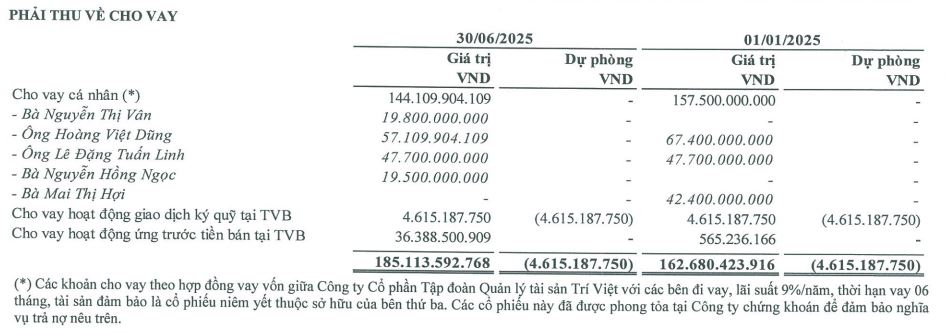

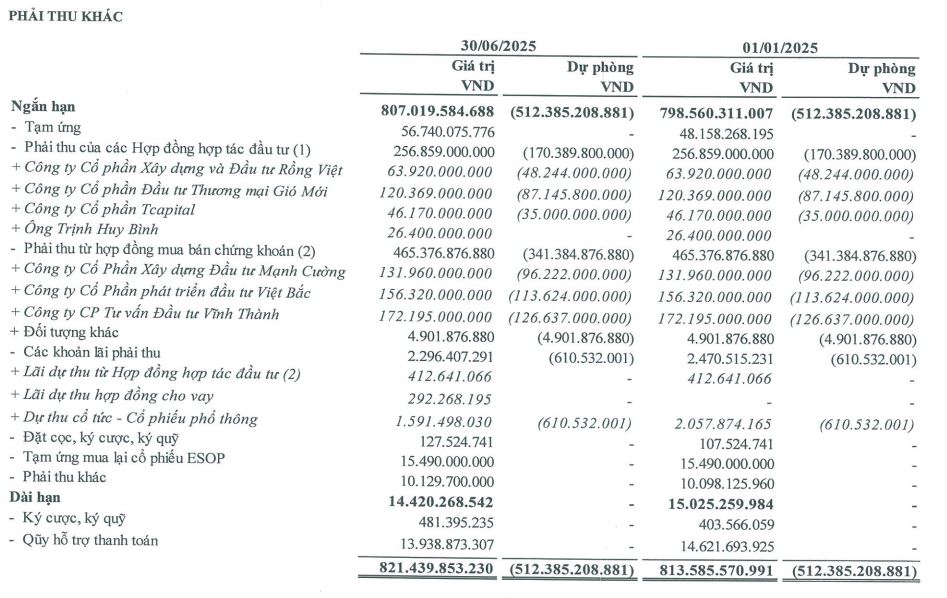

Notably, long-term receivables (185 billion VND) and other short-term receivables (807 billion VND) represent a significant portion of the company’s assets. Of this, over 512 billion VND in short-term receivables has been provisioned for potential bad debts.

|

Explanation of TVC‘s loans and short-term receivables

|

– 10:28 01/10/2025

$600 Million ETF Fund Initiates Purchases of HVN, GEE, STB, and FPT

During the period from September 8 to 15, 2025, the VanEck Vectors Vietnam ETF (VNM ETF) initiated the acquisition of four newly added stocks to its portfolio, as part of the MarketVector Vietnam Local Index—the benchmark index for the Fund.

The Power of Persuasive Copy: Crafting Compelling Headlines

“MWG Leaders Tease Stock Repurchase Timeline: Prices to Reach Six-Figure Territory”

“Our CEO is pleased to announce that we are in the process of finalizing and submitting our documentation to the relevant regulatory authorities. We are confident in our ability to meet and exceed all requirements, and we look forward to sharing more updates as we progress through this exciting journey.”

Vinhomes Slashes Registered Capital Following the Largest Treasury Stock Purchase in History

After the reduction in charter capital, Vinhomes remains the largest real estate company in Vietnam with a market capitalization of nearly VND 165,000 billion. A formidable force in the industry, Vinhomes continues to shape the landscape of the nation with its innovative and grand-scale developments.