Boosting Consumer Spending: A Key Driver for Economic Growth

A significant highlight in the government’s stimulus efforts is the additional 2% reduction in the Value Added Tax (VAT), from 10% to 8%, applicable to essential goods and services from July 1, 2025, until the end of 2026. This move directly supports consumer purchasing power, particularly for middle and low-income groups, who are heavily impacted by rising living costs. Simultaneously, it helps businesses reduce operational costs, providing room for production expansion and competitive pricing.

The ripple effect of this VAT reduction is expected to be substantial. Lower essential consumption costs will ease financial pressure, thereby boosting shopping demand during peak seasons in late 2025 and extending into 2026. With consumption accounting for over 60% of Vietnam’s GDP, this stimulus will create a vital economic cycle. It serves not only as a short-term solution but also as a foundation for sustainable growth driven by domestic purchasing power.

For the retail sector, the VAT reduction makes essential goods more affordable, encouraging consumers to shop more at modern channels like supermarkets, convenience stores, and e-commerce platforms. This presents an opportunity for large retail chains to expand their market share, especially in rural areas, where over 60% of the population resides and growth potential remains high. Both customer traffic and average basket value are expected to improve significantly, fueling the rapid expansion of modern retail chains.

In the fast-moving consumer goods (FMCG) sector, the VAT reduction enables essential products such as food, beverages, spices, and convenience items to reach consumers at better prices. This is crucial for boosting purchasing power amid ongoing cost-of-living pressures. Given the high consumption frequency of FMCG products, the sector is poised for notable volume growth, while also creating opportunities for businesses to promote premium, safe, and traceable products.

Beyond “tax cuts to boost demand,” the government is implementing a synchronized set of measures: enhancing trade promotion, encouraging Vietnamese products to win over domestic consumers, fostering e-commerce and modern retail chains, and tightening controls on counterfeit and substandard goods to ensure a level playing field. These initiatives aim not only to increase consumption quantitatively but also to enhance its quality, linking it to safe and traceable products.

With a population of 100 million and per capita income approaching the $5,000 mark, boosting consumer spending becomes a pivotal driver. It not only sustains short-term growth momentum but also reshapes market dynamics, creating opportunities for domestic businesses with extensive reach to achieve sustainable development.

In this landscape, integrated consumer-retail enterprises like Masan, with an ecosystem spanning production to distribution, are expected to directly benefit from the stimulus policy and accelerate growth in the coming period.

Profits Forecast to Rise Over 80% Year-on-Year

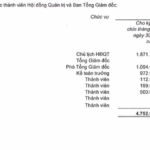

According to the latest VDSC report, Masan’s (HOSE: MSN) after-tax profit in Q3/2025 is estimated at approximately VND 1,272 billion, up 81.4% year-on-year. Recent positive figures from the company also hint at promising results in the final months of the year.

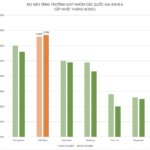

Masan’s retail arm, WinCommerce (WCM), operates the WinMart supermarket chain and WinMart+/WiN convenience stores with over 4,200 outlets nationwide, 75% of which are newly opened in rural areas. In the first eight months of the year, WCM recorded revenue of over VND 25,000 billion, up 16.1% year-on-year and surpassing the annual growth plan. In August alone, revenue reached VND 3,573 billion, up 24.2% year-on-year, reflecting the strong rebound in domestic purchasing power and the effectiveness of the modern retail model.

Meanwhile, Masan MEATLife (MML) demonstrated steady progress post-restructuring. In August 2025, MML sold 14,007 tons of products, up 12.9% year-on-year. Revenue reached VND 999 billion (+11.1%), while after-tax profit surged 60.5% to VND 35 billion. Both EBIT and EBITDA showed significant improvement, indicating strengthened operational efficiency and profit margins. These results reflect the consumer shift toward branded, safe, and traceable meat products.

These figures demonstrate that, as the stimulus policy unlocks consumer demand, integrated ecosystem companies like Masan are not only leveraging their extensive reach and product portfolio but also accelerating expansion, enhancing efficiency, and pursuing sustainable growth.

In its September 2025 update, Bao Viet Securities (BVSC) maintained an OUTPERFORM rating for MSN with a target price of VND 106,000 per share, significantly higher than the current market price. However, BVSC also highlighted challenges: intensifying competition between domestic and foreign retail chains, unpredictable fluctuations in raw material and operational costs, and new regulatory requirements like electronic invoicing, which could pose short-term pressures. This requires MSN to balance expansion with operational optimization and risk management to realize growth forecasts.

– 09:58 01/10/2025

Asian Bank Revises Vietnam’s Growth Forecast Upward

The Asian Development Bank (ADB) has revised its growth forecast for Vietnam, projecting a 6.7% expansion in 2025, while adjusting the 2026 outlook to 6.0%. The latest report underscores Vietnam’s promising trajectory but emphasizes the need for accelerated structural reforms and sustainable infrastructure investments to sustain this momentum.

Border Province Surpasses Annual Budget Target by Mid-September

This province has surpassed its assigned target by an impressive 100%, marking a significant achievement in its performance.