In an updated report, Vietcap Securities maintains confidence that FTSE Russell will announce a positive outcome for Vietnam next Wednesday (October 7). According to the brokerage, the remaining criteria—Settlement Cycle (DvP) and Settlement—costs related to failed trades, are both expected to be upgraded to “Met” status.

Citing FTSE’s September 2025 Annual Country Classification Report, Vietcap notes that FTSE Russell will announce the reclassification of Vietnam’s stock market, accompanied by a link to the FAQ – Vietnam page. This FAQ will detail the implementation plan, including the number of phases, execution dates, a list of 10-15 Vietnamese stocks expected to be included in the index, and Vietnam’s projected weighting across various indices.

Following the announcement, index funds will initiate the account opening process (including securities trading code registration) for their respective funds. Vietcap forecasts that implementation will likely occur in 4-5 phases at the end of each quarter, with the first portfolio addition expected as early as March 2026.

According to the brokerage, upgrading Vietnam’s market to Secondary Emerging status will serve as a positive counterbalance to the substantial net selling pressure from foreign investors, which has surpassed $9 billion from 2023 to 2025. International brokerages estimate that net foreign investment could reach $6-8 billion, or even $10 billion in an optimistic scenario. These projections include both active and passive fund flows, with active funds contributing the majority.

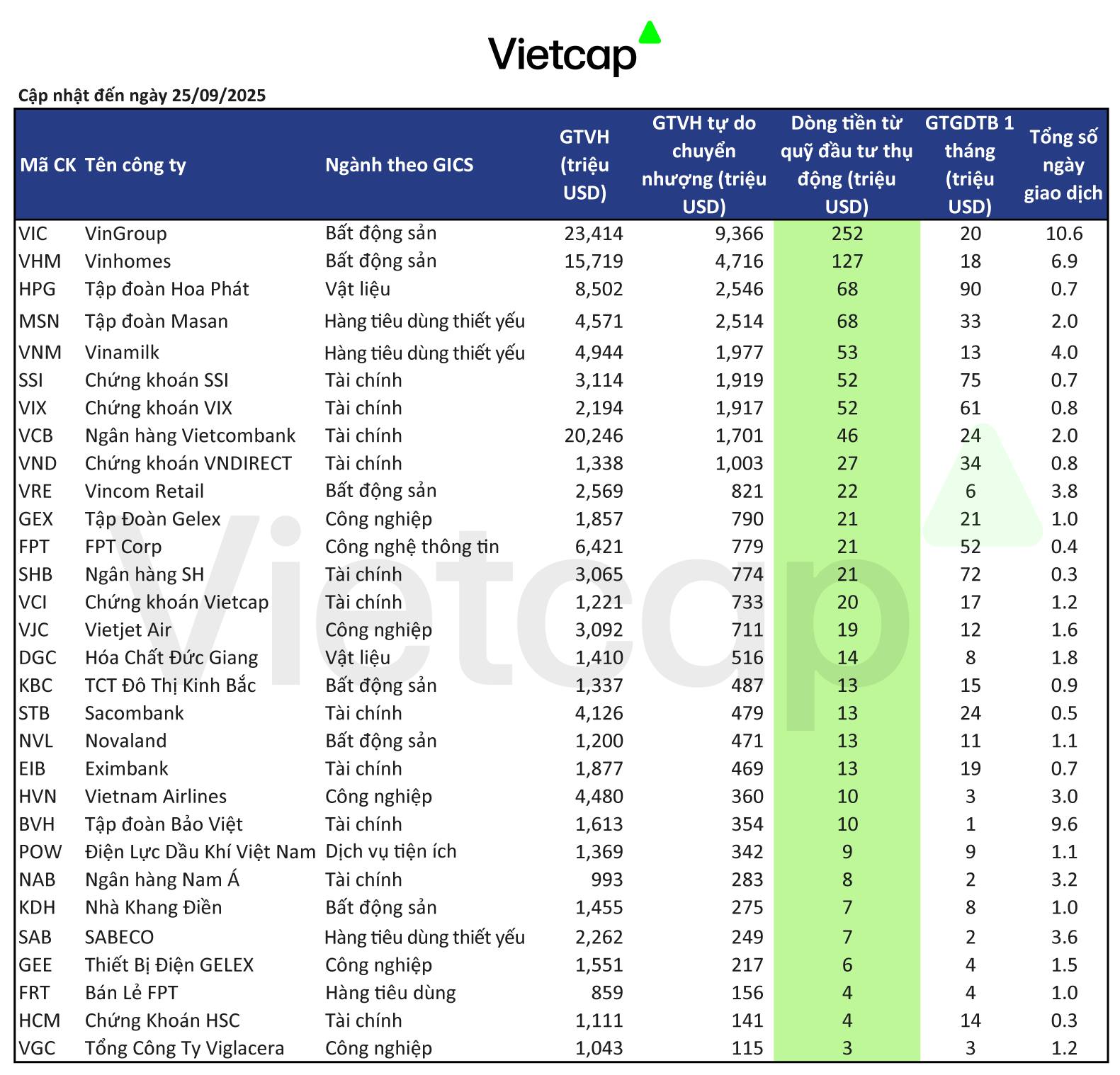

Based on Vietcap’s research, Vietnam is projected to hold a 0.3% weighting in the FTSE Emerging Markets All Cap China A Inclusion Index, in addition to being included in other FTSE indices. Approximately 30 Vietnamese stocks will be added to index fund portfolios, with passive fund inflows expected to reach at least $1 billion during implementation. FTSE Russell screens eligible stocks based on criteria such as minimum foreign ownership ratios, size, liquidity, and free float (reviewed quarterly; any violations may result in index removal).

Extensive Preparations for the Upgrade Process

Regarding index funds adding Vietnamese stocks to their portfolios, Vietcap assesses that domestic brokerages possess sufficient NPF capacity for initial deployment and portfolio rebalancing. Among Vietnamese brokerages, 10 firms currently offer NPF services to foreign investors. Based on regulatory NPF limits (twice the brokerage’s equity minus margin loan debt), the total maximum NPF capacity of these 10 firms is 132 trillion VND ($5 billion).

Focusing on the top 3 brokerages by foreign market share (accounting for 66% of total foreign share), their combined maximum NPF capacity is approximately 40 trillion VND ($1.5 billion). This is sufficient to meet the NPF requirements of index funds, which are estimated to purchase at least $1 billion in Vietnamese stocks (whether NPF capacity is $1.5 billion or $5 billion).

Additionally, index funds are expected to invest in Vietnam in multiple phases (projected at $200–250 million per phase over 4-5 phases instead of a single $1 billion phase), alleviating concerns about NPF capacity.

Regarding index funds selling securities in another Emerging Market (typically a T+2 market) to buy Vietnamese stocks, the key issue is whether these funds can meet the initial cash settlement deadline of 3:00 PM on T+1 for NPF, avoiding the need for domestic brokerages to post collateral for insufficient funds. Vietcap highlights the primary solution as an Auto-FX agreement between the investor and custodian bank, where the bank guarantees funds as long as the FX order is submitted before the deadline (typically 1:00 PM on T+1). This ensures smooth NPF transactions, eliminates the risk of fund shortages, and removes the need for domestic brokerages to post collateral.

Based on recent discussions, Vietcap confirms that index funds already have similar Auto-FX agreements in place for other markets. In the absence of Auto-FX, index funds have until 3:00 PM on T+3 (at the latest) to transfer funds domestically to avoid failed trades (which Vietcap believes is sufficient time).

Premium Stocks Scarce in Vietnam’s Market

The VN-Index has surpassed the 1,600-point milestone for the first time, potentially paving the way for an upgrade. However, experts caution that the market still lacks diversity, heavily dominated by financial and real estate stocks.

Expert Insights: Seizing the Opportunity to Accumulate 3 High-Potential Stock Groups Poised for Strong Capital Inflows

Next week, Pinetree experts forecast that without new factors boosting demand, the VN-Index could potentially retreat to around 1,600 points.