New property project launch prices are higher than previous projects

According to observations at several property projects currently on sale in Ho Chi Minh City, there has been a continuous increase in apartment prices. Specifically, at the Eaton Park project developed by Gamuda Land, located on Mai Chi Tho Street (An Phu Ward, Thu Duc City), the first sales launch in April 2024 offered units starting from VND 120 million per square meter. In the second phase, the developer released towers A1 and A2 with an average price of VND 145 million per square meter.

Similarly, at the King Crown Infinity project (Vo Van Ngan Street, Thu Duc City), a real estate agent offered units ranging from VND 99-130 million per square meter. According to the agent, the project was launched at the end of 2024, when prices were around VND 80-90 million per square meter…

Not far from the center of Ho Chi Minh City, the La Pura project (National Highway 13, Thuan An City, Binh Duong Province) was launched in April 2025 with prices ranging from VND 46-58 million per square meter. In contrast, the Phu Dong SkyOne project in Di An City, which was launched in March 2024, had an average price of approximately VND 31.5 million per square meter. Prices of pre-owned apartments have also been on the rise over time.

According to Ms. N.T.H., a resident of Tan Phu District (Ho Chi Minh City), three months ago, she purchased a 50-square-meter, two-bedroom apartment in District 11 for VND 2.9 billion. Recently, a real estate agent contacted her, informing her that there was a potential buyer willing to purchase the apartment for VND 3.3 billion.

Mr. Nguyen Van Hung, a real estate investor in Binh Thanh District (Ho Chi Minh City), noted that prices of detached houses in certain areas of Ho Chi Minh City have been increasing over time. However, there may be cases where homeowners need to sell urgently, leading to a slight decrease in price. Overall, real estate prices tend to be higher in the following years. Mr. Hung added that, currently, detached house prices in the inner-city areas have increased by VND 50-300 million (depending on the property) compared to the beginning of 2025…

Data from Cho Tot website (specializing in real estate) shows that prices of detached houses and shophouses in many districts and counties in Ho Chi Minh City have increased by an average of 7% compared to the same period in April 2025.

Resolving legal issues and increasing supply

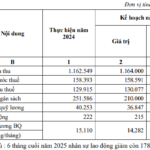

According to a report by the Ho Chi Minh City Department of Construction, from 2021 to the present, the city’s real estate market has been rather sluggish. Specifically, the market growth rates for the years 2021, 2022, 2023, and 2024 were: -5.08%; 8.3%; -6.38%; and 2.6%, respectively. Although real estate businesses have implemented various strategies to boost sales, the number of properties entering the market remains limited, failing to meet the city’s housing demands, especially for social housing.

Statistics from the Ho Chi Minh City Department of Construction also indicate a scarce supply of new properties in recent years. In 2024, the department issued eight announcements confirming that commercial housing projects met the conditions for capital mobilization for future construction projects, including 3,845 units in the luxury segment.

In 2023, Ho Chi Minh City had 19 commercial housing projects eligible for sale and lease-purchase of future construction projects, with 11,334 units in the luxury segment and 5,051 units in the mid-range segment. There were no projects in the affordable housing segment.

Faced with this situation, some real estate experts attribute the high property prices to limited supply and high demand.

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, analyzed that the cost of acquiring commercial land has been impacted by the increase in land prices compared to the past. Specifically, land prices have risen by more than three to thirty-eight times, depending on the location. The increase in land prices has led to a corresponding rise in market prices.

Additionally, prolonged administrative and legal procedures for projects have also contributed to higher housing prices at the time of the developer’s sales launch. From 2015 to 2023, 68 projects were halted or unable to proceed, and more than 345 projects encountered obstacles due to the lack of residential land.

“Resolving the issues with these projects will increase the supply and create an opportunity to bring down housing prices,” said Mr. Le Hoang Chau. “When supply increases, businesses will have to compete by lowering their prices.”

Meanwhile, Professor Dr. Dang Hung Vo offered a different perspective, attributing the rise in property prices to the psychology of asset accumulation and speculative tactics. He explained that speculators use various tricks to create a perception of rising prices.

“Anyone who owns real estate believes that prices will continue to rise, and these rumors have become ingrained in the minds of many. However, the consequence of these rumors is a low number of actual transactions. Meanwhile, those with a genuine need for housing often lack the financial means to purchase a property,” Professor Dr. Dang Hung Vo analyzed.

The conclusion of the Standing Government at the meeting on the real estate market situation in May 2025 directed the ministers, heads of ministerial agencies, agencies attached to the Government, and Chairmen of the People’s Committees of provinces and centrally-run cities:

– Immediately review and identify the reasons for the increase in real estate prices (land prices, material prices, interest rates…); urgently propose solutions to reduce the factors driving up real estate prices, improve accessibility to real estate, and increase supply.

– Study and develop support policies for homebuyers with genuine needs, young people, and improve the accessibility of the population to housing and real estate, enabling them to exercise their right to housing as stipulated in the Constitution.

– Strictly handle organizations and individuals who take advantage of auctions to drive up land prices, causing negative impacts and bottlenecks in the real estate market…

Unlocking the Appeal of Real Estate Investment in Danang

Danang, following its merger with Quang Nam, is poised to become a global city. This evolution is not just about elevating its status as one of the top 100 cities in Asia-Pacific by 2025, but also about unlocking the potential for a real estate revolution. With a focus on innovative and captivating property types, the city is set to offer lucrative and sustainable investment opportunities.

Unveiling the 2025 Business Strategy: CKG’s Transformation into the CIC Corporation

Let me know if you would like me to elaborate on this title or provide any additional content to support it.

On June 14th, Kien Giang Construction Investment Consulting Group Joint Stock Company (HOSE: CKG) will hold its Annual General Meeting of Shareholders for the year 2025 in Rach Gia City, Kien Giang Province. One of the notable agenda items at the Assembly is the proposal to change the company’s name to CIC Group Joint Stock Company.

The Great Southern Migration: Why Hanoi’s Elite are Flocking to the South’s Property Market

“A noticeable trend has emerged in early 2025, with Hanoi-based investors making a significant shift towards the southern real estate market. This movement reflects the dynamic nature of Vietnam’s real estate landscape, indicating a potential shift in the country’s property investment trends.”