Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 665 million shares, equivalent to a value of more than 19.8 trillion VND; the HNX-Index reached over 65.5 million shares, equivalent to a value of more than 1.3 trillion VND.

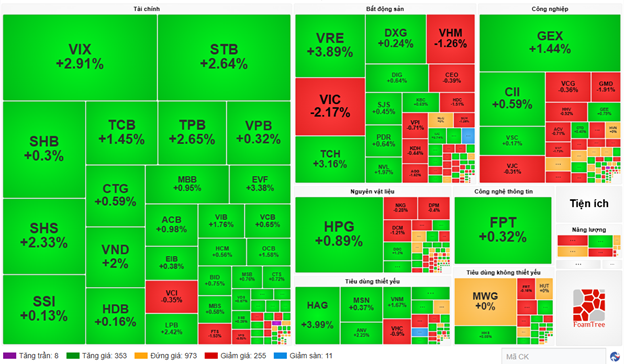

The VN-Index opened the afternoon session with a somewhat tug-of-war dynamic, but buyers maintained a stronger position, helping the index stay above the reference mark and close in a fairly positive green at the end of the session. In terms of influence, STB, TCB, LPB, and VNM were the most positively impactful stocks on the VN-Index, contributing over 4.6 points of increase. Conversely, VIC, VHM, VPB, and VJC faced selling pressure, taking away more than 6.5 points from the overall index.

| Top 10 stocks influencing the VN-Index on October 1, 2025 |

Similarly, the HNX-Index showed a fairly optimistic trend, positively influenced by stocks such as DTK (+3.25%), IDC (+1.56%), MBS (+0.88%), NVB (+0.69%), and others.

| Top 10 stocks influencing the HNX-Index on October 1, 2025 |

At the close, the market generally rose, with green dominating most sectors. The finance sector led the gains with a 0.91% increase, primarily driven by stocks such as VCB (+0.65%), BID (+0.13%), TCB (+1.85%), and CTG (+1.38%). Essential consumer goods and raw materials followed with gains of 0.78% and 0.45%, respectively. Conversely, real estate was the only sector to decline, falling by 1.25%, mainly due to VIC (-2.8%), VHM (-1.75%), and KDH (-0.3%).

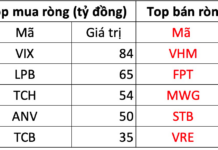

In terms of foreign trading, foreign investors continued to net sell over 1.728 trillion VND on the HOSE, focusing on stocks such as FPT (163.63 billion), MWG (154.78 billion), STB (143.11 billion), and VHM (125.33 billion). On the HNX, foreign investors net sold over 125 billion VND, concentrated in SHS (82.19 billion), CEO (35.39 billion), IDC (9.41 billion), and HUT (3.49 billion).

| Foreign net buying and selling trends |

Morning Session: Market breadth improves, VN-Index hovers around 1,665 points

The VN-Index continued to fluctuate around the 1,665-point mark during the final morning session. Market breadth significantly improved, a positive signal, although liquidity remained sluggish and foreign investors continued their net selling trend.

At the mid-session break, the VN-Index stood at 1,666.23 points, up 0.27%. The HNX-Index edged up slightly by 0.03%, reaching 273.24 points.

The finance sector dominated, occupying 7 out of the top 10 positive contributors, adding 4.5 points to the VN-Index. However, this effort was offset by pressure from VIC and VHM on the opposite side.

Source: VietstockFinance

|

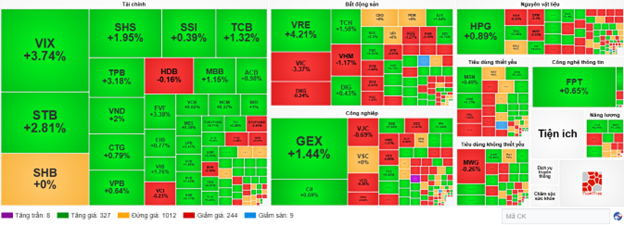

The highlight of the morning session was the market breadth. Unlike recent sessions with a “green shell, red core” scenario, green dominated more clearly. As of 11:30 AM, the market recorded 361 gaining stocks (8 at the upper limit) and only 266 declining stocks (11 at the lower limit).

Source: VietstockFinance

|

Except for real estate, all other sector indices turned green. However, polarization persisted within sectors as capital remained selective and failed to spread widely.

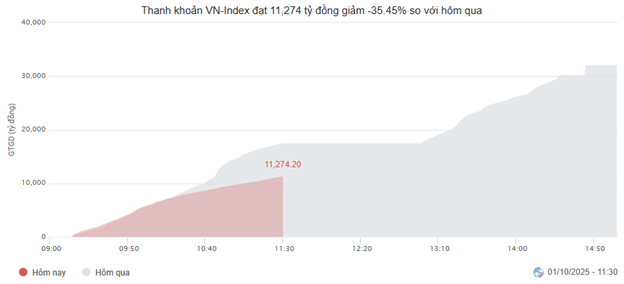

Trading value on the HOSE decreased by over 35% compared to the previous morning session, reaching more than 11 trillion VND. Similarly, liquidity on the HNX dropped by nearly 29%, reaching 772 billion VND.

Source: VietstockFinance

|

Foreign investors continued to net sell over 943 billion VND across all three exchanges. FPT led with a net sell value of over 131 billion VND, followed by MWG, STB, and SSI, each with over 85 billion VND. Meanwhile, VIX saw the most significant net buying, with a value of over 88 billion VND.

10:30 AM: Recovery spreads well in the finance sector, VN-Index awaits breakout

As of 10:30 AM, green continued to dominate the market, with the VN-Index rising over 3.5 points, trading at 1,665 points. The HNX-Index increased slightly, fluctuating around 273 points. Positive contributions to the overall rise were again seen in the finance, industrial, and raw material sectors.

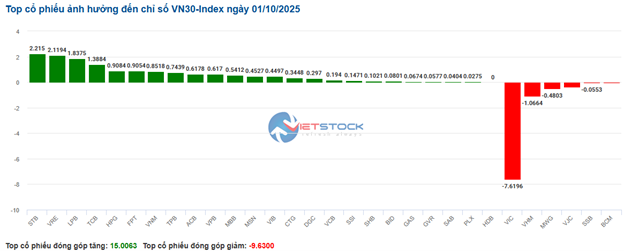

Green dominated the VN30-Index basket. Notable positive contributors included STB, VRE, LPB, and TCB, adding 2.21, 2.11, 1.83, and 1.38 points, respectively, to the VN30 index. Conversely, VIC, VHM, MWG, and VJC faced selling pressure, taking over 9 points from the overall index.

Source: VietstockFinance

|

The finance sector continued its recovery, supporting the index despite ongoing polarization in sectors like essential consumer goods and real estate, which constrained the market’s overall rise. Positive performers included BID (+1%), TCB (+1.59%), MBB (+1.15%), LPB (+1.62%), and STB (+3.16%). However, some stocks faced selling pressure, such as HDB (-0.16%), SSB (-0.26%), BVH (-0.18%), and BAB (-0.74%), though these did not significantly impact the sector index.

The raw materials sector also turned green, recovering by 0.37% despite strong polarization. Buying focused on large-cap stocks like HPG (+0.53%), GVR (+0.72%), and DGC (+0.87%).

Similarly, the industrial sector saw more red than green, but buying in major players like GEX (+1.62%), GEE (+0.24%), VGC (+0.18%), and BMP (+0.49%) helped the sector index regain its recovery momentum.

Conversely, real estate stocks remained in the red. Selling pressure was evident in the sector’s top three players: VIC (-3.09%), VHM (-0.97%), and BCM (-0.6%).

Compared to the opening, buyers maintained a stronger position. The number of gaining stocks reached 327, while declining stocks numbered 244.

Source: VietstockFinance

|

Opening: Green dominates early session

At the start of the October 1 session, as of 9:30 AM, the VN-Index rose slightly by over 3 points, fluctuating around the reference level. Similarly, the HNX-Index also increased slightly, holding around 273 points.

The energy sector was among the top performers, with leading stocks such as BSR (+1.34%), PLX (+0.15%), PVS (+0.61%), and OIL (+0.9%) showing strong recovery.

Although the finance sector remained somewhat polarized, a positive recovery trend compared to the previous session returned from the opening, driven by banking and securities stocks like VCB (+0.48%), LPB (+1.01%), VIX (+2.22%), and MBS (+0.29%).

In addition to these two sectors, many large-cap stocks also performed positively. VRE, VHM, VNM, and ACB supported the overall index rise, contributing over 4.6 points to the VN30-Index and over 2.2 points to the VN-Index.

– 15:40 01/10/2025

Market Retreats as Blue-Chip Stocks Take a Breather

The VN-Index closed today’s session (September 30) down nearly 5 points, weighed down by weakness in real estate and public investment stocks. Even Vingroup’s blue-chip shares lost momentum, despite VRE hitting its ceiling price.