The Board of Directors of Vincom Retail Joint Stock Company (Stock Code: VRE) has recently approved a resolution allowing Vincom Retail Operation LLC—a wholly-owned subsidiary—to distribute profits to its owner.

The total profit distribution amounts to VND 4,480 billion, payable via bank transfer to the owner’s account, with completion expected in Q3/2025.

Earlier, on August 26, 2025, Vincom Retail’s Board approved the merger of its wholly-owned subsidiaries. Suoi Hoa Urban Development and Investment LLC was merged into Vincom Retail Operation LLC.

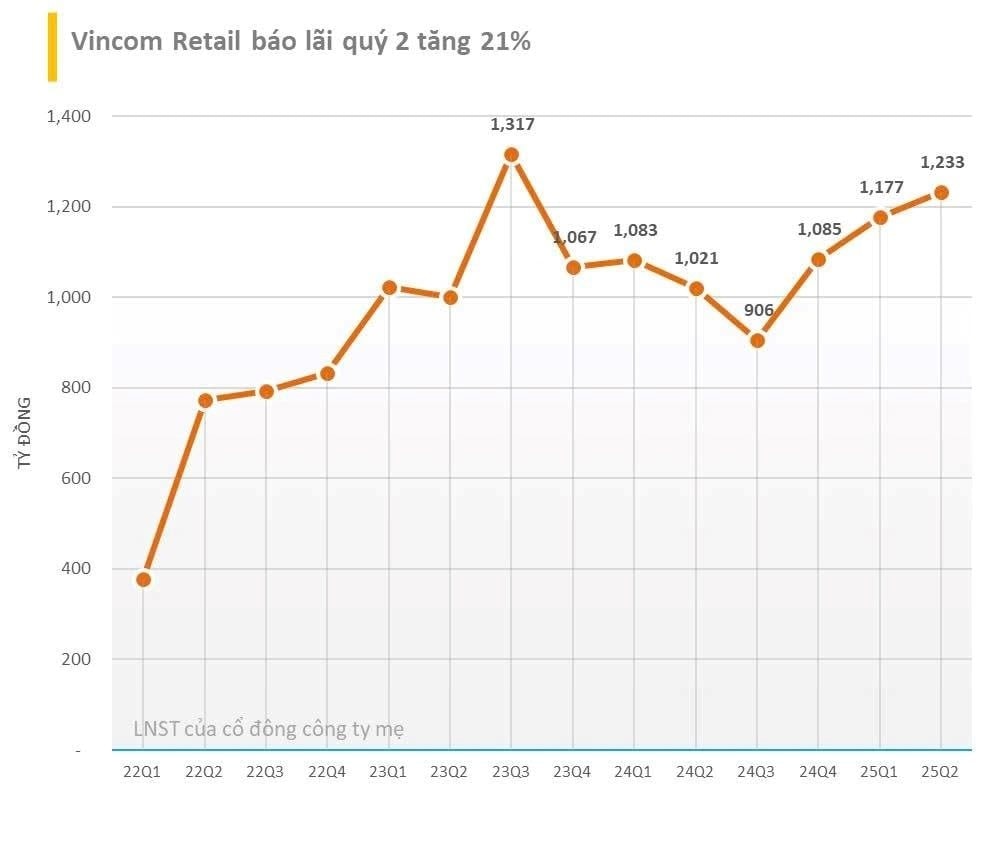

In Q2/2025, Vincom Retail reported consolidated net revenue of VND 2,100 billion, slightly lower year-over-year due to reduced contributions from property handovers at existing projects—a factor already anticipated in the company’s business plan.

After-tax profit reached VND 1,200 billion, a 20% increase compared to the same period last year.

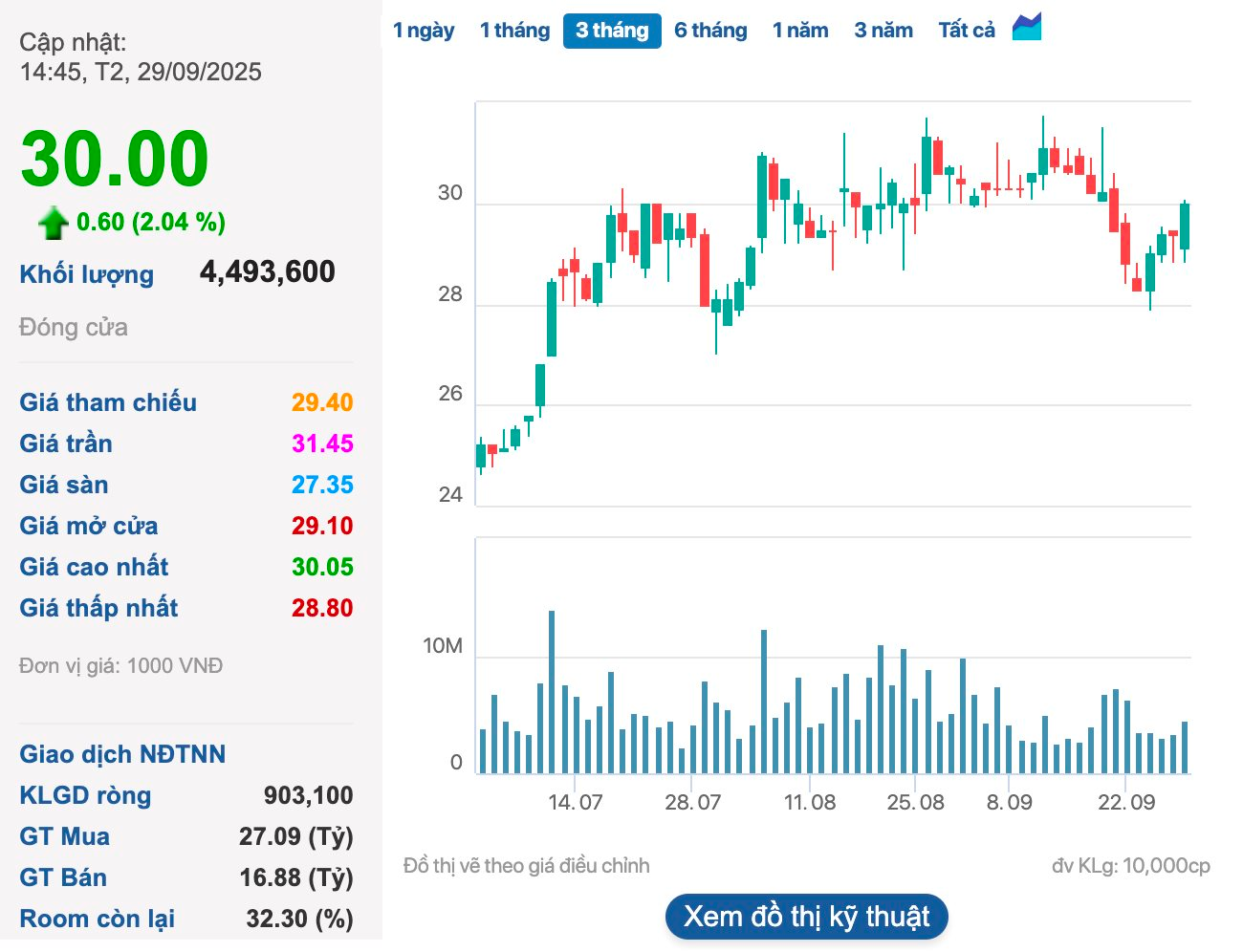

On the stock market, VRE shares closed at VND 30,000 per share on September 29.

The Vingroup Stock Surge: Legal Action Against 68 Entities Takes Center Stage

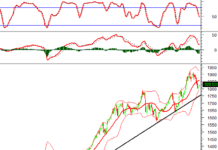

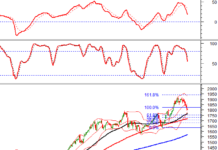

The stock market witnessed a notable rebound after a brief corrective phase, with Vingroup’s stocks playing a pivotal role in this recovery.

The Fresh Flower Giant: Hasfarm Acquires Australia’s Lynch Group

“Hasfarm is proud to announce that it has entered into an agreement to acquire 100% of the shares of Lynch Group, a leading flower company listed on the ASX in Australia. This acquisition marks a significant milestone for Hasfarm as it continues to expand its global presence and strengthen its position as a leading flower company in the industry.”