On October 1st, HBS shares of Hoa Binh Securities JSC unexpectedly surged to their upper limit, reaching VND 8,800 per share, with no sellers in sight. Trading volume exploded, with over 378,000 units changing hands—a significant increase compared to previous sessions.

Notably, this sharp rise occurred while HBS remains under scrutiny since September 22nd for delayed submission of its 2025 semi-annual audited financial report, exceeding the 30-day deadline. Previously, the stock had also been warned by HNX for a 15-day delay.

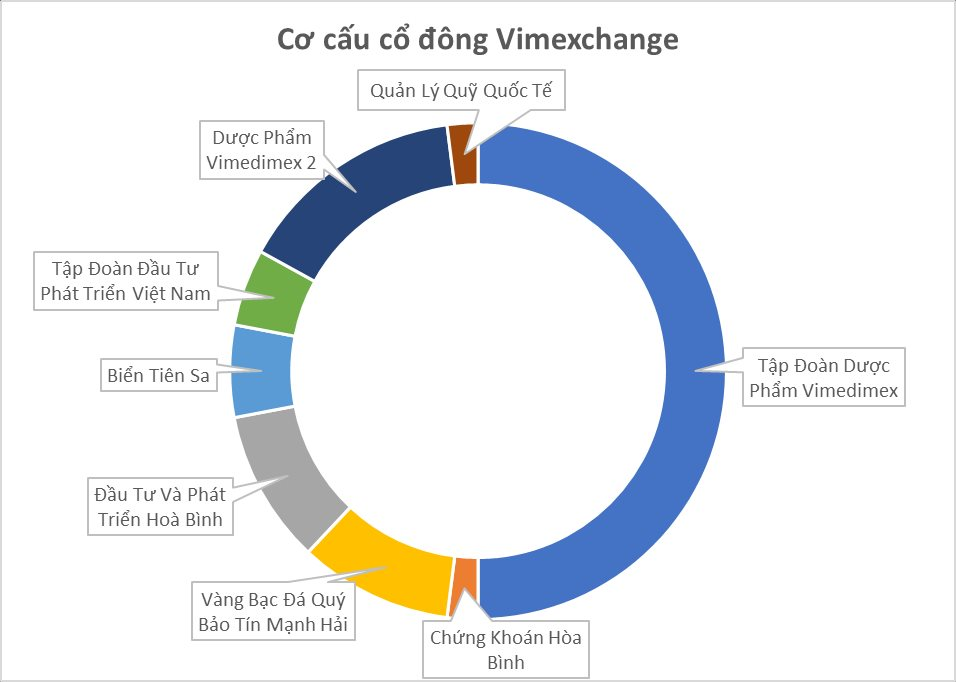

Recently, HBS gained attention by investing in VimExchange JSC, a cryptocurrency and digital asset trading company established on June 5th, 2025. Based in Hanoi, VimExchange operates in investment consulting and real estate, boasting a charter capital of VND 10 trillion and eight founding shareholders. HBS holds a 2% stake, while Vimedimex controls 50%.

VimExchange promotes the use of Blockchain 4.0, big data, and P2P trading models—common technologies in cryptocurrency. However, this plan requires regulatory approval and has raised doubts about its feasibility. HBS, a small company with declining performance and frequent personnel changes, faces significant challenges.

Simultaneously, HBS witnessed a major leadership change. On August 25th, Mr. Le Dinh Duong, Chairman of the Board for the 2023–2028 term, resigned for personal reasons. Ms. Tran My Linh, born in 1982, holding a Bachelor’s in Economics and a Master’s degree, former Deputy CEO since September 2022, was elected as the new Chairwoman.

Additionally, the company grapples with unresolved internal issues. In late 2021, Ms. Nguyen Thi Loan, Chairwoman of Vimedimex and HBS, faced legal charges related to land violations. Exploiting this situation, several executives—including Ms. Nguyen Ngoc Dung, Mr. Tran Kien Cuong, and Mr. Phan Sy Hai—organized an unauthorized shareholders’ meeting and board meeting, removing Ms. Loan and appointing Mr. Cuong as Chairman, despite Ms. Loan’s group holding over 74% of the capital.

An audit revealed that from November 2021 to August 2023, over VND 5.853 trillion was transacted through 14 HBS bank accounts but omitted from accounting records. Approximately VND 1.840 trillion was used to acquire a real estate project from a bank, later transferred to a subsidiary for takeover. Former executives were accused of creating fictitious personal accounts and advancing thousands of billions in securities sales to legitimize funds.

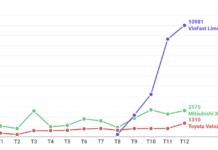

Amid internal turmoil, Hoa Binh Securities’ financial performance remains lackluster. In Q2/2025, the company reported an after-tax profit of over VND 4 billion, up 17.89% year-on-year (from VND 3.4 billion), primarily due to improved interest income. However, the six-month cumulative profit declined from VND 8 billion to VND 5.8 billion.

Shark Bình’s Blunt Take on Crypto Investors: Early Profits Rarely Earn Thanks, But Losses Spark Blame and Backlash

Mr. Binh believes that investing requires embracing both rewards and risks: profits are enjoyed, losses are accepted—much like investing in gold or stocks.