Short-Term Risk Alert

At the seminar titled “Identifying Q4/2025 Waves: Ready for the Breakout,” held on the afternoon of September 30th, HSC securities experts highlighted several risks that require attention in the near future.

Specifically, Mr. Trần Khánh – Director of Hanoi Sales Region (HSC), stated that while there are no significant systemic risks yet, there are potential “black swans” related to geopolitical fluctuations, sudden changes in the State Bank’s monetary policy, and inflation control challenges from now until year-end.

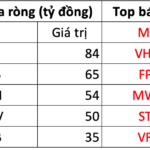

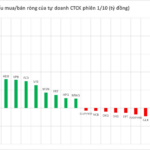

Additionally, the continuous net selling by foreign investors in recent times has been identified by HSC experts as a market risk, primarily stemming from concerns over exchange rate issues.

From a technical perspective, Mr. Đào Hoàng Tùng – Head of Analysis and Investment Advisory, Retail Division (HSC), noted that market sentiment is not overly positive, with fluctuations within the 1,600 – 1,700 point range. If the 1,600 support level is breached—a scenario HSC considers more likely than surpassing 1,700 points—the index could cool down to the 1,480 – 1,500 range, shedding short-term capital and creating more attractive entry points.

The market has been moving sideways for weeks, with capital quietly exiting, now concentrated in a few large-cap stocks like VIC and VHM. If these stocks correct, the index could face downward pressure, potentially leading to widespread shedding. However, this could also present a good opportunity to open new positions.

For investors holding a high proportion of stocks, it’s essential to rebalance portfolios, reduce underperforming stocks, and adjust margin usage. This helps mitigate unforeseen risks during market corrections or significant volatility.

HSC Warns of Short-Term Adjustment Risks – Source: HSC

|

Market Peak Not Yet Reached

Examining the overall movement of the VN-Index, it’s clear that the index has begun to recover, even surging after the April tariff shock, now approaching the 1,700 mark. During this period, numerous significant policy changes have emerged.

The market holds much promise, marked by key milestones such as the FTSE Russell’s potential upgrade to Emerging Market status, robust public investment disbursement in the latter half of 2025 and 2026, and the introduction of attractive new IPOs and financial products.

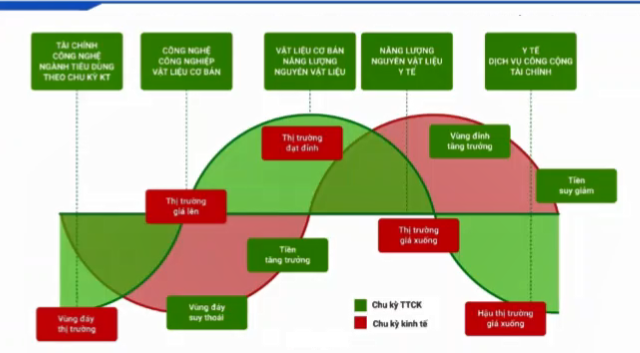

According to Ms. Vũ Thị Thu Thủy – Director of Market Information and Insights, Institutional Division (HSC), based on Fidelity’s definition of economic cycle stages, Vietnam is currently in the middle of the recovery phase. This phase is characterized by GDP rebound, rising credit, accommodative policies, strong corporate profit growth, low inventory, and improving revenues.

In terms of cyclicality, equities typically lead the economy by 6 months to a year. Currently, the market is in the mid-uptrend phase, not yet nearing its peak.

However, Ms. Thủy cautioned that opportunities to buy at extremely low prices for value investing will be scarce. Instead, there will be clearer differentiation, necessitating a shift toward growth investing strategies focused on sectors and stocks with strong future prospects.

The Current Stock Market is in the Mid-Uptrend Phase – Source: HSC

|

Highlighting Promising Sectors

Regarding the final months of this year, Mr. Trần Khánh believes opportunities are vast, given the market’s favorable conditions. The anticipated FTSE Russell upgrade is a major highlight. A late-September survey revealed that 85% of investment funds support Vietnam’s upgrade. If approved, this will not only boost investor confidence but also attract foreign capital. Looking ahead to 2030, Vietnam faces more critical evaluations, including upgrades to FTSE Russell’s Advanced Emerging Market and MSCI’s Emerging Market statuses.

Another key factor is the commitment to economic growth. The State Bank has injected liquidity, helping businesses access low-interest capital. The government is also aggressively promoting public investment and resolving real estate market challenges. Consequently, 2025’s first-half business results were positive, with optimistic forecasts for the second half and early 2026.

According to Mr. Đào Hoàng Tùng, monetary policy room is narrowing, shifting focus to fiscal policy—an area where Vietnam has significant leeway, with a 2024 year-end public debt ratio of just 37% (capped at 60%), lower than many regional peers.

While only 40% of the 1.09 trillion VND public investment plan has been disbursed in the first eight months, public investment remains a critical growth driver. Major projects underway include Hanoi Metro (Lines 2, 3), HCMC Metro (Bến Thành – Tham Lương), Long Thành Airport, HCMC Ring Road 3, and Hanoi Ring Road 4. Additionally, many domestic firms are participating as general contractors for large projects, with high localization rates reducing costs and enhancing investment efficiency.

Another factor Mr. Tùng mentioned is the expectation of a sovereign credit rating upgrade to Investment Grade, which would lower government and corporate borrowing costs and attract capital from funds focused on Investment Grade bonds.

Given these factors, directly benefiting sectors include construction contractors, basic building materials, and real estate. Real estate also benefits indirectly from increased land values around infrastructure projects. Furthermore, real estate is supported by positive sales prospects in Q3-Q4/2025 and beyond.

According to Ms. Vũ Thị Thu Thủy, alongside the market’s upward trend, many stocks have risen sharply from lows or due to strong profit outlooks, such as real estate and tourism-entertainment.

However, some sectors, despite strong profit growth, have seen stock prices underperform or decline. Capital may flow into these sectors in the coming period, providing additional market momentum. Examples include retail, telecommunications, technology, and chemicals.

– 13:56 01/10/2025

Market Pulse 01/10: VN-Index Sustains Green at 1,665 Points

At the close of trading, the VN-Index climbed 3.35 points (+0.2%) to reach 1,665.05, while the HNX-Index edged up 0.06 points (+0.02%) to 273.22. Market breadth favored the bulls, with 418 gainers outpacing 295 decliners. Similarly, the VN30 basket saw green dominate, as 22 constituents advanced, 6 retreated, and 2 remained unchanged.