The Board of Directors of STH has approved the acquisition of 17.85 million shares, representing a 51% stake in Le Premium Investment JSC. The transaction, valued at an agreed-upon price between the parties, is slated for completion in Q3/2025. Funding is expected to be sourced from equity capital and/or legal fundraising efforts. Upon completion, Le Premium will become a subsidiary of STH.

Established in February 2021, Le Premium is headquartered at Crown Villas Urban Area, Gia Sang Ward, Thai Nguyen City, specializing in real estate. By mid-June 2024, the company’s chartered capital increased from VND 180 billion to VND 250 billion. Mr. Le Dang Khoa (born in 2000), one of the three founding shareholders with an initial 35% stake, serves as the Legal Representative and CEO. His sister, Ms. Le Thi Hong Hanh, previously held a 55% stake. However, post-capital increase shareholder details remain undisclosed.

Notably, Mr. Khoa and Ms. Hanh are the children of Mrs. Nguyen Thi Vinh, the newly appointed Chairwoman of STH’s Board of Directors and Chairwoman of Thai Hung Trading JSC.

|

Thai Hung Ecosystem and Ownership Shifts at STH

Mrs. Nguyen Thi Vinh was elected to the Board of Directors and appointed Chairwoman of STH in late July 2025. Thai Hung, founded by her family in 1993, recently divested from STH. In August, the company sold a significant portion of its STH shares, reducing its ownership from 52.31% to 8%. Thai Hung has further registered to sell its remaining 8% stake from September 4 to October 2, potentially ceasing to be a major shareholder. Conversely, Mrs. Vinh personally registered to acquire over 18% of STH’s capital during the same period, positioning her to become a new major shareholder if successful.

Despite divestment, Thai Hung maintains significant influence over STH’s leadership. Mrs. Vinh is the elder sister of Mrs. Nguyen Thi Quy, former CEO and Board Member of STH, who stepped down in July 2025. Several other family members hold key positions within Thai Hung.

Concurrent with Thai Hung’s divestment, two emerging education entities, STH Gateway and Sigma Group, swiftly acquired substantial stakes in STH, holding 40.79% and 21.36% respectively. Both entities are closely linked to Mr. Le Tuan Dung, newly appointed CEO of STH in early July 2025.

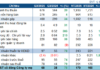

On the stock market, STH shares closed at VND 19,700 on October 1, marking a 218% year-on-year increase. Average liquidity stands at over 38,000 shares/day. The stock surged from below VND 6,000 in early April 2025 to a historic high of over VND 25,300 in mid-August, before correcting by 22% from its peak.

| STH Stock Price Performance Over the Past Year |

– 15:58 01/10/2025