Crowds gathered outside gold shops on Tran Nhan Tong Street in Hanoi on the morning of October 1st.

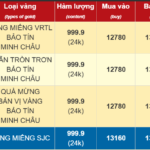

As of 11 a.m. today, October 1st, the price of gold bars at Doji and SJC was listed at 136 – 138 million VND per tael (buy – sell), an increase of 700,000 VND per tael compared to the beginning of the day. Meanwhile, the price of gold rings at Doji was listed at 131.5 – 134.5 million VND per tael, up 500,000 VND per tael.

Observations from “Gold Street” Tran Nhan Tong (Hai Ba Trung District, Hanoi) reveal that despite gold prices reaching historic highs, people are still lining up early in the hopes of further price increases.

By around 7:15 a.m., many were already waiting outside closed shops.

Mr. Tran Minh Hieu (Long Bien District) shared that he had been in line since 7:30 a.m. to secure a transaction number: “Today marks my third consecutive day buying gold. Over the past two days, I’ve purchased 2 taels each day. Despite the high prices, I’m buying with the intention of holding for the long term, around 1 to 2 years.”

Mr. Phung Dinh Cuong (Hong Ha District), who has also been queuing for gold over the past two days, mentioned he started buying gold when prices were around 13 million VND per tael, aiming to hold it as an asset. Today, Bao Tin Minh Chau limited sales to 5 taels of gold rings per customer, while Phu Quy sold a maximum of 3 taels and scheduled delivery for November 13th.

Late arrivals may face hours-long waits for their turn.

Significant Unforeseen Risks

Amidst the public’s continued gold purchases despite soaring prices, experts warn that buying and investing in gold at this juncture is highly risky.

Mr. Nguyen Quang Huy, CEO of the Department of Finance and Banking at Nguyen Trai University, analyzed that domestic gold prices have reached unprecedented levels, reflecting both the appeal of safe-haven assets and public anxiety over economic fluctuations. However, buying gold now undoubtedly carries substantial risks.

Gold prices can reverse at any moment due to global market influences and state regulatory policies. Additionally, the wide buy-sell spread means buyers could incur significant losses immediately after purchase. In reality, many recent buyers have already lost 2 to 3 million VND per tael due to inability to sell in time.

Mr. Huy advises against “herd mentality,” urging careful analysis to diversify investments. Options like savings accounts ensure cash flow, investment funds offer long-term accumulation, and opportunities in production, business, or entrepreneurship create real value and sustainable growth.

Echoing concerns about buying gold at peak prices, expert Tran Duy Phuong highlights two key risks. First, domestic gold prices far exceed global rates, which themselves are at record highs and likely to correct soon. “Gold prices have risen too sharply and too quickly, ensuring a downward adjustment that will mirror domestically,” Mr. Phuong predicts.

Experts caution that buying and investing in gold now is extremely risky.

Another risk lies in government and central bank efforts to ensure a safe, healthy, efficient, and sustainable gold market, preventing price volatility from destabilizing financial and monetary markets or the macroeconomy. These measures will directly impact future gold prices.

“Upcoming regulations under Decree 232 and the Prime Minister’s directives to inspect and rectify the gold market, curbing speculation, will likely cause prices to drop sharply by late September or early October. Thus, gold investment at this time is fraught with risk,” Mr. Phuong emphasized.

Gold Reaches New Highs as Global “Shark” Investors from the US, Europe, and Asia Rush to Accumulate

Since the beginning of the year, global investment funds have poured $57 billion into gold purchases, boosting their total holdings to approximately 3,700 tons.