The domestic gold market kicked off October with a record-breaking surge, setting unprecedented price peaks in trading history. Notably, SJC gold bars reached an all-time high of 138 million VND per tael during the morning session on October 1st.

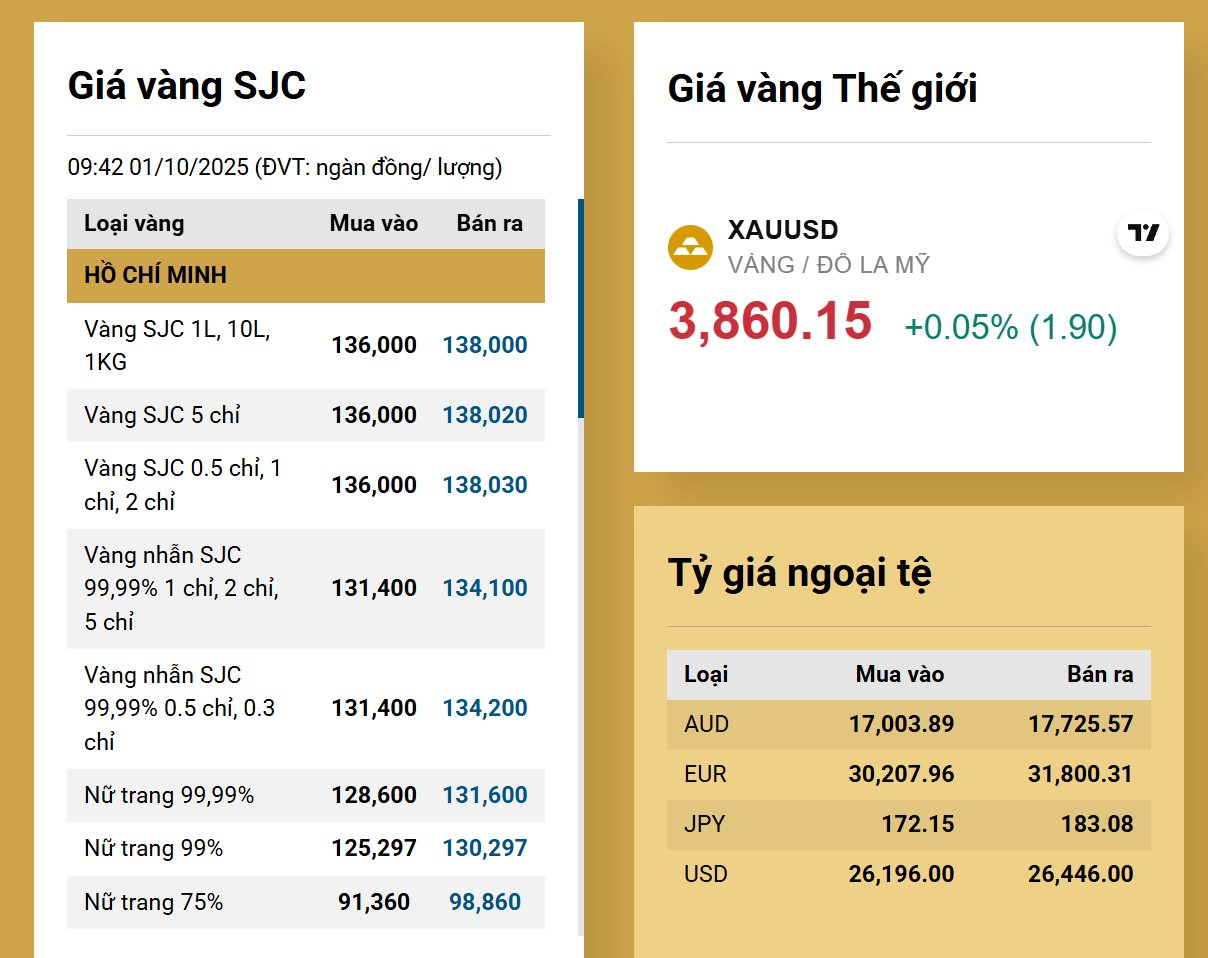

In today’s session (October 1st), SJC increased the price of gold bars by 1.2 million VND per tael, pushing the buying and selling rates to 136–138 million VND per tael. This marks the first time domestic gold bar prices have hit the 138 million VND threshold, surpassing all previous records.

This price level is also reflected by retailers such as Bảo Tín Minh Châu and Bảo Tín Mạnh Hải for SJC gold bars. The spread between buying and selling prices currently stands at 2 million VND per tael.

Gold prices today soared to 138 million VND per tael.

On September 30th, gold bar prices dipped to 134.8–136.8 million VND per tael (buy–sell). Despite this decline, SJC gold bars remained at elevated levels as global gold prices continued to shatter records.

Beyond gold bars, SJC’s 99.99 purity gold rings (1–5 tael) also surged by 1.2 million VND per tael in the month’s first session. These are now listed at 131.4–134.1 million VND per tael.

Other retailers adjusted gold ring prices to around 132.6–134.5 million VND per tael (buy–sell).

Globally, spot gold prices rose by 14 USD (+0.4%) to a record 3,872 USD per ounce. The price gap between domestic and international gold bars stands at approximately 14 million VND.

In the last three sessions alone, gold bar prices have climbed by 3 million VND per tael.

In late August, the government issued Decree 232/2025/NĐ-CP, officially ending the state monopoly on gold bar production and raw gold imports for manufacturing. Effective from October 10, 2025, the decree shifts to a licensing mechanism for gold bar production and mandates bank transfers for gold bar transactions exceeding 20 million VND.

Recently, the State Bank of Vietnam released a draft circular guiding Decree 24 on gold trading activities, amended by Decree 232. The circular is expected to take effect on October 10.

By December 15, the State Bank will allocate import/export quotas for gold bars and raw gold to businesses and commercial banks.

Quota allocation will be based on criteria such as charter capital, past performance in gold import/export activities, and actual demand.

Entities seeking to produce gold bars must submit: an application, proof of charter capital, internal production processes, and any post-inspection remediation reports. The State Bank will review and issue or deny licenses within five business days, providing specific reasons for rejections.

Gold Rush: Early Morning Queues for $5,800/Ounce Gold – Experts Warn of Risks

Investing in gold at record highs carries significant risks, warn experts, as prices could reverse at any moment.

SHB Officially Increases Chartered Capital to VND 45,942 Billion

The State Bank of Vietnam (SBV) has recently approved amendments to the charter capital outlined in the establishment and operation license of Saigon-Hanoi Commercial Joint Stock Bank (SHB). As a result, SHB’s new charter capital is now recorded at VND 45,942 billion, solidifying its position as one of the Top 5 largest private commercial banks in the system.