Hoà Bình Construction Group (UPCoM: HBC) wins a significant legal battle against TMS Group.

Hoà Bình Construction Group (UPCoM: HBC) has announced a favorable appellate court decision in its contract dispute with TMS Group. The Gia Lai Provincial People’s Court ruled in HBC’s favor, ordering TMS to pay nearly VND 154 billion, including VND 100 billion for outstanding construction work, VND 8 billion in contractual penalties, and over VND 45 billion in late payment interest. TMS is also responsible for court fees and litigation costs, with the court dismissing all appeals and upholding the initial verdict.

The dispute arose from construction contracts signed in 2018 and 2019 for the TMS Luxury Hotel Quy Nhơn Beach, the tallest 5-star hotel in Quy Nhơn. HBC was responsible for constructing the foundation, basement, main structure, and finishing work from the 29th floor to the roof.

In 2021, HBC filed a lawsuit against TMS, demanding full payment of outstanding amounts, interest, and penalties. The case was initially heard by the Quy Nhơn People’s Court in early 2025 and later appealed to the Gia Lai Provincial Court, which issued the final ruling in August-September 2025.

This is not HBC’s first legal victory. Just over a month ago, HBC won a case against Sunshine Group at the Hanoi People’s Court, securing a payment of over VND 461 billion for the Nam Thăng Long high-rise residential project, including construction costs, penalties, and late payment interest.

Earlier in February 2025, the Hanoi Court also ruled in favor of HBC, ordering Sunshine E&C Construction JSC to pay over VND 94 billion related to contracts for the Wonder Villas and Sunshine International School projects.

Chairman Lê Viết Hải emphasizes HBC’s consistent success in legal disputes and debt recovery.

At the 2025 Annual General Meeting, Chairman Lê Viết Hải stated, “Historically, HBC has never lost a lawsuit and has always recovered both principal and interest.”

He highlighted that debt recovery methods vary by project, with HBC prioritizing collaboration with developers to convert debt into products, shares, or joint investments to expedite project completion. Litigation is considered a last resort due to its time-consuming and costly nature.

In the first half of 2025, Hòa Bình reported an after-tax profit of over VND 56 billion, achieving only 14% of its annual target. Despite returning to profitability, HBC still faces accumulated losses of over VND 2,270 billion and total loans of VND 4,143 billion, three times its equity.

Chairman Lê Viết Hải attributed the prolonged losses to the impact of the COVID-19 pandemic and global geopolitical conflicts, which severely affected the domestic economy and construction sector. These factors have particularly impacted tourism and hospitality projects, key areas for HBC.

Seizing the Mai Linh Express High-Speed Vessel for Debt Recovery

Mai Linh Tay Do Joint Stock Company borrowed funds from an individual in Can Tho but failed to repay the principal and interest as agreed. The enforcement agency has decided to seize and enforce the asset, a high-speed passenger ferry previously operated by the company on the Can Tho – Con Dao route.

“FE Credit Bounces Back: VPBank Confident in 2025 Plan as GPBank Turns a Profit”

In the first half of 2025, VPBank recorded a consolidated profit of over VND 11,200 billion and successfully mobilized a record loan of $1.56 billion. Based on the results of the first half and the 4-pronged strategy, the leadership affirmed their confidence in achieving the set business goals for the year.

Peace Construction Outlines Path to Address Stock Warning and Control Status

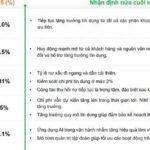

The Hoa Binh Construction Group Joint Stock Company is undergoing a comprehensive restructuring to enhance its operational efficiency and overcome challenges. This dynamic overhaul aims to fortify the company’s resilience and position it for sustained success.