When unexpected risks arise, customers are most concerned about their own safety and the protection of their assets, as well as the timely and transparent processing of their claims. Among these concerns, the claims assessment and settlement process is considered the most critical touchpoint, underscoring the practical value of an effective insurance solution. In reality, this stage presents significant challenges for the entire insurance industry, from expectations of speed and transparency to the need for synchronized processes and efficient technology integration.

Leading the way in this trend, Bao Viet Insurance has officially established the Motor Vehicle Assessment Center 3 in Da Nang, following a centralized model. This marks a significant milestone in the company’s strategy to enhance customer experience. Building on its trusted services and nationwide assessment network, Bao Viet Insurance has now modernized and standardized its assessment system to a higher level, offering customers in the Central region a swift, synchronized, and transparent claims settlement solution.

A hub of transparent technology, on-site assessment, and dedicated service

The choice of Da Nang as the Central region’s hub is not only due to its strategic geographical location and role as an economic and transportation gateway but also because it is a convergence point for major car manufacturers and high-quality repair services.

Motor Vehicle Assessment Center 3 directly serves customers in Da Nang and neighboring areas such as Hue, Quang Nam, and Quang Ngai, ensuring local access to services, minimizing claim processing times, and maintaining consistent service quality across the region. All claims are managed centrally and assessed using advanced technology, ensuring synchronization, speed, and transparency.

Mr. Do Hoang Phuong, Deputy General Director of Bao Viet Insurance Corporation

Speaking at the event, Mr. Do Hoang Phuong, representing Bao Viet Insurance’s leadership, stated, “With the growing number of customers in the Central region, we expect Motor Vehicle Assessment Center 3 to become a professional, quick, and transparent service touchpoint, accompanying customers in protecting their assets and creating sustainable value.”

The centralized claims model underscores Bao Viet Insurance’s customer-centric strategy

Since 2016, Bao Viet Insurance has pioneered the centralized assessment model in Hanoi and Ho Chi Minh City. After years of operation, the model’s effectiveness has been clearly demonstrated through faster claim resolution, clearer processes, and minimized delays.

These results not only reflect the efficiency of the centralized assessment management model but also affirm Bao Viet Insurance’s strategic focus on enhancing service quality, prioritizing customer satisfaction and peace of mind.

Through its significant contributions to the development of Vietnam’s insurance industry, Bao Viet Insurance has solidified its pioneering position, earning recognition through prestigious domestic and international awards. Notably, the company has received a B++ (Good) financial strength rating and a “bbb+” (Good) long-term credit rating from AM Best, as well as the highest national rating of aaa.VN (Excellent). Additionally, it has been honored with the “National Brand for Non-Life Insurance Services” by the Vietnamese Government and the “60 Years of Outstanding Achievement – Insurance Industry” award from Global Banking & Finance Review, cementing its brand reputation and commitment to sustainable development over six decades.

Committed to putting customers at the heart of its operations, Bao Viet Insurance offers 24/7 support through its hotline 1800 1118 or (024) 3573 0505, website https://baovietonline.com.vn, and its nationwide network of agents and distributors.

VPBank Honored at the Customer Experience Awards of the Year

VPBank has been honored with the prestigious “Customer Experience of the Year – Banking Sector” award at the Asia Experience Awards ceremony. This recognition underscores VPBank’s leadership in digital transformation and reinforces its commitment to enhancing customer experience and fostering sustainable growth.

“VIB and the “Trendsetting Card Strategy”: From Vision to Vanguard.”

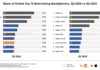

Vietnam International Commercial Joint Stock Bank (HOSE: VIB) has reached a remarkable milestone of 1 million credit cards, solidifying its successful “Leading the Card Trend” strategy implemented over the past seven years. This achievement underscores the bank’s unique vision, as the number of cards has grown tenfold since 2019. VIB has risen to the top, ranking among the leading Mastercard spenders and among the top 3 spenders in the entire market. The bank has also established collaborations with all three major international card organizations: Visa, Mastercard, and American Express.

“Zalo: The Strategic Enabler in TCBS’s Digital Transformation Journey”

In the fast-paced world of digital finance, a seamless, secure, and swift investment journey is paramount. Leading securities firm TCBS has entrusted the Zalo ecosystem to elevate its customers’ investment experience, offering a convenient, user-friendly, and secure platform.