Today’s market momentum was primarily driven by the robust recovery of the banking sector, the largest capitalized group in the market. This resurgence occurred as VIC shares dipped, taking a breather after a heated rally.

Banking stocks took center stage, with multiple tickers surging and leading the market’s rebound. STB stood out with a 5.1% gain to VND 59,900 per share. Sacombank’s stock also joined the elite group of two tickers with trillion-dong trading volumes in an otherwise sluggish session. STB’s trading value exceeded VND 1,082 billion, ranking second on the exchange. Other major players like LPB, TPB, and TCB also rallied, further bolstering the index.

Market liquidity remained cautious, with HoSE trading volume just surpassing VND 21,300 billion.

While VIC had been the market’s driving force in recent sessions, today the banking sector took the helm. Vingroup stocks saw VIC and VHM retreat, though VRE managed a 3.3% gain.

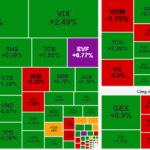

Divergence was evident in the real estate sector. While some large-cap stocks corrected, smaller and mid-cap players like TCH, DXG, HHS, CII, GEX, CEO, NVL, and PDR advanced. The securities sector rebounded, with VIX climbing 2.5% and leading in liquidity absorption. SHS, SSI, and VND also closed in the green. Investors remained selective, favoring securities stocks ahead of the market upgrade announcement.

Positive movements were also observed in construction and steel sectors. HPG rose 0.5% to VND 28,300 per share, while NKG inched up 0.3%.

At the close, the VN-Index gained 3.35 points (0.2%) to 1,665.05. The HNX-Index added 0.06 points (0.02%) to 273.22, and the UPCoM-Index rose 0.33 points (0.3%) to 109.79.

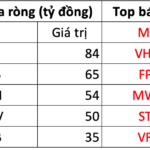

Foreign investors continued net selling, with a total value of over VND 1,651 billion. Heavily sold stocks included VHM, FPT, MWG, STB, and VRE.

Seizing Market Volatility: Strategic Investment Opportunities on October 2nd

The market continues to oscillate in a state of indecision. However, these intraday fluctuations present strategic opportunities for investors to deploy capital effectively.

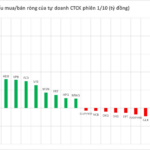

Foreign Block Continues Net Selling Streak with VND 1.8 Trillion in Early October: Which Stocks Were Hit Hardest?

Foreign investors’ trading activity has been a notable drawback, as they engaged in substantial net selling across all three major exchanges.