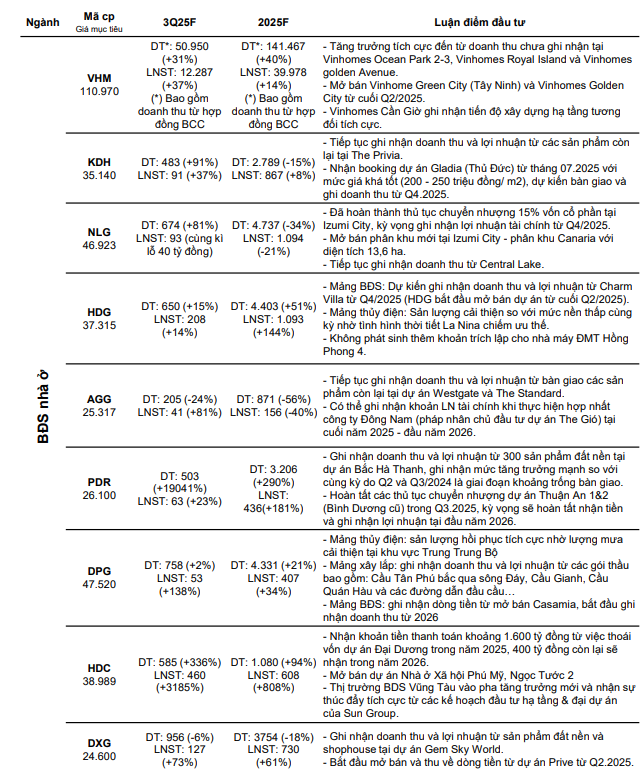

In Vietcombank Securities’ (VCBS) 2025 Residential Real Estate Business Results Forecast Synthesis Report, VCBS predicts that the final two quarters of 2025 will not yield high results. This is primarily due to the focus on legal procedures, capital mobilization, project implementation, and sales throughout the year.

However, many companies have seen significant improvements in sales volume and cash flow. There remains potential for stock price increases. Priority is given to companies with projects in the Southern region, where property prices still have room to grow over the next year.

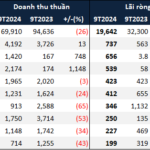

VCBS forecasts Q3/2025 business results for the residential real estate group.

Notably, among the nine residential real estate companies mentioned by VCBS, Phat Dat (PDR) is projected to achieve outstanding growth. Revenue is expected to surge by 19,041% to 503 billion VND, with post-tax profit reaching 63 billion VND (+23%).

VCBS attributes this performance to the handover of 300 land plots at the Bac Ha Thanh project, compared to a handover gap in the same period in 2024. Additionally, the company has completed the transfer procedures for the Thuan An 1 & 2 projects (Binh Duong), with payment and profit recognition expected in early 2026.

Another standout performer is Ba Ria – Vung Tau Housing Development (HDC), with estimated Q3/2025 revenue of 585 billion VND (+336%), driving post-tax profit to 460 billion VND (+3,185%). HDC’s improved results stem from a 1.6 trillion VND payment from the divestment of the Dai Duong project in 2025 (with the remaining 400 billion VND to be received in 2026). The company also launched the NOXH Phu My and Ngoc Tuoc 2 projects, capitalizing on Vung Tau’s real estate market entering a new growth phase, supported by infrastructure projects and Sun Group’s mega-projects.

The Real Estate Market Sees a Trio of M&A Deals in the Last Quarter

The residential real estate market is cautiously progressing. Amidst economic fluctuations and a wait-and-watch approach adopted by potential buyers, investors are keenly assessing market sentiment as they unveil new projects.

The Benefits of Using a Brokerage Firm for Real Estate Transactions

The real estate market is a bustling and vibrant arena, full of potential rewards but also rife with risks and challenges. It is imperative for anyone venturing into this landscape, especially those brave souls opting to sell or buy property independently, to arm themselves with comprehensive knowledge and expertise. This empowers them to navigate the intricacies of the market and make enlightened decisions.