|

Short-Term Bright Spot: Cyclical Surplus

After five consecutive quarters of pressure, Vietnam’s macroeconomy has recently shown a glimmer of hope: the balance of payments has shifted to a slight surplus. The primary driver is the current account surplus, fueled by a trade surplus.

The improvement in trade during Q2-2025 is largely a “short-term signal” rather than a sustainable shift. This recovery is cyclical, tied to businesses accelerating exports to avoid new tariff barriers. Once this effect subsides, trade prospects may weaken as global markets remain sluggish, import demand from the U.S. and Europe softens, and China—Vietnam’s largest partner—still grapples with real estate challenges.

|

The overall balance of payments surplus is welcome news, but it’s a short-term “breather” rather than a structural reversal. As the export push fades, trade may weaken again, while the capital and financial accounts continue to erode due to outward cash flows and domestic U.S. dollar demand. |

The IMF’s mid-September 2025 consultation report offers a comprehensive view of the balance of payments, forecasting a current account surplus of around 4% of GDP this year. However, the capital and financial accounts are expected to post a deficit of nearly 4.8% of GDP, reflecting capital outflows. Foreign exchange reserves stand at approximately $79.3 billion, equivalent to 2.2 months of imports—below international safety standards. This indicates the current surplus isn’t enough to ensure long-term stability.

The overall balance of payments surplus is welcome news, but it’s a short-term “breather” rather than a structural reversal. As the export push fades, trade may weaken again, while the capital and financial accounts continue to erode due to outward cash flows and domestic U.S. dollar demand.

Exchange Rate Pressure: Shifting from Interest Rate Differentials to Domestic Dollar Demand

While 2024’s exchange rate pressure stemmed mainly from the U.S. dollar-Vietnamese dong interest rate differential, 2025’s core issue lies in foreign exchange demand dynamics. U.S. interest rates have begun cooling as the Federal Reserve cut rates by 0.25 percentage points in September 2025. Domestically, however, deposit and interbank rates are rising rapidly due to credit expansion, forcing the State Bank to continuously inject liquidity through open market operations.

Deeper pressure arises from net repayment trends. Since 2021, both the government and private sector have shifted from borrowing to repaying debt. The government’s external debt-to-GDP ratio fell sharply from 47.9% in 2020 to 31.8% by year-end 2024 and is projected to drop further to 27.9% in 2025. This shift reduces dollar supply from borrowing while increasing foreign exchange demand for debt repayment—a structural factor creating medium- to long-term pressure, not easily resolved in the short term.

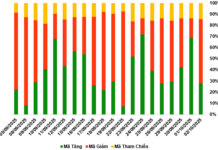

Additionally, indirect capital outflows persist. Since late 2023, foreign investors have consistently net sold on the stock market, with outflows escalating: $1 billion in 2023, over $3.5 billion in 2024, and up to $4 billion in the first nine months of 2025. The domestic bond market lacks depth to attract long-term capital. While FDI remains stable at over $20 billion annually, the overall capital flow picture leans toward outflows, keeping the capital and financial accounts in deficit.

This structural shift—distinct from trade’s short-term volatility—creates medium-term pressure, preventing the balance of payments from stabilizing despite a positive current account.

Outlook and Year-End Risks

While peak exchange rate pressure may have eased, tensions persist. In the baseline scenario, the USD/VND rate will likely hover near the upper band through year-end 2025, after depreciating 3.5-4% since the start of 2025. Interest rates are expected to hold steady to support the economy. For this scenario to materialize, the trade surplus must be sustained, FDI disbursements must remain stable, and year-end remittances must flow strongly to boost foreign exchange liquidity.

Remittances—typically peaking during the year-end holiday season—could serve as a critical “pressure valve.” Vietnam received around $16 billion in remittances in 2024, with this year’s figure expected to edge higher. If this inflow remains stable, it will help ease foreign exchange market tensions.

Overall, trade remains the primary risk to the year-end exchange rate outlook. New U.S. trade policies under the Trump administration—particularly regarding “transshipment goods”—could expose Vietnamese products to higher tariffs, directly impacting exports. Meanwhile, thin foreign exchange reserves leave Vietnam vulnerable to global volatility and limit its ability to intervene in the exchange rate.

Trịnh Hoàng

– 13:00 02/10/2025

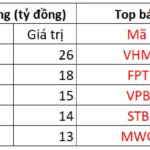

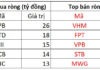

Sunshine Group Post-Restructuring: Second-Highest Market Cap in Real Estate, Full-Year Profit Projected at VND 14 Trillion, Surpassing Shareholder Meeting Targets

With projected post-tax profits of approximately VND 14,000 billion in 2025, an 18-fold increase from the previous year, Sunshine Group is poised to achieve a breakthrough growth driven by its comprehensive restructuring efforts. This remarkable performance underscores the effectiveness of the Group’s strategic focus on large-scale economic consolidation and ecosystem integration, surpassing all expectations.

Vietnam’s Commitments to Developing an International Financial Center

In a world of constant flux, the World Alliance of International Financial Centers (WAIFC) stands as a beacon of collaboration and stability. Deputy Prime Minister Nguyễn Hòa Bình underscored Vietnam’s unwavering commitment to advancing its International Financial Center through three bold pledges, reinforcing its role as a pivotal player in the global financial landscape.