Viettel Digital’s Deputy CEO, Mr. Do Manh Dung, discusses CBDC research at the VBA-hosted cross-border payment seminar.

At the seminar titled “Cross-Border Payments: Global Trends and Solutions for Vietnam,” organized by the Vietnam Blockchain and Digital Assets Association (VBA) on September 30th, Mr. Do Manh Dung, Deputy CEO of Viettel Digital Services Corporation (Viettel Digital), announced that the State Bank of Vietnam has tasked Viettel with researching Central Bank Digital Currency (CBDC) technology.

According to Mr. Dung, Viettel Digital’s research is in its early stages, focusing on assessing societal impact, technological factors, policy implications, and potential effective applications.

Established in 2019, Viettel Digital is the 8th member of the Viettel Military Industry and Telecoms Group, specializing in Fintech and Big Data solutions.

A representative from Viettel Digital confirmed that the company is closely following the State Bank’s CBDC implementation roadmap, proposing collaborative research and pilot testing in alignment with the bank’s requirements.

The State Bank of Vietnam actively engages in international CBDC discussions and initiatives.

In a May 2025 report to the National Assembly on the implementation of inquiry resolutions, the State Bank highlighted two key issues: CBDC development and the regulation of illegal Forex trading platforms. Regarding CBDC, the bank emphasized its proactive approach, studying international models, engaging with the IMF, BIS, and World Bank, and participating as an observer in the mBridge project led by China, Hong Kong, Thailand, and the UAE.

The State Bank is also collaborating with relevant ministries to prepare a report for the Prime Minister and to formulate a CBDC research implementation plan.

CBDC, or Central Bank Digital Currency, is a new form of currency issued by central banks, holding legal tender status equivalent to physical banknotes and coins.

Unlike decentralized cryptocurrencies such as Bitcoin, which are highly volatile, CBDCs are state-backed and closely tied to national monetary policies. CBDCs can be designed for retail transactions, serving individuals and businesses as a digital payment alternative to cash, or for wholesale transactions, facilitating large-scale interbank and financial institution operations.

Globally, numerous countries are actively researching and piloting CBDCs. China has launched the e-CNY, the European Union is testing a digital Euro, and the Bahamas and Nigeria have issued CBDCs nationwide. With advantages in speed, cost-efficiency, and transparency, CBDCs are poised to become a pivotal step in the global financial system’s digital transformation.

First-Time Gold Buyers Pay Prices Far Exceeding Forecasts, Prompting New State Bank Intervention

A draft circular regulating gold trading activities has been released, with an anticipated effective date of October 10th.

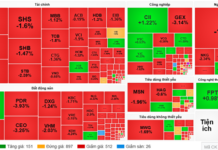

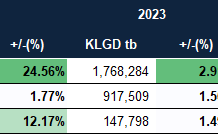

SHB Officially Increases Chartered Capital to VND 45,942 Billion

The State Bank of Vietnam (SBV) has recently approved amendments to the charter capital outlined in the establishment and operation license of Saigon-Hanoi Commercial Joint Stock Bank (SHB). As a result, SHB’s new charter capital is now recorded at VND 45,942 billion, solidifying its position as one of the Top 5 largest private commercial banks in the system.