I. MARKET ANALYSIS OF SECURITIES ON JUNE 16, 2025

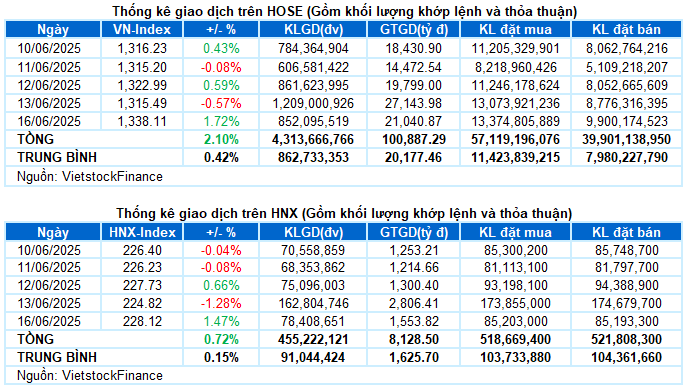

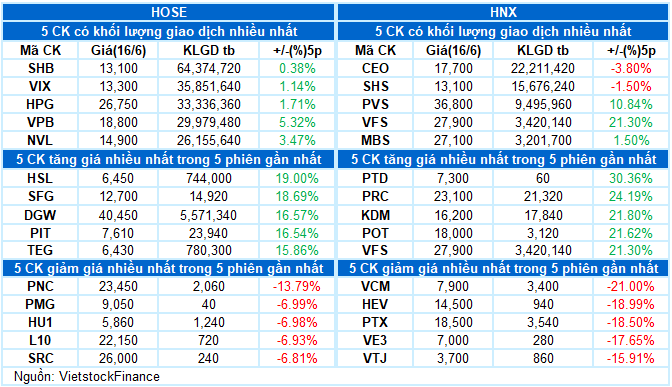

– The main indices rebounded strongly in the first trading session of the week. VN-Index increased by 1.72%, reaching 1,338.11 points; HNX-Index reached 228.12 points, up 1.47% from the previous week.

– The matching volume on the HOSE floor decreased by 29.5%, reaching 852 million units. At the same time, the HNX floor recorded more than 78 million units, down 51.8% compared to the previous session.

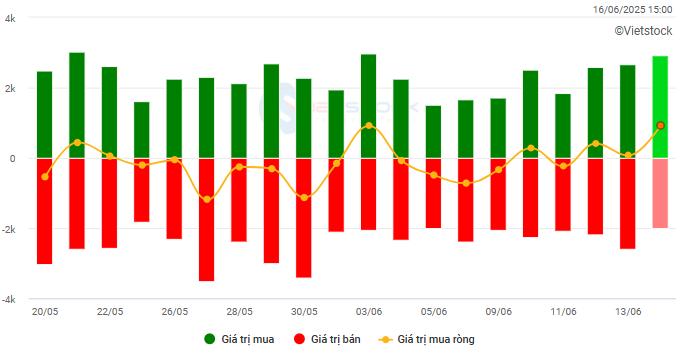

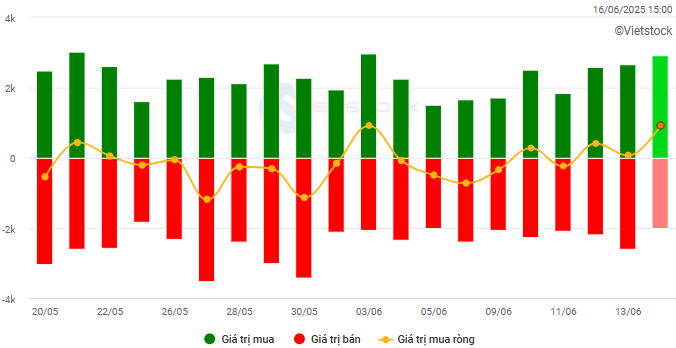

– Foreign investors continued to net buy with a value of nearly VND 943 billion on the HOSE floor but still net sold slightly less than VND 5 billion on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

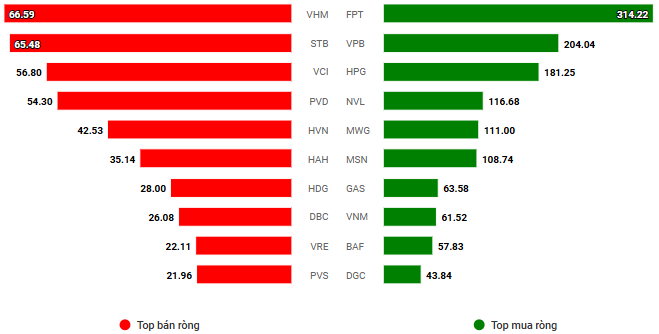

Net trading value by stock code. Unit: VND billion

The securities market started the new week on a positive note. The green color returned strongly right after the opening and spread widely. Although VN30 only increased by nearly 5 points in the morning session, VN-Index increased by more than 11 points, reflecting the increase not only from the effort to pull the pillar. The excitement continued in the afternoon session, especially when large-cap stocks bounced back stronger, further widening the common gain. At the close, VN-Index added 22 points (+1.72%), finishing at the 1,338.11 mark, posting the strongest gain in the past 2 months.

– In terms of impact, GAS and VPL had the most positive contributions, with each stock bringing in more than 2.5 points. Following were TCB, FPT, and VPB, which also contributed nearly 4.5 points to the overall index. Meanwhile, VHM was the only stock with a significant negative impact, taking away nearly 1 point from the index.

– VN30-Index ended the session up 1.37%, reaching 1,420.35. The breadth was heavily in favor of advancers with 24 gainers, 4 decliners, and 2 stocks closing unchanged. Notably, GAS and PLX shone in bright purple. In addition, stocks such as BVH, VPB, TCB, FPT, and SSI also rose more than 3%. On the other hand, VHM went against the general trend with a decrease of 1.5%, while VIC, VRE, and VJC closed just below the reference level.

The green color returned to all industry groups. The energy industry remained the most prominent bright spot with an outstanding increase of 5.46%. In addition to the two stocks of PVD and PVC hitting the ceiling, cash flow was also bustling in stocks such as BSR (+5.41%), PVS (+5.75%), AAH (+2.56%), POS (+11.7%), PVB (+4.04%),…

In addition, the non-essential consumer and information technology groups also jumped more than 3% with a series of standout names, including VPL (+6.58%), MWG (+1.74%), GEE (+6.5%), GEX (+3.24%), PNJ (+5.13%), FRT (+1.64%); FPT (+3.12%), CMG (+4.99%), ITD (+1.82%) and POT (+5.88%).

At the bottom of the table was the real estate group with a modest increase of 0.1%, due to pressure mainly from the Vingroup trio. The rest still recorded positive performance, typically stocks such as NVL (+4.2%), KBC (+3.48%), PDR (+2.69%), NLG (+1.47%), TCH (+2.1%), DXG (+1.27%), CEO (+1.72%), DIG (+2.69%),…

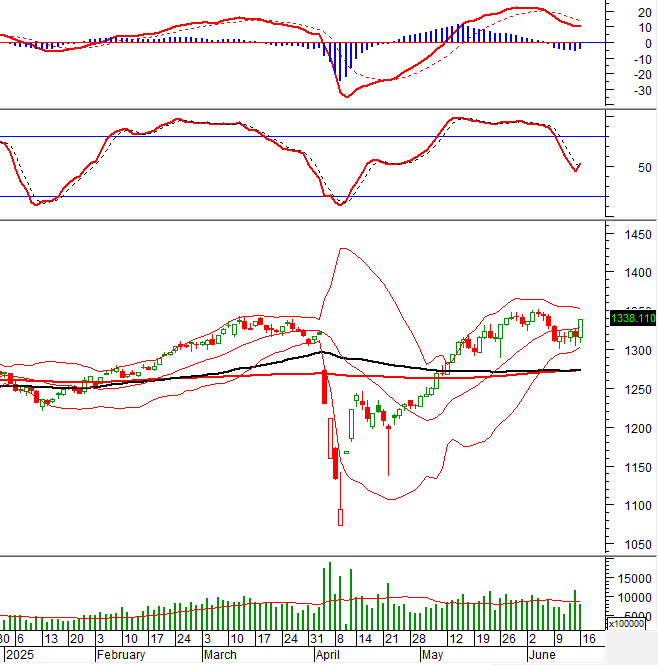

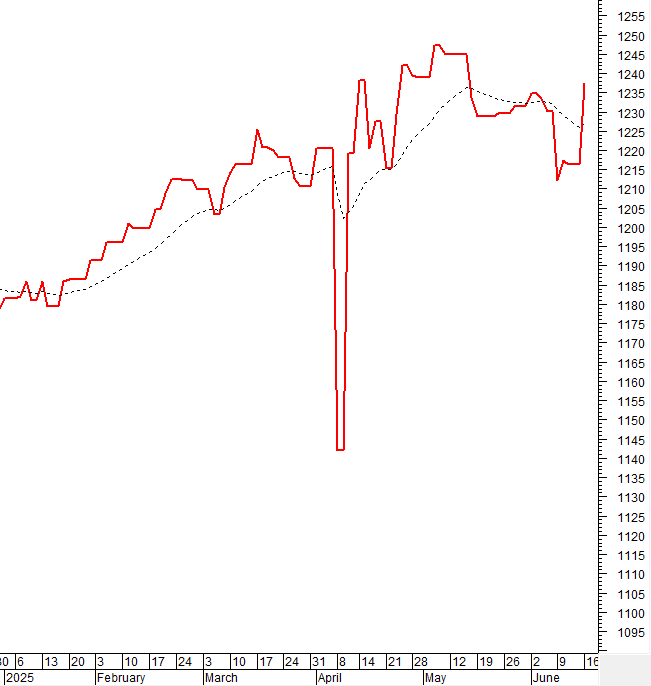

VN-Index rose sharply and broke above the Middle line of the Bollinger Bands. If in the coming sessions, the index continues to stay above this threshold, accompanied by trading volume exceeding the 20-day average, the uptrend will be reinforced. Currently, the Stochastic Oscillator indicator has given a buy signal again after exiting the oversold zone. If in the coming sessions, the MACD indicator also gives a similar signal, the short-term outlook will be even more positive.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Breaking above the Middle line of Bollinger Bands

VN-Index increased sharply and broke above the Middle line of the Bollinger Bands. If in the coming sessions, the index continues to stay above this threshold, accompanied by trading volume exceeding the 20-day average, the uptrend will be reinforced.

Currently, the Stochastic Oscillator indicator has given a buy signal again after exiting the oversold zone. If in the coming sessions, the MACD indicator also gives a similar signal, the short-term outlook will be even more positive.

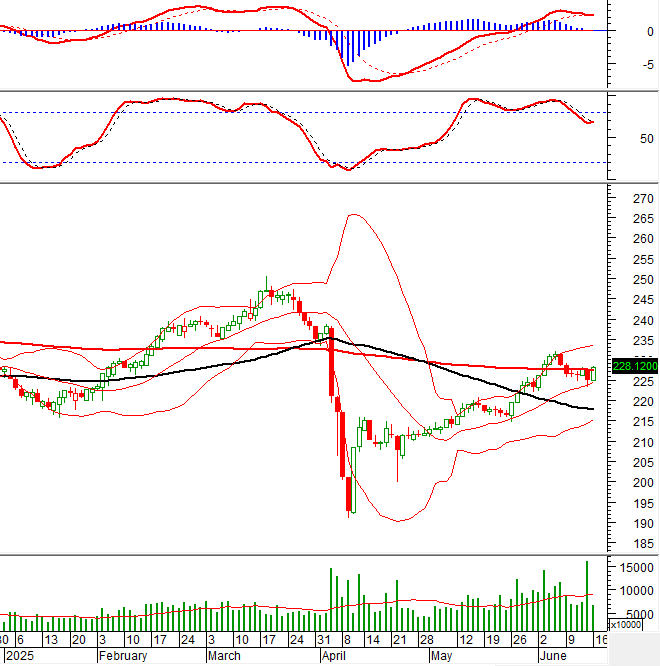

HNX-Index – Appearance of a White Marubozu candle pattern

HNX-Index bounced strongly with a candle pattern almost identical to White Marubozu and broke above the SMA 200-day moving average. If the index continues to hold above this threshold, accompanied by strong liquidity, the situation will become even more favorable.

Currently, the Stochastic Oscillator and MACD indicators are likely to give buy signals again. The short-term outlook for the index will become more optimistic if this happens in the coming sessions.

Analysis of Money Flow

Fluctuations in smart money flow: The Negative Volume Index indicator of VN-Index cuts up the EMA 20-day moving average. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuations in foreign capital flow: Foreign investors continued to net buy in the trading session on June 16, 2025. If foreign investors maintain this action in the coming sessions, the situation will become even more optimistic.

III. MARKET STATISTICS ON JUNE 16, 2025

Department of Economic and Market Strategy Analysis, Vietstock Consulting

– 17:16 16/06/2025

No Worries About Missile Issues, the Market Bounces Back Strongly, VN-Index Recaptures the 1,320-Point Level

The Middle East tensions continue to escalate, but investor sentiment has improved significantly following the weekend. Although this morning’s market saw a substantial 34% drop in capital inflows compared to the previous session, stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of waning in the latter half of the session as selling pressure emerged at higher price levels.

The Stock Market is “Stirring Up a Storm”: Small-Cap Stocks Take the Lead

Over five weeks since the KRX system officially launched, the anticipated surge in stock prices within the securities industry has yet to materialize, with SSI, HCM, and BSI all witnessing declines of over 9% since the beginning of the year. However, a silent race is underway among smaller securities firms such as VFS and APG – names that have witnessed over 70% gains thanks to aggressive capital-raising plans and internal restructuring.