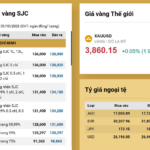

At the press conference on the banking sector’s Q3 2025 performance, hosted by the State Bank of Vietnam (SBV) on October 3, Director of the Foreign Exchange Management Department Dao Xuan Tuan announced that following the issuance of Decree 232 on gold market management, the SBV is expediting the drafting of a guiding circular. This circular will be promptly released to facilitate the decree’s implementation upon its effective date of October 10.

State Bank of Vietnam’s Q3 2025 Banking Performance Press Conference

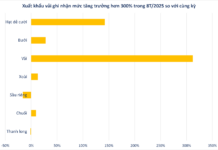

A key concern among market participants and the public is how to increase gold supply, particularly regarding import licensing and quotas. The SBV emphasized that this is a critical objective mandated by the government.

Mr. Tuan assured that the licensing process will prioritize transparency, market mechanisms, and alignment with national monetary policy.

“We guarantee a more stable gold supply to meet actual demand. All trading procedures and information will be transparent and unified to prevent market distortions, while establishing official communication channels,” stated Mr. Tuan. He added that the circular aims to bolster public and business confidence, ensuring a healthier gold market.

Deputy Governor Pham Thanh Ha noted that global gold prices have repeatedly peaked in 2025 due to geopolitical tensions, military conflicts, and strategic competition. Central banks and investment funds aggressively purchasing gold to bolster foreign reserves have further fueled price increases.

In response, the SBV advised the government to issue Decree 232, effective October 10, 2025, amending gold trading regulations. A significant change is ending the state monopoly on gold bar production, allowing qualified entities to manufacture gold bars. The decree also expands raw gold import eligibility to increase legal market supply.

“The primary goal is to create an abundant, transparent supply with diverse options for consumers. Increased competition among businesses will reduce monopolies, lower costs, and narrow the domestic-international gold price gap,” explained Mr. Ha.

Decree 232 underscores transparency in management. All import, production, and distribution data will be officially disclosed to minimize rumor-driven market volatility.

ACB Set to Launch Exclusive Branded Gold Bars

On October 1, 2025, Asia Commercial Bank (HOSE: ACB) published its “Terms and Conditions for Buying and Selling Gold Bullion” on the ACB website, in compliance with Clause 8, Article 1 of Decree 232/2025, which amends and supplements Clause 4, Article 12 of Decree 24/2012. This regulation mandates that enterprises and credit institutions engaged in the buying and selling of gold bullion must publicly disclose customer rights and obligations on their electronic information pages or at their transaction headquarters.

Central Bank Digital Currency: Viettel, MobiFone Tasked with Pre-Technical Research, Having Prepared for Years as Industry Leaders

Vietnam is racing to develop its central bank digital currency (CBDC), with major industry players actively participating in the initiative.

VietinBank Sets Date to Disburse Over VND 2.4 Trillion in Cash Dividends

VietinBank is set to distribute a substantial dividend payout of VND 2,416.5 billion for the year 2024, with the payment date scheduled for November 17, 2025.