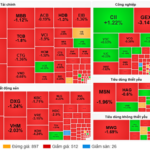

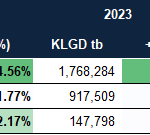

Following a low-volume rally in the early part of the month, the stock market opened the October 2nd session in positive territory. Selling pressure intensified near resistance levels, escalating further in the afternoon session. At the close, the VN-Index fell by 12.34 points (-0.74%) to 1,652.71, continuing to face resistance around the 1,680 mark. Foreign trading activity was a notable drag, with net selling reaching 2,399 billion VND across the market.

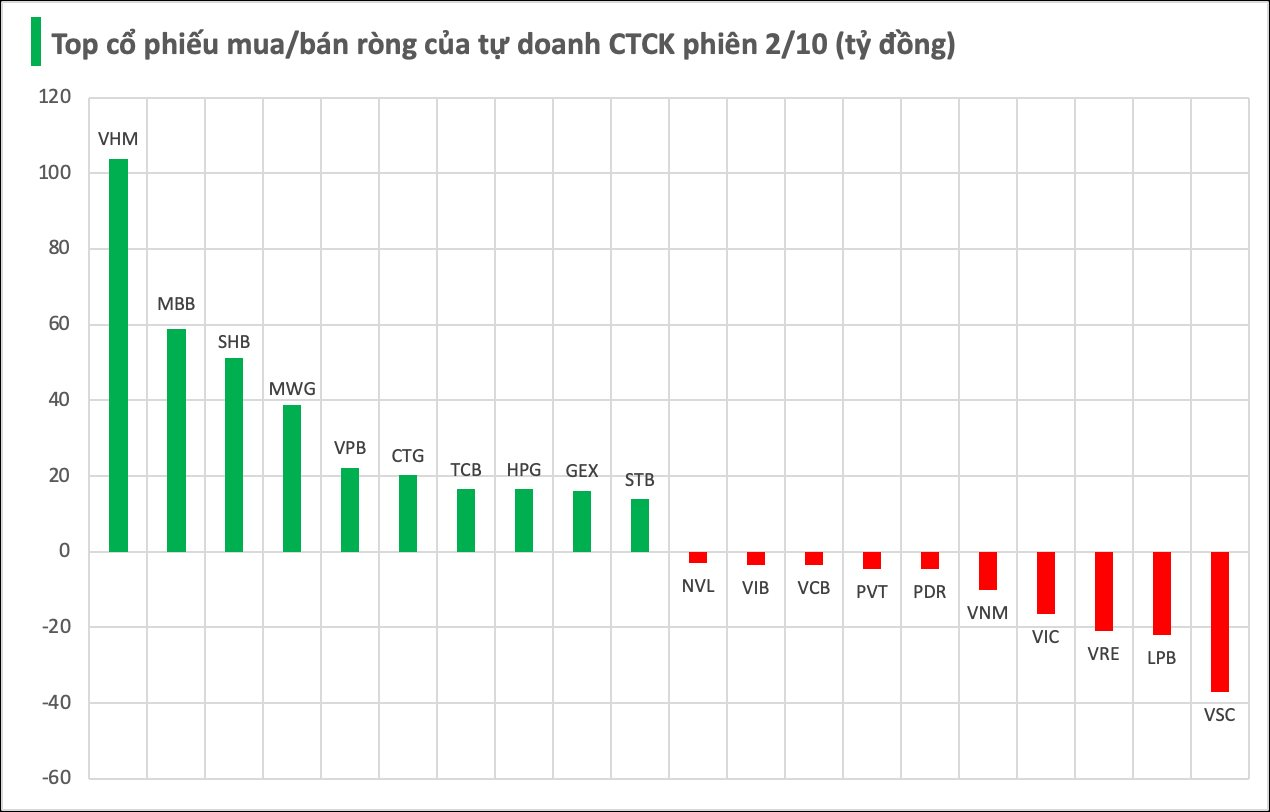

Securities firms’ proprietary trading desks recorded net buying of 343 billion VND on HOSE.

Specifically, VHM and MBB saw net purchases of 104 billion VND and 59 billion VND, respectively. They were followed by SHB (51 billion), MWG (39 billion), VPB (22 billion), CTG (20 billion), TCB (17 billion), HPG (17 billion), GEX (16 billion), and STB (14 billion VND), all of which were actively bought by proprietary trading desks.

Conversely, VSC led the sell-off with a net outflow of -37 billion VND, followed by LPB (-22 billion), VRE (-21 billion), VIC (-16 billion), and VNM (-10 billion VND). Other stocks with significant net selling included PDR (-5 billion), PVT (-4 billion), VCB (-4 billion), VIB (-4 billion), and NVL (-3 billion VND).

Vietstock Daily 03/10/2025: Sluggish Trading Sparks Investor Impatience?

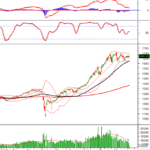

The VN-Index tumbled towards the end of the session, slicing through the Bollinger Bands’ Middle line. This movement reflects a resurgence of bearish sentiment as buying momentum remains subdued. Meanwhile, the Stochastic Oscillator has reissued a sell signal, while the MACD continues to weaken. The August 2025 low (around 1,600-1,630 points) is expected to provide support for the index should selling pressure intensify further.

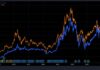

Steel Industry Shareholders Profit, But Celebrations on Hold

Following the sharp decline in April 2025 due to tariff shocks, many steel stocks have successfully formed a V-shaped recovery. However, compared to the broader market’s upward momentum, the sector still appears sluggish, as all steel stocks underperformed the VN-Index. This reflects investors’ lingering caution toward the industry.

Which Stocks Typically Surge in the First Month of Q4?

As September drew to a close with a series of fluctuating market movements, the VN-Index entered October amid heightened uncertainty. Historically, this month has often seen more stocks declining than advancing, adding to investor apprehensions about the market’s trajectory.

![VPBank Proudly Presents G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI as Title Sponsor](https://xe.today/wp-content/uploads/2025/10/screen-sho-2-218x150.png)