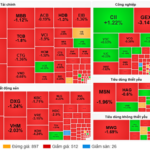

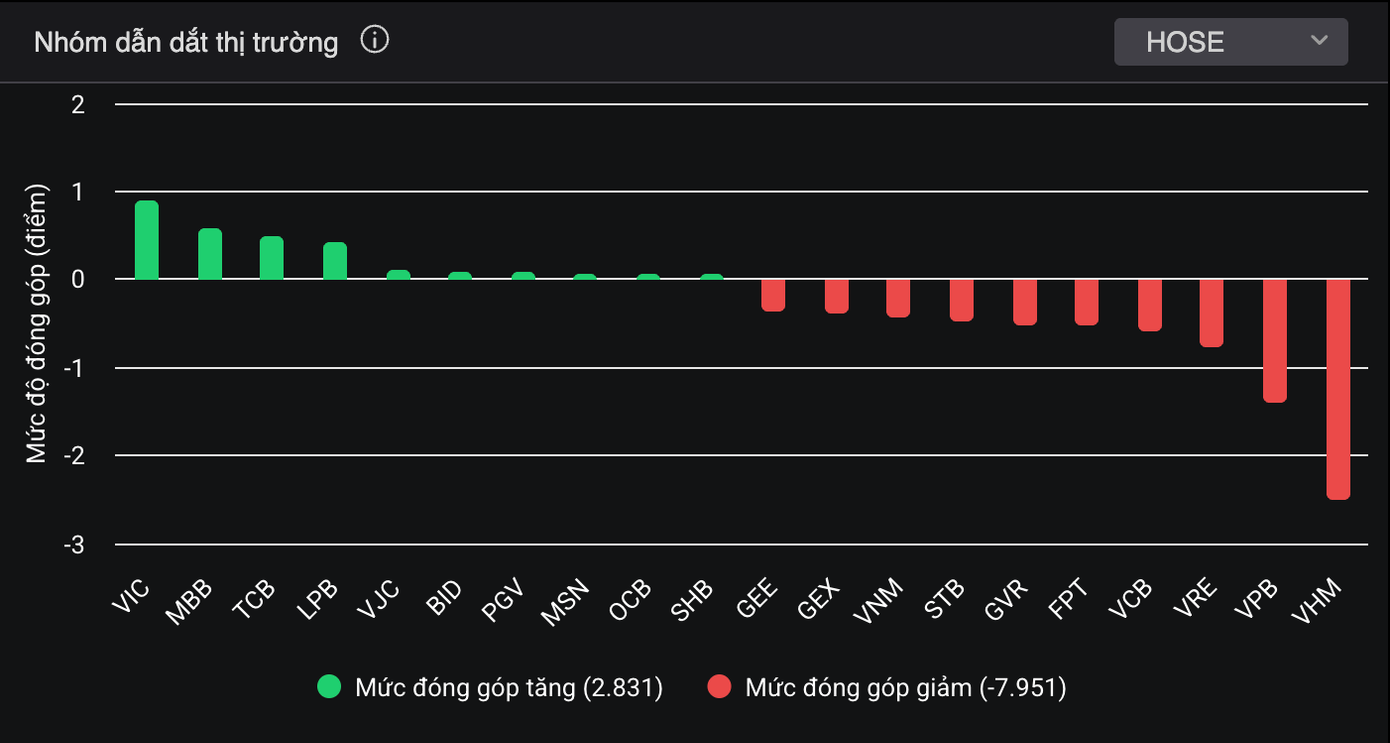

Today’s trading session (October 2nd) saw the VN-Index drop below the 1,660-point mark, with blue-chip stocks experiencing widespread adjustments. From the morning high of 1,679 points, the benchmark index plummeted by 27 points. Among the VN30 basket, 20 out of 30 stocks closed in the red, with heavyweights like VHM, VPB, VRE, and VCB leading the decline.

The banking sector, a key influencer, failed to find common ground, with TPB, EIB, VPB, VIB, STB, SSB, HDB, and VCB all retreating. Notably, VCB announced October 6th as the final registration date for the 2024 dividend payout, offering a 4.5% rate. The ex-dividend date is set for October 3rd, with payment scheduled for October 24th.

Blue-chip stocks witness a collective downturn.

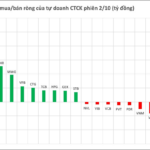

Mid-cap stocks also faced corrections, particularly in the real estate and construction sectors, with GEX, PDR, SCR, DIG, TCH, DXG, and IJC shedding over 3%. Steel stocks were bathed in red, as HPG, HSG, NKG, TLH, and SMC all declined. Securities firms followed suit, with VND, VIX, AGR, SHS, APS, MBS, VDS, VUA, CTS, DSC, HAC, and ORS posting losses of 1-3%.

Notably, Bamboo Capital Group’s stocks (BCG and TCD) hit the lower limit following news of their trading suspension. The reason cited was the delayed submission of their 2024 audited financial reports (both consolidated and separate), exceeding the 45-day deadline. Previously, on September 30th, BCG and TCD were placed under warning and control status.

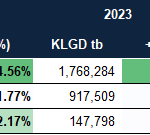

Market liquidity improved compared to the previous session, with HoSE trading value reaching nearly VND 22,200 billion. This was a rare bright spot amidst the prevailing trend of investors focusing on declining stocks.

At the close, the VN-Index settled at 1,652.71 points, down 12.34 points (0.74%). The HNX-Index lost 3.67 points (1.34%) to end at 269.55 points, while the UPCoM-Index remained unchanged.

Vietstock Daily 03/10/2025: Sluggish Trading Sparks Investor Impatience?

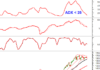

The VN-Index tumbled towards the end of the session, slicing through the Bollinger Bands’ Middle line. This movement reflects a resurgence of bearish sentiment as buying momentum remains subdued. Meanwhile, the Stochastic Oscillator has reissued a sell signal, while the MACD continues to weaken. The August 2025 low (around 1,600-1,630 points) is expected to provide support for the index should selling pressure intensify further.

Steel Industry Shareholders Profit, But Celebrations on Hold

Following the sharp decline in April 2025 due to tariff shocks, many steel stocks have successfully formed a V-shaped recovery. However, compared to the broader market’s upward momentum, the sector still appears sluggish, as all steel stocks underperformed the VN-Index. This reflects investors’ lingering caution toward the industry.

Which Stocks Typically Surge in the First Month of Q4?

As September drew to a close with a series of fluctuating market movements, the VN-Index entered October amid heightened uncertainty. Historically, this month has often seen more stocks declining than advancing, adding to investor apprehensions about the market’s trajectory.

![VPBank Proudly Presents G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI as Title Sponsor](https://xe.today/wp-content/uploads/2025/10/screen-sho-2-218x150.png)