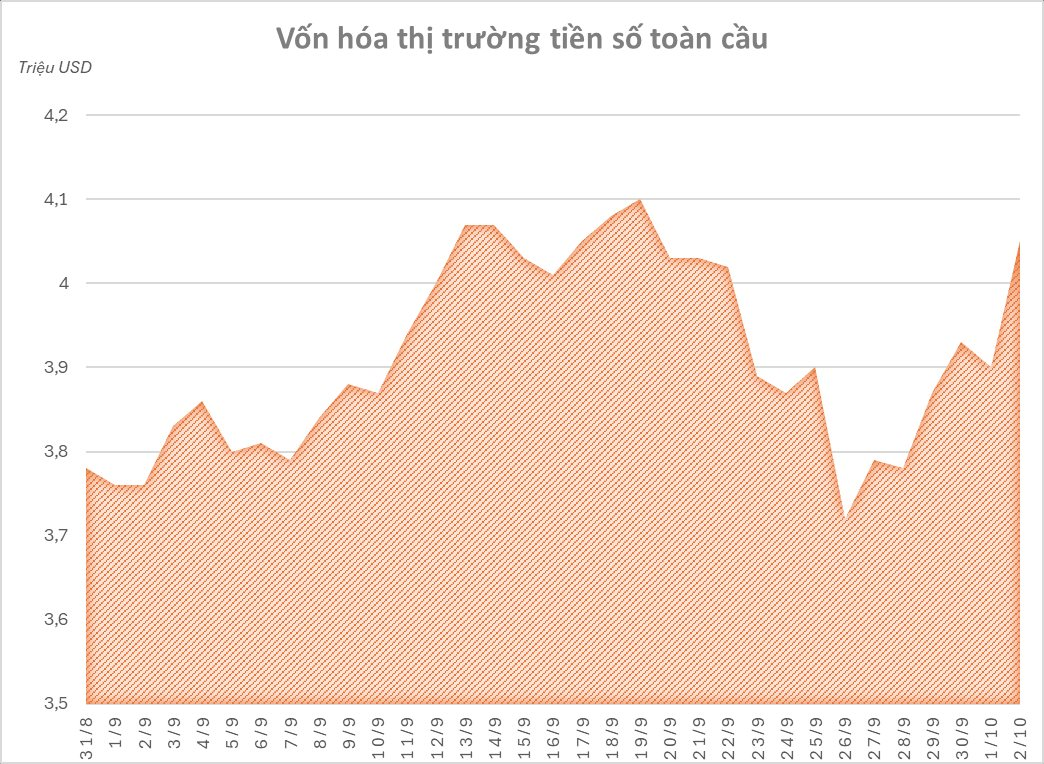

According to recent statistics, the global cryptocurrency market cap reached a staggering $4.05 trillion as of October 2nd.

Compared to the previous week, the market capitalization surged by over $330 billion, marking a nearly 9% increase. This figure is just shy of the all-time high of $4.1 trillion recorded on September 18th.

Bitcoin (BTC) continues to dominate the market, with its market value coinciding with the token’s upward trajectory toward its historical peak. BTC has surpassed the $120,000 mark, reflecting a 10% increase over the past week.

Bitcoin’s price has shown significant growth in recent sessions.

Meanwhile, Ethereum (ETH), a prominent altcoin, has seen an impressive 17% surge over the past seven days, reaching over $4,500. This bullish trend has extended to other major cryptocurrencies like Solana (SOL) and XRP.

The cryptocurrency market’s resurgence comes as global investors seek safe-haven assets following the U.S. government’s announcement of a shutdown at midnight on October 1st (Eastern Time), or 11 a.m. Vietnam Time. This marks the 15th shutdown since 1981 and the first since the longest shutdown in history, which lasted 35 days six years ago.

Historically, government shutdowns have led to financial market instability, characterized by a weakening U.S. dollar, volatile stock markets, and soaring bond yields. In such environments, investors often shift their focus to alternative assets like gold and Bitcoin, viewed as safe havens against systemic risks.

Beyond macroeconomic factors, the influx of capital from Bitcoin ETFs continues to drive prices higher. Aggregated data reveals that in September, global Bitcoin ETFs attracted nearly $3.1 billion in net inflows, rebounding from the outflows seen in August. Year-to-date, this figure has surpassed $22 billion.

Additionally, corporate treasuries and large institutional investors have been actively accumulating Bitcoin. Data from Bitcoin Treasuries indicates that publicly listed companies worldwide now hold nearly 1,040,000 BTC.

While the outlook appears promising, experts caution investors to remain vigilant against potential market volatility. Last-minute budget agreements in the U.S. Congress or hawkish signals from the Federal Reserve regarding interest rates could swiftly shift market sentiment. Furthermore, Bitcoin’s proximity to its previous peak may trigger short-term profit-taking activities.

Bitcoin Surges Amid US Government Shutdown Concerns

The Bitcoin surge has sparked a rally across major altcoins, with Ethereum (ETH), Solana (SOL), and XRP leading the charge, each recording impressive gains of 4–6% in the past 24 hours.