The trading session on October 3rd witnessed a continued freefall of Bamboo Capital Group’s stocks. Both BCG, representing Bamboo Capital Group, and TCD, representing Tracodi Construction Corporation, plummeted by the maximum 7% decline, with no buyers and relentless selling pressure.

As of 2:25 PM, BCG’s share price dropped to VND 2,800, with over 32 million shares left to be sold at the floor price, equivalent to approximately 3.6% of the total outstanding shares. TCD experienced a similar situation, with 6.6 million shares left to be sold at the floor price, and its share price falling to VND 2,100.

Additionally, BGE and BCR, traded on the UPCoM, also turned pale green. Their share prices collectively dropped to historical lows.

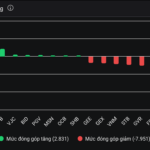

Performance of Bamboo Capital Group’s stocks in the afternoon session on October 3rd

Recently, the Ho Chi Minh City Stock Exchange (HoSE) announced that BCG and TCD shares would be moved from restricted trading to suspension starting October 9th, 2025. This is due to the listed company’s delay in submitting its 2024 audited financial report, exceeding the deadline by more than 6 months.

On October 3rd, Bamboo Capital Group issued an explanation. According to the company, the primary reason for the delay in the financial report stems from personnel changes. In the first 9 months of the year, the company experienced numerous changes related to major shareholders and senior management, including financial and accounting personnel. Additionally, the process of addressing bond obligations and debt restructuring requires more time to complete procedures with relevant authorities.

Regarding remedial measures, BCG stated that it has essentially completed its personnel restructuring and finalized the handover of records. The company is urgently implementing the next steps.

To expedite the auditing process and minimize risks for the company and shareholders, BCG is closely coordinating with the auditing firm and relevant parties to compile records, address outstanding issues, and aim to release the 2024 audited financial report and the 2025 semi-annual reviewed financial report as soon as possible.

Accordingly, the 2024 audited financial report is expected to be released before December 31st, 2025. Furthermore, BCG will collect documents from departments and subsidiaries to prepare the self-compiled financial reports for Q1 and Q2 2025. After releasing the audited financial report, the company will organize the 2025 Annual General Meeting and proceed with auditing the 2025 semi-annual financial report.

Regarding loan and bond restructuring, BCG has sent documents to partners and bondholders to agree on handling plans and coordinate implementation. Some subsidiaries and affiliates have made significant progress. The company continues to work with banks and authorities to address issues, including handling collateral to settle all bond debt.

Previously, Bamboo Capital Group planned to release the 2024 audited financial report in September 2025, but actual developments did not align with the plan.

Bamboo Capital Group’s business operations have stalled amid continuous changes in the senior management of companies within the Bamboo Capital ecosystem following the prosecution of founder Nguyễn Hồ Nam in March 2025.

Bamboo Capital Group has repeatedly explained the delay in submitting its financial report. In its latest statement, the company noted that coordinating with relevant parties to resolve bond issues and handle debt is crucial for completing the audited financial report. However, the company acknowledged that progress has fallen short of expectations due to personnel changes at both the parent company and subsidiaries, as well as affiliates. Additionally, the prosecution information has caused concern among partners and service providers.

According to the self-compiled Q4 2024 report, Bamboo Capital Group recorded full-year 2024 revenue of VND 4,372 billion and after-tax profit of VND 845 billion, increasing by 9% and 394%, respectively, compared to the previous year.

“Bamboo Capital Group’s Stock Plummets as Subsidiary Delisted”

Shares of Bamboo Capital Group and its affiliates plummeted to their daily limit following news of a trading suspension. The Ho Chi Minh City Stock Exchange (HoSE) has officially halted trading for Bamboo Capital Group (ticker: BCG) and Tracodi Construction Group (ticker: TCD), upgrading their status from restricted trading to full suspension.

Two Stocks Suspended from Trading on HOSE

BCG and TCD have been suspended from trading on HoSE, escalating from their previous restricted trading status. This decision stems from violations related to the disclosure of financial reports.