This trend not only reflects the improving domestic purchasing power but also lays the foundation for leading enterprises like Masan (HOSE: MSN) to accelerate their expansion strategies and enhance business efficiency in the remaining months of the year.

Consumer Market Rebounds, Domestic Demand Sustains Growth Momentum

Vietnam’s economic landscape in Q3 opens with optimistic signals from domestic demand. After a period of stagnation in previous years, consumption has rebounded significantly, becoming a key growth driver. According to the General Statistics Office (GSO), the total retail sales and consumer service revenue in August 2025 is estimated at 588.2 trillion VND, a 10.6% increase compared to the same period last year. For the first eight months, this figure reached 4,579.0 trillion VND, up 9.4%, surpassing the 8.9% growth rate of the same period in 2024.

In the spending structure, essential consumer goods such as food, beverages, and daily necessities still dominate and lead the way. Additionally, the recovery of the tourism sector has further boosted consumption. With favorable visa policies, promotional campaigns, and various events celebrating major holidays, Vietnam welcomed 1.68 million international visitors in August, a 16.5% increase year-over-year; cumulatively, 13.9 million visitors were recorded in the first eight months, up 21.7% from last year. The surge in visitors has driven spending on dining and retail shopping, adding momentum to the retail sector as the year-end approaches.

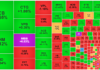

These figures highlight that consumption has become a “bright spot” in the economy, especially as other drivers like exports and foreign investment face ongoing challenges. Notably, spending demand is not confined to major cities but is spreading to local areas, particularly with the expansion of modern retail infrastructure. Modern retail channels are no longer limited to urban supermarkets but are extending to rural areas and satellite cities. Consumers increasingly prioritize safety, convenience, and quality control, making modern retail models an inevitable choice. This trend opens significant opportunities for domestic enterprises, which have a deep understanding of local needs and the capability to rapidly scale operations.

Advantages for Domestic Enterprises to Surge Ahead

In Vietnam’s retail consumption landscape, domestic enterprises hold a distinct advantage due to their market insights and flexible execution. Masan Group (HOSE: MSN) stands as a prime example of this trend. With its integrated consumer-retail ecosystem, Masan operates both as a manufacturer and a distributor with an extensive network, creating a closed-loop growth cycle from production to consumption.

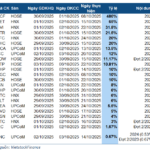

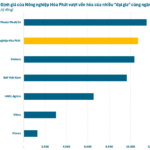

According to BVSC’s September 2025 update, Masan is projected to achieve positive growth, with 2025 revenue estimated at 85.042 trillion VND (+2.2% YoY) and post-tax profit at 3.501 trillion VND (+75.1% YoY). BVSC recommends an OUTPERFORM rating for MSN stock (29% above the closing price of 81,800 VND on September 29), emphasizing growth drivers from WinCommerce (WinMart/WinMart+ retail chain), Masan MEATLife (meat processing), Masan High-Tech Materials (minerals, UpCom: MSR), and Phúc Long, while Masan Consumer (FMCG, UpCom: MCH) is expected to recover strongly from 2026.

From another perspective, VDSC highlights MSN’s long-term potential due to its integrated “production-distribution-consumption” model. The report notes that the recovery in domestic purchasing power, Vietnam’s stock market upgrade, and the potential HOSE listing of MCH will significantly support MSN’s valuation in the coming period. This positions MSN as a strategic stock for investors focusing on Vietnam’s 100 million population and booming consumption. VDSC analysts forecast Masan’s Q3/2025 post-tax profit at approximately 1.272 trillion VND, up 81.4% year-over-year.

Alongside the prospects, securities firms also highlight challenges that could impact MSN. Firstly, competition in the retail sector is intensifying as domestic and foreign chains expand their networks and invest in technology, requiring WinCommerce to balance growth with cost control. Secondly, volatile raw material prices and operational costs could pressure profit margins for MML and MCH. Additionally, the restructuring of distribution channels and the mandatory adoption of electronic invoices may affect short-term results.

Overall, MSN is well-positioned to benefit from Vietnam’s consumption recovery and retail modernization trend. Its integrated ecosystem provides a long-term competitive edge, while valuations from BVSC and VDSC, along with recent performance, indicate significant growth potential for MSN.

VN30-Listed Company Projected to Report Over 80% Profit Surge in Q3

Vietnam’s consumer market is experiencing a robust recovery, with double-digit retail growth recorded in August 2025. This trend not only highlights the strengthening domestic purchasing power but also provides a solid foundation for leading enterprises like Masan Group to accelerate their expansion strategies and enhance business efficiency in the remaining months of the year.

Unlocking Business Opportunities: How Government Stimulus Boosts Consumer Spending

Amidst a volatile global economic landscape, the Vietnamese government is strategically prioritizing domestic consumption as the cornerstone of its growth agenda. At numerous economic forums, experts and policymakers have consistently emphasized that stimulating the domestic market will serve as the pivotal driver to sustain economic recovery and achieve breakthrough momentum in the upcoming period.