According to the published Annual General Meeting (AGM) documents, Thanh Thanh Cong – Bien Hoa Joint Stock Company (AgriS, HOSE: SBT) plans to present seven proposals and three reports to the AGM. Key topics include the approval of the Business Production Plan and Profit Distribution Scheme, Board of Directors (BOD) Remuneration, Bond Registration, Listing, and the 2025-2030 Development Strategy, among others.

AgriS reported positive financial results for the 2024-2025 fiscal year to the AGM, with consolidated net revenue reaching VND 28,492 billion, achieving 109% of the plan. Pre-tax profit stood at VND 950 billion, meeting 106% of the target. Post-tax profit reached VND 834 billion, a 3% increase year-over-year. Sugar sales volume nearly hit 1.4 million tons. Based on these strong profits, the company proposed a 6% stock dividend for the 2024-2025 fiscal year, ensuring consistent annual dividend payments to shareholders.

Notably, AgriS presented its detailed 2030 development strategy to the AGM. The company will focus on implementing the Circular Commercial Value Chain model with five strategic goals: (1) A 3-Center, 3-Service, 1-Multinational Management System organizational model; (2) Developing multi-dimensional international trade and cooperation; (3) Sustainable development, ESG commitments, and enhanced governance; (4) Building a high-caliber workforce for international trade and markets; (5) Achieving a market capitalization of USD 2.7 billion by 2030.

The 2025-2026 fiscal year is expected to face a slow global economic recovery, geopolitical instability, and a downturn in the sugar industry. AgriS proposed a conservative revenue target of VND 26,500 billion and a pre-tax profit of VND 951 billion, maintaining stable growth. A 5-7% stock dividend is also planned.

SBT Shares Surge, Reaching an 8-Year High

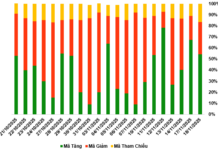

By the end of the 2024-2025 fiscal year (June 30, 2025), SBT shares had risen over 80% since June 30, 2024, marking one of HOSE’s most impressive growth streaks. In early 2025-2026 trading sessions, SBT continued its upward trend, peaking at VND 25,000 per share on August 11, 2025, the highest in eight years.

The company’s market capitalization now stands at VND 19,500 billion, with stable 12-month liquidity. Average daily trading volume exceeds 2 million shares, valued at nearly VND 34 billion. Institutional ownership has risen to nearly 54%, up from 40% at the start of 2024-2025, reflecting growing interest from professional investors amid AgriS’s business model transformation.

SBT Share Price and Liquidity Trends from September 30, 2024 – October 1, 2025 (Source: Vietstock)

Growth Driven by a Bold Strategic Transformation

2024 marked a pivotal year for AgriS as it shifted from a production-focused company to a high-tech agricultural conglomerate, developing an AgTech-FoodTech-FinTech ecosystem grounded in ESG principles. The new model revolves around three core centers: Agriculture, Production, and Integrated Commerce. Each center plays a strategic role, from sustainable raw material development to enhanced processing and expanded domestic and international distribution, creating a flexible, adaptive value chain.

AgriS successfully hosted the AgriS Agro Day 2025 Summit on August 7-8, 2025, gathering top leaders, experts, and scientists to advance high-tech, circular agriculture and international integration.

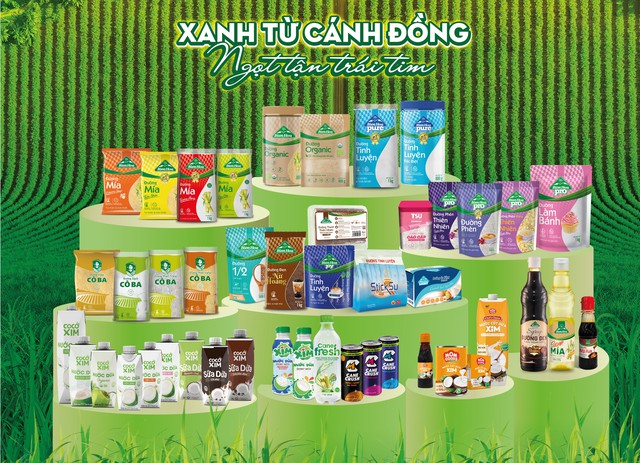

Alongside restructuring, AgriS is expanding into the international Food-Beverage-Dairy-Confectionery market. Its product range, derived from regional crops like sugarcane, coconut, banana, rice, and cassava, meets high international quality standards. By 2030, this segment is targeted to contribute 40% of total revenue.

Beyond sugar, AgriS has expanded its portfolio to over 200 consumer products derived from crops like sugarcane, coconut, banana, and rice.

AgriS has recently focused on portfolio restructuring, concentrating on core areas. To support its food and beverage expansion, the company will intensify capital raising and M&A activities, increasing ownership in strategic value chain units. AgriS has acquired over 30% of Betrimex, a leading coconut processor, with a target of 40%. Additional deals are expected soon.

This transformative shift positions the 2025-2026 fiscal year as a critical pivot, bridging the current phase with the 2025-2030 strategy. AgriS aims to enhance agricultural value, develop sustainable natural nutrition solutions, and integrate into the global food and beverage supply chain. The company targets VND 60,000 billion in revenue by 2030 and Net Zero emissions by 2035.

AgriS (SBT) Surpasses Targets, Presents Key Strategies to Shareholders for Vision 2030

On October 1, 2025, AgriS announced the convening of its Annual General Meeting of Shareholders (AGM) for the fiscal year 2024-2025, scheduled to take place on October 24, 2025, at the company’s headquarters in Tay Ninh.

“TTC Agri Appoints New Vice President”

“TTC AgriS is proud to announce the appointment of Mr. Nguyen Duc Hung Linh as the new Deputy General Director. Mr. Linh’s tenure will commence on August 1, 2025, and conclude on July 31, 2026. With a wealth of experience and expertise, Mr. Linh is poised to make a significant contribution to the company’s growth and success during his tenure.”

“ĐHĐCĐ SBT: Pushing for Financial Restructuring and Core Business Focus, Asserts Ms. Đặng Huỳnh Ức My.”

On October 24, in Tay Ninh, TTC Thanh Thanh Cong – Bien Hoa Joint Stock Company (TTC AgriS, HOSE: SBT) successfully held its Annual General Meeting for the 2023 – 2024 term with the theme “TTC AgriS 55: Serving and Perfecting a Responsible Value Chain.”