Recently, Song Da Corporation (Stock Code: SJG, UPCoM) announced a Board of Directors Resolution regarding the payment of dividends for 2024.

Accordingly, Song Da Corporation plans to pay a cash dividend for 2024 to shareholders at a rate of 10%, meaning shareholders holding one share will receive 1,000 VND.

The final registration date for dividend rights is October 20, 2025, with the expected payment date being October 31, 2025.

With over 499.5 million SJG shares currently circulating in the market, it is estimated that Song Da Corporation will allocate approximately 449.5 billion VND for this dividend payment.

Illustrative image

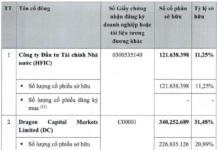

As of June 30, 2025, the State Capital Investment Corporation (SCIC) holds nearly 448.6 million SJG shares and is expected to receive approximately 448.6 billion VND in dividends from Song Da Corporation.

In other developments, Song Da Corporation previously reported on the results of the public offering of SJE shares by Song Da 11 Joint Stock Company.

Following the registration and deposit period from August 15, 2025, to 4:00 PM on September 4, 2025, no investors registered to purchase the SJE shares offered by Song Da Corporation.

Based on Point a, Section 2.14, Article 2 of the Auction Regulations for Share Lots, the auction session for the share lot of Song Da Corporation was unsuccessful.

According to the initial plan, Song Da Corporation intended to auction the entire lot of nearly 4.1 million SJE shares (including purchase rights), equivalent to a 16.94% stake in Song Da 11. The auction was organized by UP Securities Joint Stock Company.

With a starting price of 77,143 VND per share, the estimated starting value of the entire share lot was approximately 316 billion VND.

The auction session was scheduled for September 12, 2025, with the payment period for successful bids running from September 12 to September 16, 2025.

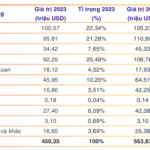

Regarding business performance, according to the audited consolidated financial statements for the first half of 2025, Song Da Corporation achieved a net revenue of over 3,146.4 billion VND, a 22.5% increase compared to the first six months of 2024; after-tax profit reached over 433 billion VND, up 144.9%.

For 2025, Song Da Corporation set a business target with an expected after-tax profit of 725 billion VND. Thus, by the end of the first two quarters, the company has achieved 59.7% of its planned profit.

As of June 30, 2025, the company’s total assets increased slightly by 110 billion VND compared to the beginning of the year, reaching over 22,369.2 billion VND. Of this, investments held to maturity recorded nearly 2,310.7 billion VND, accounting for 10.3% of total assets; inventory stood at over 1,935.7 billion VND.

On the liabilities side, total payables were over 13,301.9 billion VND, an increase of 156 billion VND compared to the beginning of the year. Of this, loans and finance leases amounted to nearly 6,412.6 billion VND, representing 48.2% of total liabilities.

GELEX CEO’s Mother Registers to Purchase 12 Million GEX Shares

According to recently disclosed information, Mrs. Đào Thị Lơ, the biological mother of Mr. Nguyễn Văn Tuấn, CEO of GELEX Group Corporation (HOSE: GEX), has registered to purchase 12 million shares, with an expected transaction value of 120 billion VND (at par value), for the purpose of increasing her ownership stake.

Vietnamese “Shrimp King” Establishes Subsidiary in Australia

As of June 30, 2025, Minh Phu Seafood Corporation (MPC) has established a robust ecosystem comprising 16 subsidiaries, spanning aquaculture, seed production, biological products, logistics, and port systems to support its comprehensive supply chain.

Vietnamese Billionaire Receives Additional Trillions in Dividends

Vietnam Exhibition Fair Center JSC played a pivotal role in securing approximately VND 6,000 billion in dividends for Vingroup, the conglomerate led by billionaire Pham Nhat Vuong. Similarly, Nguyen Dang Quang and Masan Group reaped substantial dividends totaling thousands of billions of Vietnamese dong from Techcombank, Vinacafé Bien Hoa, and Net Detergent.

A Hydroelectric Power Company Announces a Generous 100% Dividend Payout

The Hydropower Generation Corporation of Que Phong (UPCoM: QPH) has just announced a generous cash dividend proposal of up to 100%, equivalent to VND 10,000 per share. The company is seeking shareholders’ approval through a written resolution. Following this announcement, QPH’s share price soared, reflecting investors’ positive response to the news.