44% Reduction in Tax Administrative Procedures

As a law directly impacting citizens and businesses, the draft Tax Administration Law being developed by the Ministry of Finance aims to streamline numerous administrative procedures. Mr. Đặng Ngọc Minh, Deputy Director of the Tax Department, stated that the draft law reduces administrative procedures by 44%. These procedures are simplified in line with reform principles, focusing on a taxpayer-centric policy approach.

Tax officers guiding taxpayers through procedures. Photo: Hanoi Tax Department

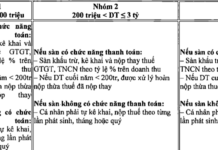

The new draft law eliminates 10 provisions from the current law, including: Tax Advisory Councils at commune, ward, and town levels; the tax registration responsibilities of the Minister of Finance and tax authorities; the order of payment for taxes, late payment fees, and penalties; conditions and issuance of business licenses for tax procedure services; and duties and powers of tax audit decision-makers, audit team leaders, and members, as well as the rights and obligations of audited entities, audit conclusions, and re-audits in tax audits.

According to the Tax Department’s statistics, in 2021, there were 435 administrative procedures. This number was reduced to 204 procedures, and by early 2025, it stood at 219. Currently, 99% of businesses file and pay taxes electronically, 100% use electronic invoices, and nearly 7 million individuals use the Etax Mobile app.

“The elimination of these procedures does not impact the state budget and allows for a focus on reducing and simplifying tax administrative procedures. Streamlined documentation, shortened processing times, and simplified workflows support taxpayers in registration, declaration, settlement, and refunds, reducing compliance costs for citizens and businesses,” the Ministry of Finance stated.

According to Mr. Đậu Anh Tuấn, Deputy Secretary-General of the Vietnam Chamber of Commerce and Industry (VCCI), the Tax Administration Law is foundational. While specialized tax laws establish tax rates and liable entities, the Tax Administration Law governs the procedures.

“The Tax Administration Law regulates the entire tax compliance process—from registration, declaration, and payment to refunds, exemptions, enforcement, inspections, and appeals. This law directly affects compliance costs, time, and convenience for businesses and individuals,” Mr. Tuấn explained.

Mr. Tuấn suggested that the Ministry of Finance develop a roadmap for implementing a digital tax ecosystem, invest in resources, ensure data security and privacy, and prevent misuse. Drafting authorities should continue reviewing and standardizing forms, enhancing online public services, and ensuring new regulations are immediately applicable, especially for small and micro enterprises.

Cost Reduction Needed

Tax-related administrative procedures and costs are among the most frequent complaints from businesses. In the 2025 Provincial Competitiveness Index (PCI) report, VCCI noted that, according to a 2024 survey, foreign-invested enterprises still find administrative procedures burdensome.

Tax procedures topped the list of concerns, with 35% of surveyed businesses citing tax-related issues as the most troublesome. This figure rose sharply from 16% in 2023, reversing the previous downward trend.

At a recent seminar on legal bottlenecks, Mr. Phan Đức Hiếu, a member of the National Assembly’s Committee on Economics and Finance, highlighted the costs associated with tax administrative procedures. He noted that complex procedures often force businesses to hire 3-4 staff to handle tax reporting. Some even maintain entire tax and accounting departments with 10-15 employees, resulting in significant labor costs. Simplifying procedures could allow one person to manage tax matters for three businesses, reducing costs.

Ms. Hương Vũ, CEO of EY Consulting Vietnam, noted that recent tax policy amendments align with international standards, promoting transparency and efficiency. These policies ease compliance, reduce administrative burdens, and lower costs for businesses.

The draft Tax Administration Law clarifies the direction toward digital transformation, modernizing tax management through information technology, big data, and artificial intelligence (AI) to enhance efficiency. It emphasizes a shift from a “management” to a “service” mindset, prioritizing taxpayers. The law also promotes voluntary compliance based on risk assessment and compliance levels, alongside administrative reforms.

Since early 2025, one notable simplification is the automated personal income tax refund process. Taxpayers can receive refunds within three working days directly into their bank accounts. The Tax Department’s automated database generates refund orders and electronically sends them to the State Treasury for processing. In the initial phase, nearly 257,000 automated personal income tax refund applications were processed, totaling approximately 1.17 trillion VND.

Digital Transformation: The Catalyst Elevating the Consumer-Retail Ecosystem

Digital transformation is becoming an irreversible trend in the retail industry. In Vietnam, major corporations are increasingly integrating artificial intelligence and real-time data into their operational management, from demand forecasting to supply chain optimization.

Citek and SAP Unveil Revolutionary 3-in-1 Integrated Platform: SAP Business Suite

In an era where data and AI are reshaping how businesses operate, SAP and its Platinum Partner, Citek, have unveiled a comprehensive SAP Business Suite integration platform in Hanoi. This innovative solution is guided by the philosophy of “Suite-First, AI-First,” designed to empower organizations with seamless, intelligent capabilities for the future.

Techcombank Honored as “Best Bank in Vietnam” by Euromoney for the Sixth Consecutive Year

October 1, 2025 – Surpassing over 600 contenders from 100 countries worldwide, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) has been crowned “Best Bank in Vietnam” by Euromoney magazine at the prestigious 2025 Euromoney Awards for Excellence. Techcombank stands as the only Vietnamese bank to achieve this esteemed recognition for six consecutive years.