Royal De Heus CEO Gabor Fluit (left) and Hung Nhon Chairman Vu Manh Hung (right) share insights – Photo: TRUONG LINH. Tuoi Tre

During a meeting with senior leaders from De Heus (Netherlands), Heineken Vietnam, and Hung Nhon, HCMC Chairman Nguyen Van Duoc emphasized the city’s commitment to addressing business concerns directly, fostering sustainable partnerships.

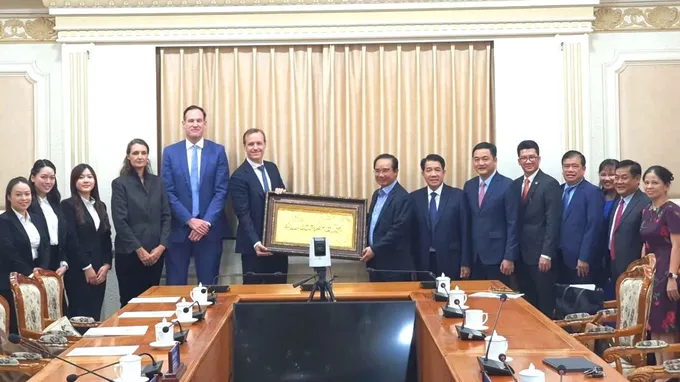

HCMC Chairman Nguyen Van Duoc engages with leaders from De Heus, Heineken Vietnam, and Hung Nhon on October 2. Photo: Truong Linh. Tuoi Tre

This meeting highlights the Netherlands’ role as a key economic partner of HCMC, with investments exceeding $5.1 billion by 2024 in high-value sectors like logistics, advanced manufacturing, renewable energy, and agri-food processing.

Chairman Nguyen Van Duoc presents souvenirs to Dutch business leaders. Photo: THUY VU. SGGP

Dutch businesses raised concerns about administrative delays, logistics infrastructure, and the need for skilled labor. Duoc pledged administrative reforms, technology integration, and infrastructure projects to address these issues.

Notably, Gabor Fluit announced De Heus’ plan to relocate its Asia headquarters to HCMC, seeking clarity on the city’s financial hub ambitions. This move underscores Vietnam’s growing strategic importance in Asia.

“We aim to relocate our Asia headquarters to HCMC and seek the city’s vision for this move,” Fluit stated.

This relocation would significantly boost HCMC’s global investment appeal, solidifying Vietnam’s role as a regional business hub.

Chairman Duoc assured ongoing dialogue to support long-term business growth.

About Royal De Heus

De Heus’ 300-year milling history is tied to Jacob van Ruisdael’s “Windmill at Wijk bij Duurstede.” Source: De Heus

Founded in 1911, Royal De Heus is a Dutch family-owned company honored with the “Royal” title for its global agricultural impact. It ranks among the world’s top 10 feed producers, with 80+ factories across 20+ countries.

De Heus’ Dutch headquarters. Source: De Heus

With 2022 revenue nearing €7 billion, De Heus leads competitors like Agrifirm (€2.81 billion) and ForFarmers (€3.3 billion). Since entering Vietnam in 2008, it acquired Masan’s feed division and recently CJ Feed & Care, expanding across Southeast Asia and entering South Korea and the Philippines.

The CJ acquisition, valued at ₩1 trillion ($850 million), cements De Heus’ dominance in Asia, highlighting HCMC’s strategic role in its expansion.

Elevating Vietnam’s Global Standing Through an International Financial Hub

Amidst the dynamic shifts in the global economy, Vietnam is strategically positioning itself to establish an international financial hub as a new growth engine. This ambitious initiative aims to serve as a magnet for global capital and expertise, while simultaneously elevating the nation’s standing on the world financial map.