On October 2, 2025, as part of the National Innovation Day, the forum titled “Digital Asset Market: From Trends to Breakthroughs” was held in collaboration with the Ministry of Finance, Ministry of Science and Technology, State Securities Commission, and the Vietnam Blockchain & Digital Asset Association (VBA). The event attracted nearly 1,000 attendees.

In his opening remarks, Mr. Vu Quoc Huy, Director of the National Innovation Center (NIC), emphasized that the global digital economy is witnessing a significant shift, with digital assets (TSMH) experiencing rapid growth. The Asia-Pacific region is the fastest-growing market globally, and Vietnam ranks third in the region, with digital asset investments surpassing $220 billion, a 55% increase from the previous year. This surge reflects a growing demand for digital payments, savings, and services, though most activities still occur on international platforms, leading to tax losses and challenges in anti-money laundering (AML/CFT) efforts.

Mr. Phan Duc Trung, Chairman of VBA and 1Matrix, highlighted the irreversible global trend of tokenizing real-world assets (RWA). According to Boston Consulting Group (BCG), RWA is projected to reach $19 trillion by 2033, equivalent to over 10% of global GDP.

Mr. Phan Duc Trung emphasized that RWA is an inevitable and irreversible trend.

This trend is evident in projects by leading global financial institutions, such as JPMorgan’s Tokenized Collateral Network, which recorded over $1.5 trillion in cumulative transactions in 2025, averaging $2 billion daily. Hong Kong also issued a $6 billion multi-currency green bond, enabling T+1 trading in multiple currencies.

Mr. Trung described this as a financial innovation breakthrough, comparable to the introduction of mutual funds or ETFs.

Mr. To Tran Hoa emphasized that Resolution 05 provides a crucial legal framework for the domestic digital asset market.

In Vietnam, the domestic digital asset market’s foundation is strengthened by Resolution 05/2025/NQ-CP on the pilot implementation of digital assets, issued by the Government on September 9, 2025.

Mr. To Tran Hoa, Deputy Director of the Securities Market Development Department (State Securities Commission), noted that the Resolution outlines clear issuance conditions (requiring enterprises to be legal entities in Vietnam and backed by real assets). It also sets stringent standards for virtual asset service providers (VASPs), including a minimum capital of $10 billion, foreign ownership capped at 49%, and Tier 4 technology infrastructure compliance.

Mr. Hoa believes this pilot mechanism will act as a “filter,” eliminating risky models, building investor confidence, and aligning Vietnam with international standards.

Mr. David Chan described digital assets as the beginning of the “on-chain economy flywheel.”

Echoing this sentiment, Mr. David Chan, Market Development Director at BCG Hong Kong, described digital assets as the precursor to a broader trend: the “on-chain economy flywheel,” a self-reinforcing growth mechanism operating directly on blockchain.

Ms. Nguyen Thi Minh Tho emphasized AML/CFT requirements for VASPs.

However, the digital asset market poses new risks, particularly in AML/CFT. Ms. Nguyen Thi Minh Tho, Deputy Director of the Anti-Money Laundering Department at the State Bank of Vietnam, noted that Vietnam is actively implementing measures to exit the FATF “Grey List” (since June 2023). The National Risk Assessment classified risks associated with virtual assets as Medium-High/High. Thus, Resolution 05/2025/NQ-CP and the Digital Technology Industry Law impose strict AML/CFT regulations on VASPs, requiring customer identification, transaction monitoring above $1,000, and data retention for at least 10 years.

Senior Lieutenant Nguyen Thanh Chung highlighted the role of Resolution 05 and the Digital Technology Industry Law in combating cybercrime.

From a security perspective, Senior Lieutenant Nguyen Thanh Chung, Deputy Head of Division 4, A05 Department (Ministry of Public Security), warned that digital assets are being exploited for illegal fundraising and online fraud, causing over $12 billion in losses in five years.

Mr. Chung stressed that transactions on licensed domestic platforms not only enhance AML/CFT effectiveness but also directly protect customer rights.

During the panel discussion “Digital Assets and Blockchain – Driving Double-Digit Economic Growth: Opportunities, Challenges, and Actions,” moderated by Mr. Tran Huyen Dinh (Head of the Fintech Application Committee, VBA), experts discussed leveraging digital assets for double-digit economic growth under Resolution 57-NQ/TW.

Prof. Phan Trung Ly, former Chairman of the National Assembly’s Legal Committee, called for the swift establishment of specialized regulatory institutions to clarify the legal framework for digital assets and blockchain, including definitions related to ownership, tax obligations, and consumer protection. He emphasized that policies must “balance protection with flexibility for innovation,” while market development must ensure security, personal data protection (Resolution 27-NQ/TW), and a level playing field for private entities (Resolution 68-NQ/TW).

In his concluding remarks, Mr. Phan Duc Trung noted that piloting safe and transparent assets like government bonds or treasury bills, as outlined in Resolution 05, will help the market launch in alignment with international standards and achieve sustainable growth. He also underscored the importance of international cooperation, citing partnerships with leading institutions like BlackRock and JPMorgan as critical for attracting long-term capital.

Finance Ministry Announces Licensing for Crypto Asset Services

As of now, no company has submitted an application to provide cryptocurrency services, according to Deputy Minister of Finance Nguyen Duc Chi. However, several businesses have expressed interest and engaged in preliminary technical discussions with regulators to fully understand the requirements and conditions, paving the way for formal proposals in the near future.

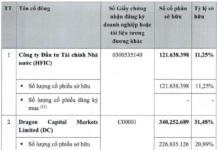

SSI Chairman Nguyen Duy Hung: Five Years Ago, I Thought Bitcoin Could Drop to Zero, But Now It’s a Completely Different Story

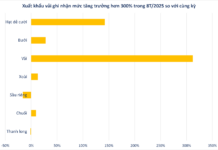

Unlocking the vast potential of digital asset growth, SSI has assembled a team of tech-savvy experts, poised to execute with precision. This strategic move has captured significant interest from the investor market, signaling a promising future for SSI’s ventures in the digital realm.