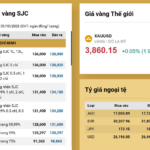

The global precious metals frenzy shows no signs of cooling. Gold prices have surged nearly 50% since the start of the year, reaching a new peak of nearly $3,900 per ounce, while silver has soared over 60%, inching closer to its historical high. This trend is expected to persist in the short term as substantial capital continues to flood into these markets.

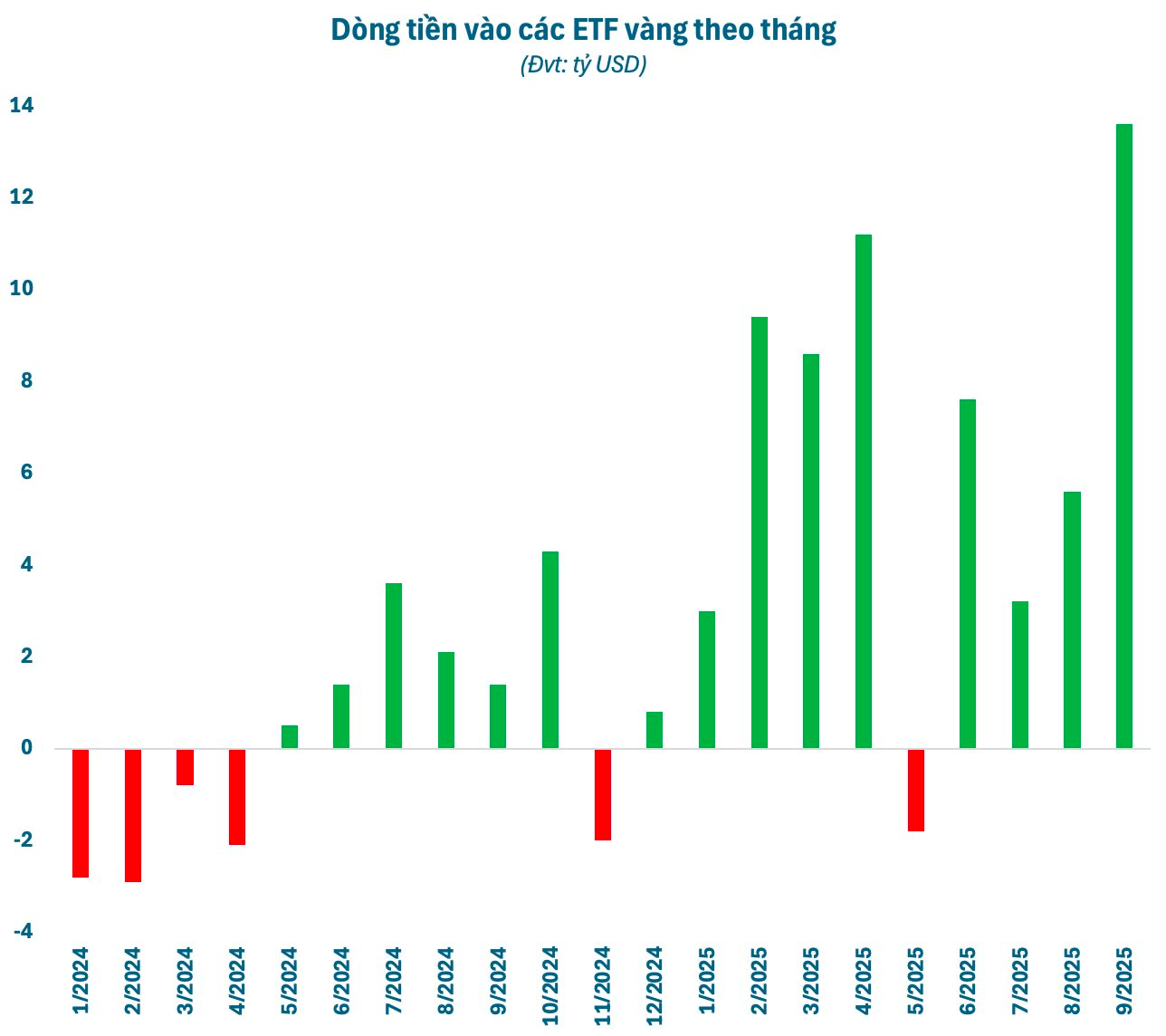

Global gold ETFs have seen robust inflows for four consecutive months. In September alone, these funds attracted approximately $14 billion in investments. Year-to-date, net inflows total $60 billion, enabling the acquisition of nearly 590 tons of gold, pushing total holdings past 3,800 tons. This capital influx is primarily driven by ETFs managed by BlackRock and State Street Global Advisors (SSGA).

The world’s largest gold ETF, SPDR Gold Trust (SSGA), has drawn $15 billion in net inflows this year, purchasing nearly 150 tons of gold. Its holdings now exceed 1,000 tons, the largest among global gold funds. Another SSGA fund, SPDR Gold MiniShares Trust, has attracted over $6 billion in net inflows year-to-date.

BlackRock’s trio of ETFs—iShares Gold Trust ($9.4 billion), iShares Physical Gold ($4.5 billion), and iShares Gold Trust Micro ($2.4 billion)—have collectively attracted over $16 billion in net inflows this year. Additionally, China’s largest gold ETF, Huaan Yifu Gold, has seen net inflows exceeding $3 billion.

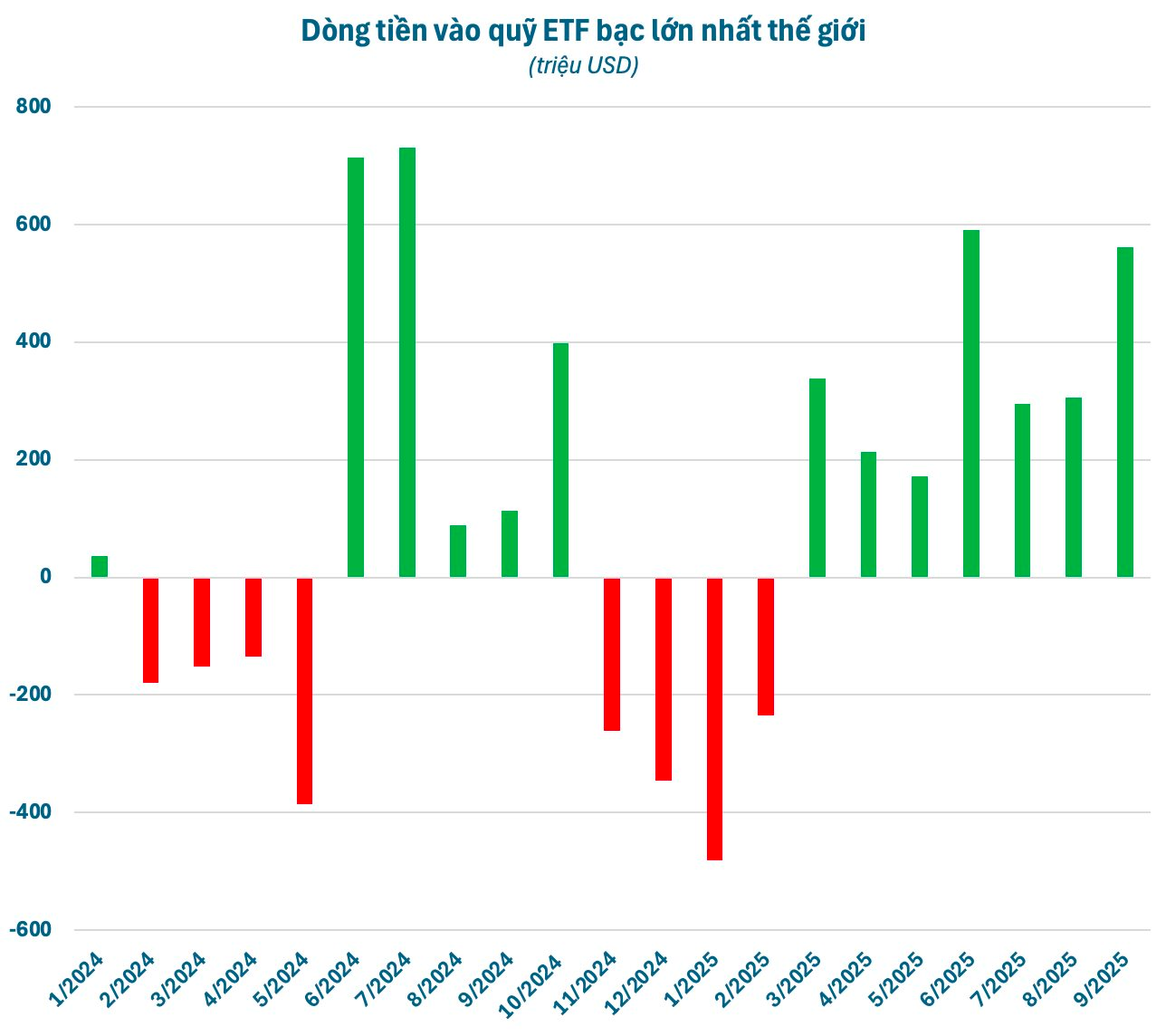

Silver ETFs, though smaller in scale, have also experienced strong inflows. The world’s largest silver ETF, iShares Silver Trust, has recorded seven consecutive months of net inflows, its longest streak in years. Year-to-date, it has attracted nearly $1.7 billion, acquiring approximately 1,100 tons of silver, bringing total holdings to over 15,600 tons.

Gold and silver have become investor focal points for distinct reasons. Gold remains the premier safe-haven asset amid geopolitical tensions and global trade uncertainties. Additionally, the weakening U.S. dollar, driven by economic uncertainty, has bolstered gold demand. Central banks worldwide have significantly increased their gold reserves, surpassing U.S. Treasury holdings globally for the first time since 1996.

BMO Capital Markets analysts predict gold prices will surpass $4,000 per ounce next year. Similarly, Goldman Sachs Research analyst Lina Thomas forecasts gold reaching $4,000 by mid-2026 if global instability persists and monetary policies remain accommodative.

Silver’s appeal lies in its supply deficit, driven by high demand in industries such as solar panels, electric vehicles, and electrical infrastructure. The rapid expansion of these sectors has created a multi-million-ounce annual shortfall. The U.S. Department of the Interior’s designation of silver as a critical mineral in 2025 underscores its growing importance.

First-Time Gold Buyers Pay Prices Far Exceeding Forecasts, Prompting New State Bank Intervention

A draft circular regulating gold trading activities has been released, with an anticipated effective date of October 10th.