According to the plan, SGP will offer over 1.1 million shares of SPL, equivalent to 74.13% of its charter capital, to fewer than 100 domestic investors. The starting price is not less than VND 27,926 per share, making the minimum value of the share lot over VND 31 billion. The bidding list is expected to include at least 15 financial institutions and 15 individual or other organizational investors.

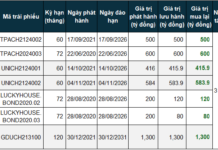

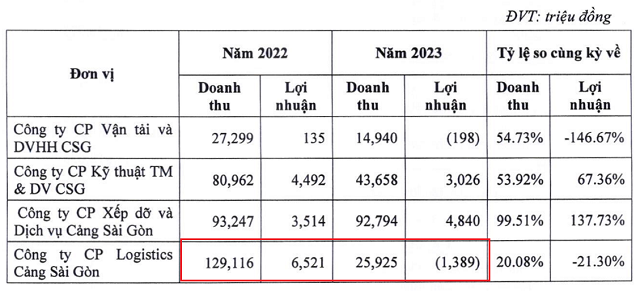

Established in 2009, SPL has a charter capital of VND 15 billion and operates in the warehousing and logistics sector, with its headquarters located in former District 4, Ho Chi Minh City. In 2024, the company achieved revenue of over VND 32 billion, an increase from VND 26 billion in 2023, but still incurred a loss of VND 1.1 billion, following a VND 1.4 billion loss the previous year. Previously, during the 2021-2022 period, SPL’s revenue was significantly higher, reaching VND 140 billion and VND 129 billion, respectively, with annual profits exceeding VND 6 billion.

By the end of June 2025, SGP’s investment in SPL had an original value of VND 11.1 billion but required a provision of VND 1.5 billion. Additionally, SPL has cross-ownership, with Hai Phong Port (UPCoM: PHP), another member of Vietnam Maritime Corporation (VIMC, UPCoM: MVN), holding 21% of its capital.

SPL’s revenue and profit plummeted in 2023. Source: SGP’s 2023 Annual Report

|

This move is part of SGP’s ongoing divestment series. In June 2025, the company approved the plan to sell its entire 5.15 million shares in Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB), expecting to raise nearly VND 63 billion, while the original cost was only around VND 23 billion. Earlier, SGP also decided to withdraw capital from SP-SPAM Maritime Towage Company, with an original investment of over VND 2 billion but a starting price of over VND 16 billion.

According to SGP, many subsidiaries like SPL originated from branches that were equitized and operate in auxiliary sectors such as loading, unloading, forwarding, and mechanical repairs. These units have limited land advantages, primarily relying on leased premises, with assets consisting of equipment, average profitability, and significant dependence on SGP. Therefore, the Board of Directors has approved the divestment from four member companies, including Sai Gon Port Loading and Services, Sai Gon Port Technical and Commercial Services, Sai Gon Maritime Transport and Services, and SPL.

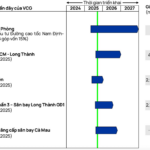

At the 2024 Annual General Meeting, SGP’s leadership emphasized the need to focus resources on major projects, such as investing in exploitation equipment at Sai Gon Port – Hiep Phuoc and developing the Can Gio Port project. Due to this priority, SGP decided not to pay dividends for 2023.

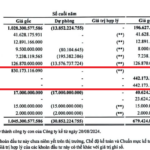

The investment in SPL represents only a small portion of the total original value of over VND 832 billion that SGP has invested in its subsidiaries. The current focus remains on Sai Gon Port – Hiep Phuoc, where SGP holds 90.54% of the equity with an original value of VND 771 billion. In joint ventures, SGP also owns significantly larger investments, such as VND 1.19 trillion in Sai Gon Port – SSA International Container Services (SSIT) for a 38.93% stake, and nearly VND 890 billion in SP-PSA International Port. However, these investments still require provisions of hundreds of billions of dong.

The first-half 2025 business results show that SGP maintained efficiency due to financial income and profits from joint ventures. Revenue reached VND 538 billion, a slight decrease compared to the same period, but net profit increased by 77% to nearly VND 218 billion, the highest in four years, achieving 76% of the plan. Of this, SSIT contributed nearly VND 92 billion, 2.4 times higher than the same period, while SP-PSA contributed VND 30 billion, reversing the previous year’s loss.

| SGP’s first-half profit boosted by joint ventures/associates |

– 10:53 04/10/2025

“Quiet Markets Post-Holiday: Investment Funds See Lull in Trading Action”

The stock market resumed trading after an extended holiday break with three sessions (September 3-5, 2025) in an attempt to conquer the psychological threshold of 1,700 points, yet it fell short. Amid this backdrop, investment funds’ activities were relatively subdued, with no significant new transaction announcements as of yet.