PV Trans (stock code: PVT), a leading petroleum transportation company, has announced its impressive Q1-Q3 2025 results. Consolidated revenue soared to VND 11 trillion, a 30% year-over-year increase, surpassing the period’s target by 50% and achieving over 107% of the annual goal. Pre-tax profit reached approximately VND 1.14 trillion, slightly down 5% year-over-year but still exceeding the nine-month plan by 37%.

The addition of three new vessels – PVT Pearl, PVT Solana, and PVT Avira – has significantly boosted PV Trans’ transportation capacity and strengthened its competitive edge.

Additionally, the company’s cost-saving initiatives yielded positive results, reducing expenses by VND 16 billion in the first nine months, reaching 77% of the annual target.

Despite global economic challenges, PV Trans remains optimistic about Q4 2025. The company aims to not only meet but exceed its annual targets, with a projected consolidated revenue of VND 4.5 trillion and pre-tax profit of VND 586 billion for the quarter.

As of August, PV Trans boasts a fleet of 61 diverse vessels with a combined deadweight tonnage of nearly 1.8 million DWT, over 90% of which operate internationally. Fleet capacity increased by 3% compared to the beginning of the year, thanks to the acquisition of the LPG carrier Phoenix Gas in June and the bulk carrier PVT Fortune in July, totaling an investment of nearly USD 26 million.

On the stock market, PVT shares closed at VND 17,750 on October 3rd, with a market capitalization of VND 8.3 trillion.

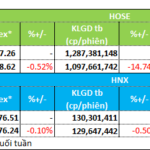

Market Liquidity Weakens as Capital Flows Out of Equity Securities

In recent weeks, cash flow has shown signs of weakening. Despite this trend, certain sectors continue to attract investment. Conversely, the financial sector, particularly stocks, has experienced significant outflows.

VEFAC Shocks Again with 330% Dividend Advance Proposal, Total Payout Nearing 5.5 Trillion VND

After distributing over VND 7.2 trillion in dividends at a rate of 435% in July, Vietnam Exhibition Fair Center Corporation (VEFAC, UPCoM: VEF) is now proposing an interim dividend payout of 330%, equivalent to nearly VND 5.5 trillion. As the majority shareholder with over 83% ownership, Vingroup stands to be the primary beneficiary.

HOSE-Listed Company Declares Massive Dividend of VND 48,000 per Share for Shareholders in Early October

With over 26.6 million outstanding shares, the company is poised to allocate approximately VND 1.3 trillion for dividend payments.