Vietnam’s stock market is experiencing a subtle yet persistent decline, eroding investor accounts with consecutive small losses and weak liquidity. This phenomenon, likened to “sawing the table legs,” lacks dramatic crashes but fails to generate enough momentum to retain investor confidence.

The “sawing the table legs” phase is a particularly dangerous correction. While it doesn’t trigger immediate panic, it gradually wears down investor patience and discipline. Many, despite not suffering significant losses, opt to exit due to prolonged frustration.

Low liquidity complicates portfolio restructuring, leaving investors “stuck” with fundamentally strong stocks lacking trading volume. Weak rebounds are often met with immediate selling pressure, extinguishing optimism and fostering a sense of “difficulty in profiting.”

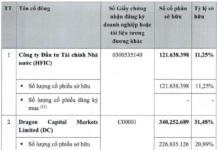

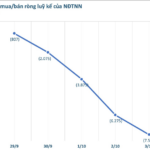

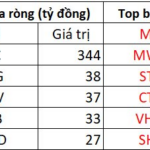

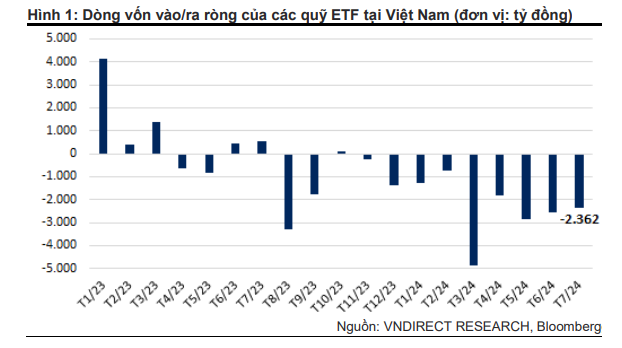

This situation stems from multiple factors, with foreign investors’ net selling pressure being a major contributor. Since the year’s start, foreign investors have withdrawn over 100 trillion VND, primarily from large-cap stocks, further dampening domestic investor sentiment.

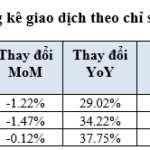

Additionally, the market’s valuation is no longer as attractive following the mid-year rebound. The VN-Index P/E ratio has returned to around 15, not overly expensive but lacking the allure for value-driven capital. Meanwhile, Q3 earnings reports have left the market in an information vacuum, devoid of new catalysts.

Many investors are also awaiting updates on the market’s potential upgrade. While short-term capital remains cautious, experts anticipate that an upgrade could significantly boost foreign investment, ushering in a positive cycle.

What should investors do now?

During the “sawing the table legs” phase, investors are prone to emotion-driven mistakes. Many sell at short-term lows out of exhaustion, only to re-enter at higher prices during technical rebounds. Maintaining psychological stability and discipline is crucial.

The current strategy should focus on portfolio restructuring, prioritizing fundamentally strong stocks with leading market positions, healthy financials, and sustainable growth potential. Investors should avoid widespread disbursement, instead allocating capital in phases and closely monitoring money flow signals to prevent “double erosion” – both price losses and missed opportunities.

Historically, periods of stagnation often precede significant trends. The key is to maintain position rather than overact in an unclear market. In such conditions, fewer but well-timed actions are more valuable than frequent, directionless trading.

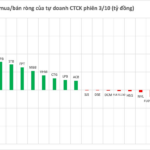

Week 29/9 – 3/10: Foreign Investors Offload Another VND 7.6 Trillion, Which Stocks Were Hit Hardest?

Foreign investors maintained their strong net selling pressure, recording another week of net outflows exceeding 7,000 billion VND.

Stock Market Week 29/09–03/10/2025: Anticipating Fresh Momentum

The VN-Index extended its decline in the final session of the week, shedding nearly 15 points after a lackluster trading week. Weak buying demand coupled with persistent net selling pressure from foreign investors has sapped the market’s momentum. Next week, updates on market upgrade results and the unveiling of third-quarter earnings reports will be pivotal in shaping the market’s future trajectory.