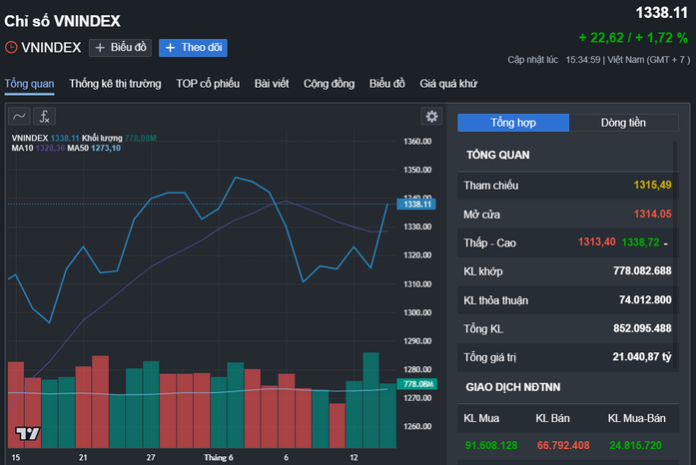

The Vietnamese stock market opened on June 16 with a positive sentiment, pushing the VN-Index towards the 1,328-point mark. However, the upward momentum slowed down as the index approached this level, and the market entered a period of consolidation between 1,325 and 1,328 points.

In the afternoon session, the market continued to trade within a narrow range but picked up pace towards the closing bell, resulting in a strong finish for the VN-Index.

At the close, the VN-Index gained 22.62 points to settle at 1,338.11. Turnover on the Ho Chi Minh Stock Exchange (HOSE) decreased, with 778.1 million shares changing hands.

The large-cap VN30 index climbed 19.15 points to close at 1,420. Out of 30 constituents, 24 stocks added value, led by strong gains in GAS (+7%), PLX (+6.9%), BVH (+4.7%), VPB (+3.6%), and TCB (+3.5%), among others.

On the other hand, only four stocks closed in negative territory, with VHM (-1.5%), VRE (-0.2%), VJC (-0.2%), and VIC (-0.1%) witnessing minor losses.

Market performance over the past month. Source: Fireant

The market’s upbeat sentiment was reflected in the broad-based gains across various sectors. The oil and gas sector stood out with significant advances, while technology, chemicals, and banking stocks also witnessed robust activity.

Foreign investors continued to be net buyers on HOSE, injecting VND984.8 billion into the market. Their major buys included FPT (+VND314.4 billion), VPB (+VND205 billion), HPG (+VND181.4 billion), and NVL (+VND116.6 billion), among others.

On the selling side, they offloaded substantial stakes in STB (-VND65.6 billion), VCI (-VND56.8 billion), PVD (-VND54.4 billion), and HVN (-VND42.6 billion).

According to the Vietnam Dragon Securities Company (VDSC), the VN-Index is expected to consolidate within the 1,330–1,350 range in the near term. Market sentiment and supply-demand dynamics within this range will play a crucial role in determining the market’s future trajectory.

As such, investors are advised to monitor trading activities and volume at resistance levels to gauge the market’s strength. “Investors can consider taking profits on stocks that have witnessed rapid gains and approach resistance levels. For new purchases, investors can look for stocks with positive signals from support levels or those exhibiting strong upward momentum,” VDSC recommended.

VCBS, another securities firm, noted that the VN-Index’s rise of over 20 points from the 1,310 level, coupled with improved buying demand, underscores the robustness of this support zone in the short term.

VCBS suggested that investors hold on to stocks currently in an uptrend. Additionally, they can selectively invest in stocks that have shown signs of accumulation and attracted cash flow in recent sessions for short-term trading purposes. Sectors to watch include securities, investment, banking, and retail.

The VN-Index Struggles at Former Peak, Selling Pressure Intensifies on the Green Zone

The Vietnamese stock market witnessed a robust upward momentum during the morning session, largely driven by the strong performance of the Vin group’s stocks. The VN-Index soared to a high of 1353.01 points, surpassing the peak reached earlier in June. However, this upward trajectory was short-lived as the index began to retreat…

The Vietnam Stock Market Surges Ahead in Asia Despite Middle East Tensions

The Vietnamese stock market has just witnessed its strongest rally in over two months, dating back to April 11th.