Signing ceremony between Germany’s GEO Group and Vietnam’s O-DOOR Company for the Renewable Energy Training and Human Resource Development Center project in Gia Lai province. (Photo: Sy Thang/TTXVN)

|

Vietnam is emerging as one of the most attractive destinations for German investors in the 2025-2026 period.

With its young workforce, competitive costs, expanding domestic market, and open investment environment, more and more businesses from Europe’s largest economy are choosing Vietnam as a long-term strategic destination.

According to a September 2025 report by the German Chamber of Industry and Commerce in Vietnam, cited by a TTXVN correspondent in Berlin, German capital began flowing into Vietnam in the early 1990s, shortly after the country opened up.

In 1992, Bültel, known for its Camel Active brand, established a factory in Binh Duong, while outdoor gear brand Tatonka also opened a production line in Ho Chi Minh City.

After Vietnam joined the World Trade Organization (WTO) in 2007 and the Enterprise Law and Investment Law were revised in 2015, investment from Germany accelerated significantly.

To date, 576 German companies have invested in Vietnam, with a total capital of nearly 3.7 billion USD, creating at least 50,000 jobs nationwide.

Although Germany is globally renowned for its manufacturing industry, in Vietnam, nearly half of the projects are in the service sector, including consulting, logistics, business process outsourcing, and information technology.

There are 71 companies operating in this field, notably Digi-Texx with over 1,500 employees in Ho Chi Minh City and Bosch with 4,000 personnel in technology and engineering.

Meanwhile, German manufacturing plants in Vietnam continue to grow, with a total of 117 companies currently operating across various sectors.

Bosch operates a belt drive production plant in Dong Nai and maintains research centers in Ho Chi Minh City and Hanoi.

Stada-Pymepharco has a pharmaceutical plant in Phu Yen. Messer Gases, a renowned German family business, supplies industrial gases from large production facilities in Hai Phong and Quang Ngai.

Export garment production for the US and EU markets at Maxport Company. (Photo: Tran Viet/TTXVN)

|

In the textile and garment sector, many German suppliers and original equipment manufacturers are present, continuing the industry’s long-standing tradition.

The chemical sector primarily serves domestic customers, while the automotive industry, though not yet strongly developed in Vietnam, has seen notable investments from Schaeffler, Bosch, and Dräxlmaier.

Geographically, Ho Chi Minh City is the “gateway” for German businesses, accounting for 75% of sales and service activities.

Dong Nai and Tay Ninh are home to many factories. The northern region is witnessing strong development along the Hanoi-Hai Phong corridor, with the presence of B.Braun, Messer, and new projects like Harting, RRC, and Certoplast.

The central region is increasingly attracting attention due to its cost advantages and quality of life, with notable projects in Da Nang, Quang Nam, and Gia Lai.

Overall, most German factories are concentrated within a 30-40 km radius of Ho Chi Minh City, which has long been a hub for foreign investment.

One of the key drivers for German businesses choosing Vietnam is the reasonable labor costs, while the investment environment is increasingly open, and most sectors allow 100% foreign-owned enterprises.

German companies typically invest for the long term, bringing not only capital but also technology, management expertise, and dual vocational training models, contributing to improving the quality of Vietnam’s workforce.

They also focus on sustainable development, applying international environmental standards and strict legal compliance.

Many companies collaborate with local suppliers, facilitating technology transfer and management skills.

With the EU-Vietnam Free Trade Agreement (EVFTA) in effect, Vietnam’s green growth strategy being promoted, and the global supply chain shift, the prospects for investment cooperation between Germany and Vietnam in the coming years are highly promising.

With their long-term commitment and technological advantages, German companies are expected to continue accompanying Vietnam’s socio-economic development in the future.

Phuong Hoa

– 08:25 05/10/2025

Bridging the Gap: Maximizing Local and Business Potential Through FTA Utilization

The inaugural FTA Index, released in April 2025, reveals persistent challenges in local and business utilization of free trade agreements. Amid rising trade protectionism, pinpointing these “strengths and weaknesses” is crucial for crafting effective solutions and strategic implementation in the years ahead.

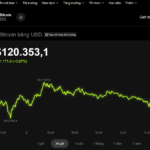

Today’s Crypto Market, October 3: Unraveling the Controversy Surrounding Shark Binh’s Antex Project

As smaller Bitcoin holders begin to accumulate, larger investors continue to offload their holdings, creating a dynamic shift in the market.