“Avoiding the Referee-Player Dilemma”

In the draft of the amended Tax Administration Law, the Ministry of Finance proposes adjustments to the criteria for tax debt cancellation to address current inefficiencies. Tax cancellation will only apply in truly unavoidable circumstances, such as: businesses or cooperatives declared bankrupt under the Bankruptcy Law with no remaining assets for payment; individuals who are deceased or lack civil capacity, with no assets to fulfill obligations, including inherited assets. Tax debts outstanding for over 10 years, despite enforcement measures, will also be considered for cancellation.

Debts arising from natural disasters, widespread epidemics, or severe business disruptions will also qualify for cancellation. Notably, if a taxpayer resumes business operations after a 10-year debt cancellation, they must repay the previously canceled debt.

Citizens processing documents at a tax office (Illustrative image)

The Ministry of Finance adds provisions excluding land use fees, land rent, late payment fees, and penalties from tax cancellation, aligning with the Land Law.

“Clarifying the cancellation of uncollectible debts ensures fairness among taxpayers and prevents policy exploitation. This also enhances accountability for local authorities and tax agencies,” stated the Ministry of Finance.

Speaking with Tiền Phong, tax expert Nguyễn Văn Được (Tax Consultancy Association) noted that previous National Assembly resolutions on tax debt write-offs were incorporated into the Tax Administration Law with rigorous procedures.

While previous regulations were rigorous and scientific to prevent abuse, tax officials faced challenges during implementation. The revised Tax Administration Law simplifies the debt cancellation process for easier execution.

“Tax agencies, as direct managers, require oversight to avoid conflicts of interest. The cancellation process should include monitoring and enhanced accountability. Approval should come from a higher authority level and be decided by the local People’s Council, which oversees local budget management,” proposed Mr. Được.

Expert Nguyễn Ngọc Tú (University of Business and Technology, Hanoi) emphasized that tax cancellation applies to dissolved or bankrupt businesses, untraceable individuals, or those lacking payment capacity. Lingering debts become uncollectible, burdening tax agencies with tracking and reporting. Such cases warrant cancellation under regulations.

“Debt cancellation is essential during economic hardships, providing relief for businesses and individuals facing insurmountable challenges. For instance, aquaculture farmers losing payment capacity due to prolonged tax debts should receive state support. However, measures must prevent exploitation.

Particularly in import-export, large tax debts may involve absconding traders using proxies,” noted Mr. Tú.

Mr. Tú suggested maintaining tax debt records for 10–20 years. If debtors remain untraceable after this period, debts should be permanently canceled, similar to administrative penalty statutes. Comprehensive debtor and cancellation data will facilitate searches by authorities.

Debate Over Expanded Travel Ban Proposal

To address tax debts, the Ministry of Finance proposes extending travel restrictions to individuals owning 25% or more of a tax-indebted business. However, businesses and experts express disagreement.

“The cancellation process requires monitoring and accountability. Approval should come from a higher authority and the local People’s Council, ensuring budget oversight.” – Mr. Nguyễn Văn Được, Tax Consultancy Association

The Vietnam Chamber of Commerce and Industry (VCCI) deems this proposal unreasonable. VCCI argues that individuals owning 25% equity are considered beneficiaries regardless of management involvement.

“Beneficiaries are liable only to the extent of their investment, not indefinitely for the business’s tax obligations. Often, beneficiaries do not directly manage or decide business operations,” explained VCCI.

The Logistics Business Association recommends removing travel restrictions for beneficiaries, suggesting they apply only if proven complicit in tax evasion.

“Drafters should differentiate thresholds within businesses. Legal representatives may face restrictions for prolonged, significant debts due to their management role.

For beneficiaries, restrictions should apply only to single-member LLCs, where the beneficiary is solely responsible for all company activities,” proposed the association.

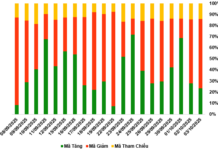

As of June 2025, total tax debt managed by tax authorities is estimated at 239.8 trillion VND. Recoveries in the first half totaled 43.1 trillion VND, including 2 trillion VND through enforcement.

Finance Ministry Proposes 0.1% Income Tax on Gold Bar Sales

Following consultations with the State Bank of Vietnam, the Ministry of Finance has submitted a proposal to the Government, incorporating it into the draft Law on Personal Income Tax. This proposal mandates the imposition of personal income tax on transactions involving the transfer of gold bars. The initially suggested tax rate stands at 0.1% of the transfer value.

Unveiling the Truth: Hoàng Hường’s Health Supplements Face Penalties for Misleading Ads

Before facing legal charges, the Hoàng Hường brand dominated social media with aggressive advertising campaigns. However, beneath the surface lay a series of violations in product promotion.

The Hoàng Hường Scandal: Exaggerated Claims of Miracle Cures, Flaunted Wealth, and Arrogant Online Behavior

Over the past few years, the name Hoàng Hường has ignited social media. From her high-profile endorsements of health supplements to her lavish displays of wealth and luxury living, she captivated audiences with an image of opulence. However, this glittering facade was swiftly dismantled when authorities revealed significant financial irregularities, exposing the truth behind the glamour.

When Will Resigned Employees Receive Benefits Under Decree 178?

The government has mandated that all ministries, agencies, and local authorities promptly finalize the disbursement of benefits and policies as outlined in Decree 178.