A recent report from the Ministry of Agriculture and Environment reveals that Vietnam’s rice exports in the first nine months of the year reached approximately 7 million tons, valued at $3.55 billion. This marks a 0.1% increase in volume but an 18.5% decrease in value compared to the same period in 2024.

Spending More on Rice Imports Than Wheat and Soybeans

The decline is attributed to the average export price of rice in the first nine months of 2025, which stood at $509 per ton, an 18.6% drop from the same period in 2024.

Not only has the export value decreased, but the rice industry’s surplus has also shrunk to $2.04 billion, a 38.7% reduction compared to the previous year.

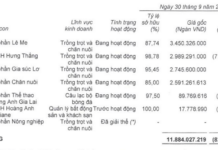

Surprisingly, Vietnamese businesses spent $1.51 billion on rice imports during this period, a figure that has raised eyebrows among many.

The report lacks detailed information on rice imports, such as quantities, unit prices, primary import markets, and comparisons with other high-value imports like wheat, corn, and soybeans.

During the same period, Vietnam’s wheat imports were valued at $1.09 billion, a 13.4% increase, while soybean imports reached $953.3 million, up by 28.7%. These are commodities where Vietnam lacks a competitive advantage, leading to higher production costs.

Vietnam spent over $1.5 billion on rice imports

Vietnam: The World’s Second-Largest Rice Importer!

In June, the United States Department of Agriculture (USDA) reported that Vietnam is projected to become the world’s second-largest rice importer this year, following the Philippines, with an estimated record import volume of 4.1 million tons. In 2024, Vietnam ranked third, after the Philippines and Indonesia.

“This increase is due to a decline in domestic rice production and a growing demand for affordable rice from Cambodia,” the USDA report stated.

A representative from a company importing rice from India explained that the lower prices are due to the rice’s inferior quality compared to Vietnamese rice. Indian rice tends to break easily and has a less desirable appearance, making it suitable for animal feed or processed foods like noodles, cakes, and alcohol.

Indian Rice Prices Hit a 3-Year Low

In September 2025, global rice prices experienced a widespread decline. Indian rice prices dropped to their lowest point in over three years due to weak demand and abundant supply. Vietnamese rice prices also reached a near two-month low.

Specifically, 5% broken rice from Thailand averaged $355 per ton, a $3.5 decrease; Indian rice at $374 per ton, down $2.6; and Vietnamese rice at $376 per ton, a $15.6 drop.

Durian Exports Surge to New Heights

The latest data reveals that Vietnam’s durian exports surged to a record high in August, marking an unprecedented growth. Simultaneously, market prices exhibited notable fluctuations, reflecting dynamic shifts in the industry.

“Nafoods Secures $20 Million in Funding from Dutch Bank”

Speaking at the signing ceremony, representatives from FMO praised the strong ESG standards of Nafoods Group Joint Stock Company (HOSE: NAF) and affirmed that the $20 million financing is just the beginning of a long-term partnership to develop a sustainable and green agriculture value chain in Vietnam.